The Role of APIs in Modern Financial Ecosystems

Introduction to APIs in Banking and Fintech Collaboration

The integration of APIs in banking and fintech collaboration is revolutionizing the financial sector by facilitating seamless data sharing between banks and fintech companies. In regions like Saudi Arabia and the UAE, where financial innovation is a key strategic priority, APIs (Application Programming Interfaces) play a critical role in fostering a collaborative environment that drives innovation and competition. By enabling secure and efficient data exchange, APIs allow traditional banks and fintech startups to leverage each other’s strengths, creating a dynamic and customer-centric financial ecosystem.

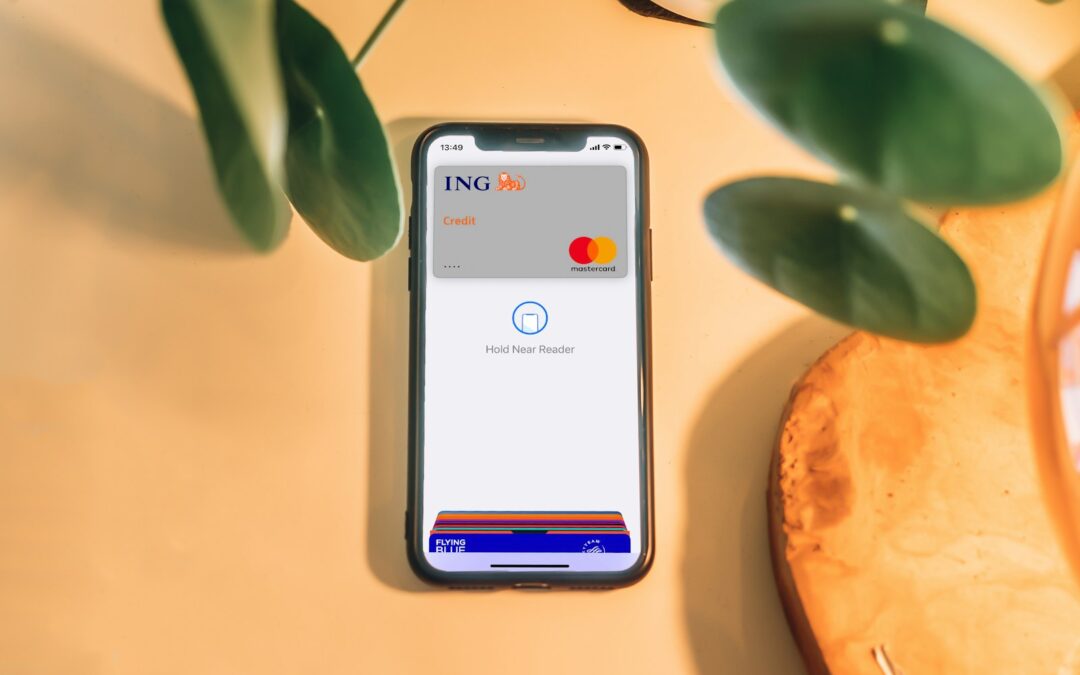

APIs act as bridges between different software systems, allowing them to communicate and share data in real-time. This connectivity is crucial in today’s digital economy, where customers demand seamless and personalized financial services. In Riyadh and Dubai, banks are increasingly adopting APIs to integrate with fintech solutions, enhancing their service offerings and improving operational efficiency. By opening their systems to external developers, banks can quickly implement innovative solutions that meet the evolving needs of their customers.

Moreover, the use of APIs in banking and fintech collaboration supports the broader goal of financial inclusion. By providing access to a wide range of financial services through a single platform, APIs make it easier for underserved populations to access banking services. This inclusivity is particularly important in regions like Saudi Arabia and the UAE, where there is a strong emphasis on digital transformation and economic diversification. By leveraging APIs, financial institutions can reach a broader audience and promote greater financial inclusion.

Enhancing Innovation Through API Integration

The integration of APIs in banking and fintech collaboration significantly enhances innovation by enabling the rapid deployment of new financial products and services. APIs allow fintech companies to access and utilize bank data in real-time, creating opportunities for developing innovative solutions that improve customer experience and operational efficiency. In regions like Saudi Arabia and the UAE, where financial technology is rapidly evolving, APIs provide the foundation for a vibrant and competitive fintech ecosystem.

In Riyadh and Dubai, banks are leveraging APIs to offer a wide range of digital services, from mobile banking and payment solutions to personalized financial advice and automated investment platforms. By integrating with fintech solutions, banks can provide their customers with a seamless and cohesive digital experience. This collaboration also allows banks to stay ahead of industry trends and respond quickly to changing customer needs, ensuring they remain competitive in a fast-paced market.

Furthermore, APIs enable the creation of open banking platforms, where customers can access a variety of financial services from different providers through a single interface. This open banking model fosters competition by giving consumers the freedom to choose the best products and services for their needs. In regions like Saudi Arabia and the UAE, where regulatory frameworks are evolving to support open banking, the use of APIs is critical for driving innovation and competition in the financial sector.

Boosting Competition and Consumer Choice

The use of APIs in banking and fintech collaboration boosts competition and enhances consumer choice by lowering barriers to entry for new market participants. APIs provide fintech companies with the tools they need to develop innovative solutions that challenge traditional banking models. This increased competition benefits consumers by driving down costs, improving service quality, and expanding the range of available financial products and services.

In regions like Saudi Arabia and the UAE, where financial markets are becoming increasingly competitive, APIs are instrumental in fostering a level playing field. By enabling fintech companies to access bank data and infrastructure, APIs reduce the time and cost associated with developing new financial services. This accessibility encourages a diverse range of fintech startups to enter the market, bringing fresh ideas and innovative solutions that enhance the overall financial ecosystem.

Moreover, the collaboration between banks and fintech companies facilitated by APIs leads to the development of more customer-centric solutions. By leveraging data insights and advanced analytics, fintech companies can create personalized financial products that meet the specific needs of individual consumers. In Riyadh and Dubai, where consumers are increasingly seeking tailored financial solutions, the use of APIs is key to delivering personalized and responsive services that enhance customer satisfaction and loyalty.

Strategic Importance of API-Driven Financial Innovation

Driving Business Success with API Integration

The strategic implementation of APIs in banking and fintech collaboration is essential for driving business success and maintaining a competitive edge in the financial sector. In regions like Saudi Arabia and the UAE, where there is a strong emphasis on technological advancement, APIs offer a unique opportunity to enhance operational efficiency and improve customer experience. By adopting API-driven solutions, financial institutions can streamline their processes, reduce costs, and deliver better services to their clients.

In Riyadh and Dubai, financial institutions are increasingly recognizing the value of APIs in enhancing their service offerings. By integrating with fintech solutions, banks can provide their customers with a seamless and cohesive digital experience. This integration allows banks to stay ahead of industry trends and respond quickly to changing customer needs, ensuring they remain competitive in a fast-paced market. Additionally, APIs enable banks to offer a wide range of digital services, from mobile banking and payment solutions to personalized financial advice and automated investment platforms.

Furthermore, the use of APIs supports the development of data-driven decision-making processes. By providing access to real-time data, APIs enable financial institutions to gain valuable insights into customer behavior and market trends. This information can be used to develop targeted marketing strategies, optimize product offerings, and improve customer engagement. In regions like Saudi Arabia and the UAE, where data-driven innovation is a key strategic priority, the adoption of APIs is crucial for driving business success and staying ahead of the competition.

Enhancing Leadership and Management Skills

The adoption of APIs in banking and fintech collaboration requires strong leadership and effective management skills. Financial institutions must be able to navigate the complexities of API integration and ensure that their teams are equipped with the necessary skills and knowledge to leverage these technologies effectively. In regions like Saudi Arabia and the UAE, where the pace of technological change is rapid, proactive leadership is key to staying ahead of the curve and capitalizing on the benefits of APIs.

In Riyadh and Dubai, financial institutions are investing in leadership development programs to enhance their teams’ skills and capabilities. These programs focus on fostering a culture of innovation and collaboration, enabling teams to work effectively with fintech partners and drive successful API integrations. By promoting continuous learning and professional development, financial institutions can ensure that their teams are well-prepared to navigate the challenges and opportunities of the digital economy.

Moreover, effective project management is essential for the successful implementation of API-driven solutions. Financial institutions must be able to manage complex integration projects, coordinate with multiple stakeholders, and ensure that their systems are secure and compliant with regulatory requirements. In regions like Saudi Arabia and the UAE, where regulatory frameworks are evolving to support API-driven innovation, strong project management skills are crucial for navigating this dynamic landscape and achieving successful outcomes.

The Future of API-Driven Financial Innovation

Looking ahead, the role of APIs in banking and fintech collaboration is poised to expand, offering even more sophisticated solutions for financial services. As technology continues to advance, APIs will become more versatile and capable, enabling a wider range of financial services and enhancing the overall customer experience. In regions like Saudi Arabia and the UAE, where digital transformation is a key strategic priority, the adoption of APIs will play a crucial role in shaping the future of finance.

The integration of APIs with other emerging technologies, such as artificial intelligence (AI) and blockchain, will further enhance their capabilities. For instance, AI can be used to analyze data and provide personalized financial recommendations, while blockchain can ensure the security and transparency of transactions. This convergence of technologies will create a more robust and secure financial ecosystem, capable of addressing a wide range of challenges. In Riyadh and Dubai, where technological innovation is a priority, the adoption of such integrated solutions will drive the financial sector’s growth and resilience.

Furthermore, the continued development of regulatory frameworks to support the use of APIs in banking and fintech collaboration will be essential. By working closely with regulators, financial institutions can ensure that their API implementations comply with legal and regulatory requirements. This collaboration will help to foster a supportive environment for innovation while ensuring the security and integrity of financial transactions. In conclusion, the use of APIs in banking and fintech collaboration is transforming the financial landscape in Saudi Arabia and the UAE. By facilitating seamless data sharing and enabling rapid innovation, APIs are driving competition and enhancing consumer choice. As technology continues to evolve, the role of APIs in financial services will become even more critical, driving innovation and growth in the financial sector.

#APIs #Banking #Fintech #DataSharing #FinancialInnovation #SaudiArabia #UAE #Riyadh #Dubai #ModernTechnology #BusinessSuccess #Leadership #ManagementSkills #ProjectManagement