Understanding the Legal Complexities of the Metaverse

The Emergence of Cross-Border Transactions in the Metaverse

The rapid expansion of the metaverse has introduced a new realm of digital commerce, enabling cross-border transactions that transcend traditional geographic boundaries. However, this growth also presents significant legal challenges. Businesses operating within the metaverse must navigate a complex web of international laws and regulations to ensure compliance and foster seamless transactions. This task is particularly pertinent for regions like Saudi Arabia, the UAE, Riyadh, and Dubai, which are at the forefront of digital innovation and commerce.

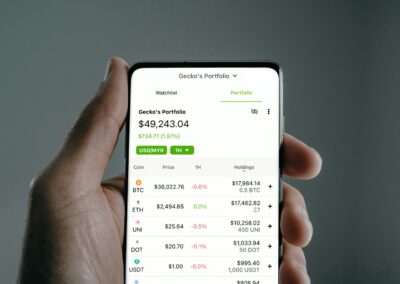

Cross-border transactions in the metaverse involve the exchange of virtual goods, services, and currencies between parties in different countries. These transactions are facilitated by advanced technologies such as blockchain and artificial intelligence, which ensure security, transparency, and efficiency. However, the lack of standardized legal frameworks across jurisdictions creates numerous challenges, including regulatory compliance, taxation, and consumer protection. Addressing these issues requires a concerted effort from international bodies and local governments to establish cohesive and comprehensive legal standards.

Regulatory Compliance and Legal Frameworks

One of the primary legal challenges of cross-border transactions in the metaverse is regulatory compliance. Different countries have varying regulations regarding digital transactions, data privacy, and consumer protection. Businesses must ensure that they comply with these regulations to avoid legal repercussions and maintain consumer trust. This task is particularly complex in the metaverse, where transactions often occur in real-time and involve multiple jurisdictions.

In Saudi Arabia and the UAE, governments are actively developing regulatory frameworks to support digital commerce and innovation. These frameworks aim to balance the need for security and consumer protection with the desire to foster a thriving digital economy. Businesses operating in these regions must stay abreast of regulatory developments and adapt their practices accordingly. This proactive approach not only ensures compliance but also positions businesses as leaders in the emerging digital economy.

Taxation and Financial Regulations

Taxation presents another significant challenge for cross-border transactions in the metaverse. Traditional tax systems are based on physical presence and tangible assets, making it difficult to apply existing tax laws to virtual transactions. The metaverse blurs the lines between physical and digital realms, complicating the determination of tax liabilities and compliance requirements. Governments must develop new tax frameworks that account for the unique nature of virtual commerce while preventing tax evasion and ensuring fair competition.

In Riyadh and Dubai, authorities are exploring innovative approaches to taxation in the digital economy. These efforts include the introduction of digital tax policies and international cooperation to harmonize tax regulations across borders. By collaborating with international bodies and other countries, Saudi Arabia and the UAE can create a more predictable and equitable tax environment for businesses operating in the metaverse. This cooperation is crucial for fostering a stable and sustainable digital economy that benefits all stakeholders.

Promoting International Cooperation and Legal Harmonization

The Role of International Bodies in Legal Harmonization

International cooperation is essential for addressing the legal challenges of cross-border transactions in the metaverse. Global organizations, such as the United Nations and the World Trade Organization, play a vital role in promoting legal harmonization and establishing common standards for digital commerce. These organizations can facilitate dialogue between countries, provide guidance on best practices, and develop model laws that countries can adopt to ensure consistency and predictability in the legal landscape.

For Saudi Arabia and the UAE, active participation in international forums and collaboration with other countries are crucial for shaping the future of digital commerce. By contributing to the development of global standards, these countries can ensure that their interests are represented and that the unique challenges of their digital economies are addressed. This proactive approach not only enhances the legal environment for cross-border transactions but also strengthens the global position of Saudi Arabia and the UAE as leaders in digital innovation.

Developing Bilateral and Multilateral Agreements

In addition to international cooperation, bilateral and multilateral agreements between countries can provide a more tailored approach to addressing legal challenges in the metaverse. These agreements can establish specific rules and guidelines for cross-border transactions, data sharing, and consumer protection, reflecting the unique needs and priorities of the participating countries. By developing such agreements, countries can create a more predictable and secure legal environment for businesses and consumers.

For example, Saudi Arabia and the UAE can collaborate with key trading partners to develop agreements that facilitate cross-border transactions in the metaverse. These agreements can address issues such as jurisdiction, dispute resolution, and enforcement of legal judgments, providing a clear framework for businesses to operate within. This collaborative approach not only enhances legal certainty but also fosters stronger economic ties and promotes mutual benefits for all parties involved.

Implementing Best Practices for Legal Compliance

Businesses operating in the metaverse must also take proactive steps to ensure legal compliance and mitigate risks. Implementing best practices for legal compliance involves staying informed about regulatory developments, engaging with legal experts, and adopting robust compliance programs. These practices can help businesses navigate the complex legal landscape of the metaverse and avoid potential legal pitfalls.

For businesses in Riyadh and Dubai, leveraging the expertise of local legal professionals and engaging with regulatory authorities can provide valuable insights and guidance. By fostering a culture of compliance and ethical conduct, businesses can build trust with consumers and regulators, enhancing their reputation and competitive advantage in the digital economy.

Conclusion

The integration of traditional e-commerce models within the metaverse presents both significant challenges and opportunities. Navigating the legal complexities of cross-border transactions requires a collaborative effort from businesses, governments, and international bodies. By addressing regulatory compliance, taxation, and consumer protection, and promoting international cooperation and legal harmonization, stakeholders can create a secure and predictable legal environment for digital commerce. For regions like Saudi Arabia and the UAE, embracing these changes and actively shaping the future of digital commerce can drive economic growth and innovation, positioning them as leaders in the global digital economy.

—

#metaverse #crossbordertransactions #digitaleconomy #SaudiArabia #UAE #Riyadh #Dubai #blockchain #AI #internationalcooperation