How Automating Financial Tasks with Machine Learning is Revolutionizing Compliance

Reducing Errors through Financial Automation

In the ever-evolving world of finance, automating financial tasks with machine learning is becoming a game-changer for businesses aiming to enhance accuracy and reduce the margin for error. This innovation is particularly crucial in financial hubs such as Saudi Arabia and the UAE, where precision and compliance are paramount. By leveraging machine learning algorithms, businesses can automate routine financial processes such as data entry, reconciliation, and transaction monitoring. This reduces the likelihood of human errors that can lead to significant financial discrepancies and non-compliance with regulatory requirements. For business executives and entrepreneurs in cities like Riyadh and Dubai, where the financial sector plays a critical role in the economy, adopting machine learning in financial tasks is essential to maintaining the integrity of their operations.

Moreover, machine learning algorithms excel in identifying patterns and anomalies in large datasets, which is crucial for detecting potential errors before they escalate into more significant issues. As financial transactions grow in complexity and volume, especially in the Middle Eastern market, the traditional methods of managing financial data become increasingly insufficient. Automation with machine learning not only ensures that errors are minimized but also enables businesses to handle a larger volume of transactions without compromising accuracy. This technological advancement is vital for companies that aim to scale their operations while maintaining high standards of financial management.

The benefits of automating financial tasks extend beyond error reduction. It also supports the decision-making process by providing executives with accurate, real-time financial data. In regions like Riyadh and Dubai, where businesses operate in a fast-paced environment, having access to precise financial information is crucial for making informed decisions. Whether it’s evaluating investment opportunities or managing cash flow, automating routine financial tasks with machine learning ensures that decision-makers have the reliable data they need to drive business success. This shift towards automation is not merely a trend but a strategic move that aligns with the broader goals of financial stability and growth in the Middle East.

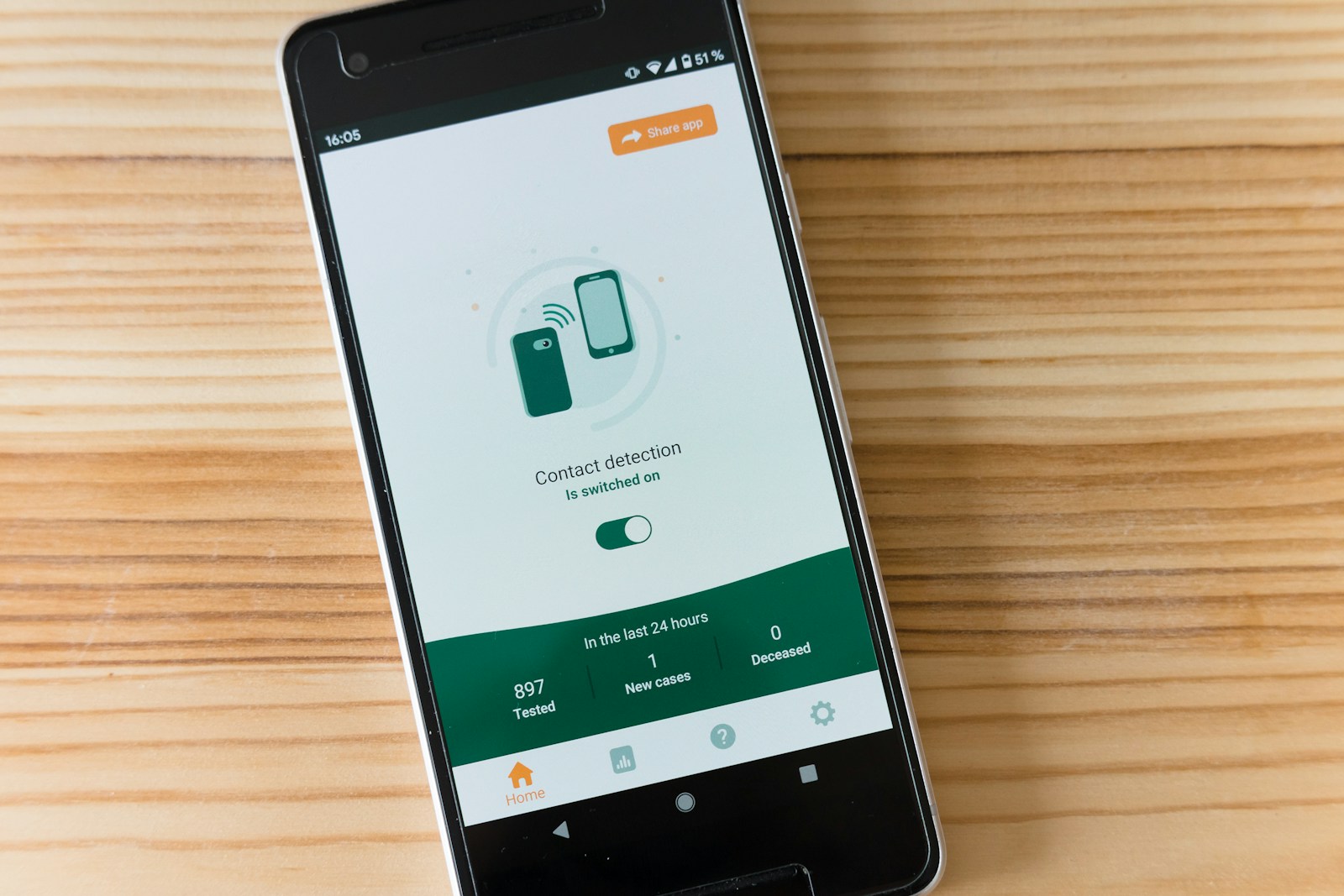

Enhancing Compliance with AI-Driven Financial Automation

As regulatory frameworks in the financial sector become increasingly stringent, ensuring compliance is a top priority for businesses operating in Saudi Arabia, the UAE, and beyond. Automating financial tasks with machine learning is proving to be an invaluable tool in enhancing compliance and mitigating the risks associated with regulatory breaches. Machine learning algorithms can be trained to monitor financial activities in real-time, ensuring that all transactions adhere to the relevant regulations and standards. This continuous monitoring not only reduces the risk of non-compliance but also allows businesses to quickly adapt to changes in regulatory requirements, which is particularly important in dynamic markets like Riyadh and Dubai.

Furthermore, machine learning enhances compliance by enabling more effective reporting and audit processes. Traditional methods of financial reporting often involve manual data compilation, which is time-consuming and prone to errors. By automating these processes, businesses can generate accurate reports quickly and efficiently, ensuring that they meet regulatory deadlines without compromising on quality. This is especially relevant in the Middle Eastern financial landscape, where transparency and accountability are increasingly being emphasized by regulatory bodies. By embracing machine learning, businesses can not only meet these expectations but also set new standards for financial management in the region.

In addition to improving compliance, automating financial tasks with machine learning also contributes to better risk management. Machine learning models can predict potential compliance risks based on historical data and emerging trends, allowing businesses to take proactive measures to mitigate these risks. For business leaders in Saudi Arabia and the UAE, where the financial industry is a cornerstone of the economy, this capability is invaluable. It ensures that companies can navigate the complexities of the regulatory environment with confidence, safeguarding their operations and reputation in the market. As the financial sector continues to evolve, the role of machine learning in automating financial tasks and enhancing compliance will only grow in importance.

#AutomatingFinancialTasks #MachineLearningInFinance #ComplianceAutomation #BusinessSuccess #AIinFinance #SaudiArabia #UAE #Riyadh #Dubai #LeadershipSkills #ExecutiveCoaching