Leveraging Modern Technology for Enhanced Financial Management

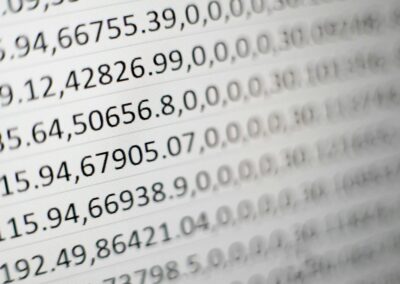

The Role of Billing Data Analysis in Law Firms

In the competitive landscape of legal services, analyzing billing data has become a crucial practice for law firms aiming to optimize their financial performance. This process involves scrutinizing billing records to uncover insights into cost structures, client profitability, and operational efficiency. For law firms operating in dynamic regions like Saudi Arabia and the UAE, leveraging billing data analysis is essential for identifying opportunities for cost savings and driving revenue growth.

Billing data provides a wealth of information that, when analyzed effectively, can reveal patterns and trends in a firm’s financial performance. By examining detailed billing records, firms can gain a comprehensive understanding of their expenses, revenue streams, and overall financial health. In bustling business hubs such as Riyadh and Dubai, where the legal market is highly competitive, understanding these financial dynamics is key to maintaining profitability and sustainability.

Moreover, analyzing billing data supports better financial planning and decision-making. For business executives, mid-level managers, and entrepreneurs, having access to accurate and actionable financial insights enables them to make informed decisions about resource allocation, pricing strategies, and client management. In the rapidly evolving markets of Saudi Arabia and the UAE, data-driven financial management is a strategic advantage that can enhance a firm’s competitive edge.

Key Features and Benefits of Billing Data Analysis

Billing data analysis offers a range of features that help law firms improve their financial performance. One of the key features is detailed financial reporting, which provides an in-depth view of a firm’s revenue, expenses, and profitability. These reports enable firms to track financial performance over time, identify trends, and make data-driven decisions to optimize their operations. In the fast-paced legal environments of Riyadh and Dubai, timely and accurate financial reporting is critical for maintaining a competitive edge.

Another important feature is cost analysis, which helps firms identify areas where they can reduce expenses and improve efficiency. By analyzing billing data, firms can pinpoint cost drivers, assess the profitability of different practice areas, and implement cost-saving measures. For business leaders and managers in Saudi Arabia and the UAE, effective cost management is essential for sustaining growth and ensuring long-term financial stability.

Furthermore, billing data analysis includes client profitability analysis, which evaluates the financial contribution of each client to the firm’s overall revenue. This analysis helps firms identify their most profitable clients, assess the profitability of different types of cases, and develop strategies to enhance client value. In regions like Saudi Arabia and the UAE, where client relationships are paramount, understanding client profitability is crucial for building strong and sustainable client partnerships.

Implementing Billing Data Analysis for Financial Success

For law firms looking to implement billing data analysis, several strategic steps are necessary to ensure successful integration and maximum benefit. The first step is to choose a reliable and feature-rich billing software that offers robust data analysis capabilities. In markets like Riyadh and Dubai, where technological innovation is a key driver of business success, selecting the right software is crucial for achieving financial efficiency and accuracy.

Once the software is selected, firms should invest in comprehensive training to familiarize their staff with its features and functionalities. This includes understanding how to generate financial reports, conduct cost analysis, and assess client profitability. For business executives and mid-level managers, providing ongoing training ensures that all team members are proficient in using the software and can leverage its full capabilities to enhance financial performance.

Regularly reviewing and updating financial practices is also critical for maintaining financial efficiency and accuracy. Firms should periodically assess their use of billing data, identify areas for improvement, and adjust their practices as needed to align with best practices and technological advancements. For entrepreneurs and business leaders in Saudi Arabia and the UAE, this continuous process of evaluation and improvement is essential for achieving long-term financial and business success.

Conclusion: The Strategic Value of Billing Data Analysis in Law Firms

In conclusion, analyzing billing data for financial performance provides significant benefits for law firms by offering comprehensive insights into cost structures, client profitability, and operational efficiency. For firms in Saudi Arabia, the UAE, and beyond, these practices offer the flexibility and control needed to optimize financial management and ensure long-term success. By leveraging modern technology and data-driven insights, law firms can enhance their financial planning, improve decision-making, and achieve better financial outcomes.

The strategic value of billing data analysis extends beyond individual financial metrics. For firms, these practices can enhance overall financial health, support strategic planning, and promote a culture of accountability and transparency. In dynamic markets like Riyadh and Dubai, where financial precision and efficiency are critical for success, implementing billing data analysis is a practical and effective solution. For business executives, mid-level managers, and entrepreneurs, investing in these practices can lead to improved financial performance and sustainable growth.

Looking ahead, the importance of billing data analysis in law firms will continue to grow as financial management processes become increasingly digitalized. By staying informed about the latest developments and continuously enhancing their financial strategies, firms can ensure they remain resilient and competitive in the evolving economic landscape. In the Middle East, where innovation and technological advancement are driving economic growth, adopting billing data analysis is not just a strategic advantage but a necessity for future success.

As businesses and individuals continue to navigate the complexities of the digital age, the role of billing data analysis in promoting financial accuracy, efficiency, and transparency will become even more critical. By implementing robust financial management tools and fostering a culture of proactive financial planning, organizations can achieve their financial and operational goals and ensure long-term success. In the vibrant and innovative markets of Saudi Arabia and the UAE, the adoption of billing data analysis will drive financial excellence and support economic progress.

—

#BillingDataAnalysis, #FinancialPerformance, #CostSavings, #RevenueGrowth, #LawFirms, #LegalTechnology, #SaudiArabia, #UAE, #Riyadh, #Dubai