Revolutionizing Online Transactions with Blockchain Technology

The Advantages of Blockchain in Cross-Border E-commerce Payments

Blockchain for cross-border e-commerce payments offers a transformative solution for enhancing the security and efficiency of online transactions. In thriving economies like Saudi Arabia and the UAE, where e-commerce is rapidly expanding, blockchain technology provides a reliable and transparent method for processing payments across borders. This technology addresses several challenges associated with traditional payment systems, making it a valuable tool for businesses and consumers alike.

One of the primary benefits of using blockchain for cross-border e-commerce payments is its ability to significantly reduce transaction times. Traditional banking systems often involve multiple intermediaries, leading to delays and increased costs. Blockchain technology, on the other hand, allows for direct peer-to-peer transactions, eliminating the need for intermediaries and enabling faster processing times. For businesses in Riyadh and Dubai, this means quicker access to funds and improved cash flow management.

Additionally, blockchain enhances the transparency and traceability of transactions. Each transaction is recorded on a decentralized ledger that is accessible to all parties involved. This transparency helps in building trust between buyers and sellers, as they can verify the status and history of payments in real time. In the Middle East’s competitive e-commerce market, this level of trust is crucial for fostering long-term business relationships and customer loyalty.

Securing E-commerce Payments with Blockchain

Security is a major concern for e-commerce businesses, especially when dealing with cross-border transactions. Blockchain technology addresses this issue by providing a secure and tamper-proof platform for processing payments. Each transaction on the blockchain is encrypted and linked to the previous transaction, creating an immutable record that is extremely difficult to alter or hack. This level of security is particularly important for protecting sensitive customer data and preventing fraud.

In Saudi Arabia, where cybersecurity is a top priority, the adoption of blockchain for e-commerce payments can significantly enhance the overall security of the financial ecosystem. By leveraging blockchain’s cryptographic features, businesses can safeguard their transactions against unauthorized access and cyber threats. This not only protects the integrity of the payment process but also enhances customer confidence in online shopping.

Furthermore, the use of smart contracts in blockchain can automate and enforce the terms of payment agreements. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automatically execute actions when predefined conditions are met, reducing the need for manual intervention and minimizing the risk of disputes. For e-commerce businesses in Dubai, this automation can streamline operations and ensure timely and accurate payments.

Cost Efficiency and Financial Inclusion through Blockchain

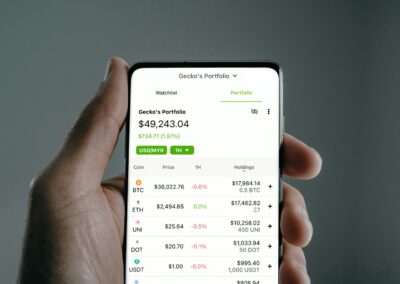

Cost efficiency is another significant advantage of using blockchain for cross-border e-commerce payments. Traditional payment systems often involve high fees due to currency conversion, intermediary charges, and processing costs. Blockchain technology reduces these costs by enabling direct transactions and using cryptocurrencies that do not require conversion fees. This cost reduction can be particularly beneficial for small and medium-sized enterprises (SMEs) in Riyadh and Dubai, allowing them to compete more effectively in the global market.

Moreover, blockchain technology can promote financial inclusion by providing access to secure and efficient payment systems for underserved populations. In regions where access to traditional banking services is limited, blockchain can offer an alternative method for conducting transactions and participating in e-commerce. This inclusivity can drive economic growth and create new opportunities for businesses and consumers alike.

In the UAE, initiatives such as the Dubai Blockchain Strategy aim to make the city a global leader in blockchain technology. By fostering an environment that supports blockchain adoption, Dubai is positioning itself at the forefront of fintech innovation. This strategic approach not only benefits the local economy but also attracts international businesses looking for a secure and efficient platform for cross-border transactions.

Conclusion: The Future of E-commerce Payments with Blockchain

In conclusion, the use of blockchain for cross-border e-commerce payments offers numerous benefits, including enhanced security, efficiency, and cost savings. For businesses in Saudi Arabia and the UAE, blockchain technology provides a reliable and transparent solution for processing online transactions. By reducing transaction times, improving security, and lowering costs, blockchain is poised to revolutionize the e-commerce industry.

As the adoption of blockchain technology continues to grow, the financial and technological landscapes of Riyadh and Dubai are set to evolve. By embracing blockchain, these regions can enhance their competitive edge, attract international investment, and drive economic growth. The future of e-commerce payments is undoubtedly bright, with blockchain technology leading the way toward a more secure, efficient, and inclusive financial system.

#Blockchain #CrossBorderPayments #Ecommerce #OnlineTransactions #SaudiArabiaTechnology #UAEBlockchain #RiyadhEcommerce #DubaiFintech #SecurePayments #EfficientTransactions