Transforming the Landscape of Cross-Border Payments

Efficiency and Speed with Blockchain

Blockchain technology has the potential to revolutionize cross-border payments by providing a faster, more secure, and cost-effective alternative to traditional methods. In Saudi Arabia and the UAE, the adoption of blockchain for cross-border transactions is gaining traction due to its ability to significantly reduce transaction times. Traditional cross-border payments often take several days to process, involving multiple intermediaries and complex verification processes. Blockchain, on the other hand, enables near-instantaneous transactions by eliminating these intermediaries and providing a direct, peer-to-peer transfer of funds.

In Riyadh, financial institutions are exploring blockchain-based solutions to enhance the efficiency of international payments. The Saudi Arabian Monetary Authority (SAMA) has been at the forefront of this innovation, partnering with Ripple to pilot a blockchain-based payment system. This initiative aims to provide a seamless and rapid transfer of funds between banks in Saudi Arabia and other countries, demonstrating the potential of blockchain to streamline cross-border transactions.

Dubai, known for its technological advancements and forward-thinking policies, has also embraced blockchain for cross-border payments. The Dubai Future Foundation’s Blockchain Strategy aims to integrate blockchain into 100% of government transactions, including cross-border payments, by 2020. This ambitious goal reflects Dubai’s commitment to leveraging blockchain to enhance efficiency and security in financial transactions. The success of these initiatives underscores the transformative potential of blockchain technology in the realm of cross-border payments.

Security and Transparency Enhancements

The implementation of blockchain in cross-border payments significantly enhances security and transparency, addressing some of the key challenges associated with traditional payment methods. Blockchain’s decentralized nature ensures that transaction records are immutable and accessible to all parties involved, providing a transparent and tamper-proof ledger of all transactions. This transparency reduces the risk of fraud and enhances trust among participants.

In Saudi Arabia, the adoption of blockchain for cross-border payments is seen as a way to enhance the security of financial transactions and build trust among investors. By using blockchain to record and verify transactions, financial institutions can ensure that all parties adhere to the agreed terms, reducing the risk of disputes and fraud. This is particularly important in sectors such as trade finance, where trust and transparency are critical.

Dubai has also recognized the security benefits of blockchain and is actively promoting its use in various industries. The Dubai Financial Services Authority (DFSA) is exploring the use of blockchain to enhance regulatory compliance and oversight. By automating compliance checks and reporting, blockchain can help financial institutions in Dubai adhere to regulatory requirements more efficiently and accurately. This not only improves regulatory compliance but also fosters a more transparent and trustworthy financial ecosystem. The security and transparency offered by blockchain make it an ideal solution for cross-border payments in a globalized economy.

Cost-Effectiveness and Financial Inclusion

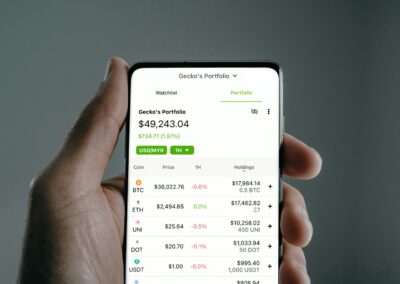

One of the most significant advantages of blockchain in cross-border payments is its cost-effectiveness. Traditional cross-border transactions often involve high fees due to the involvement of multiple intermediaries and currency exchange costs. Blockchain eliminates the need for these intermediaries, reducing transaction fees and making cross-border payments more affordable for businesses and individuals alike.

In Riyadh, financial institutions are leveraging blockchain to reduce the costs associated with cross-border payments. By eliminating the need for correspondent banks and reducing the complexity of the transaction process, blockchain can significantly lower transaction fees. This cost savings can be passed on to consumers, making international payments more accessible and affordable. This is particularly beneficial for small and medium-sized enterprises (SMEs) that rely on cross-border transactions for their operations.

Dubai has also embraced the cost-saving potential of blockchain for cross-border payments. The Dubai International Financial Centre (DIFC) is actively supporting the development of blockchain-based solutions to enhance financial inclusion. By reducing transaction costs and making cross-border payments more affordable, blockchain can help bridge the gap between the formal financial system and underserved communities. This can stimulate economic activity and support broader economic development goals. The cost-effectiveness of blockchain makes it a powerful tool for promoting financial inclusion and driving economic growth.

Leadership and Strategic Implementation

Leadership in Blockchain Adoption

Effective leadership and strategic vision are crucial for the successful adoption of blockchain in cross-border payments. In Saudi Arabia and the UAE, leaders in both the public and private sectors have recognized the transformative potential of blockchain and are championing its integration into the financial system. By fostering a culture of innovation and embracing new technologies, these leaders are driving digital transformation and setting the stage for long-term success.

In Riyadh, government agencies and financial institutions are working together to develop a supportive regulatory framework for blockchain. This involves establishing clear guidelines and standards to ensure that blockchain is implemented securely and effectively. The Saudi Arabian Monetary Authority (SAMA) has been at the forefront of these efforts, promoting the adoption of blockchain through pilot projects and industry collaborations. This proactive approach is essential for building confidence in blockchain technology and encouraging widespread adoption.

Dubai has also demonstrated strong leadership in the adoption of blockchain, with initiatives led by the Dubai Future Foundation and the Smart Dubai Office. These organizations are driving the implementation of blockchain across various sectors, from finance to real estate. By providing strategic direction and fostering collaboration among stakeholders, Dubai’s leadership is creating an ecosystem that supports innovation and growth. The success of these initiatives highlights the importance of visionary leadership in achieving digital transformation.

Project Management and Implementation Strategies

The successful implementation of blockchain projects for cross-border payments requires robust project management and strategic planning. In Saudi Arabia and the UAE, financial institutions and technology companies are adopting best practices in project management to ensure the seamless execution of blockchain initiatives. This involves careful planning, resource allocation, and continuous monitoring to achieve desired outcomes.

In Riyadh, banks and fintech companies are employing agile project management methodologies to drive blockchain projects. This approach allows for greater flexibility and adaptability, enabling project teams to respond quickly to changing requirements and challenges. By fostering collaboration and communication among team members, agile methodologies help ensure that blockchain projects are delivered on time and within budget.

Dubai has also seen the implementation of numerous blockchain projects across various sectors, supported by comprehensive governance frameworks. The Dubai Blockchain Strategy provides a clear roadmap for the deployment of blockchain, ensuring alignment with broader economic and development goals. Effective project management is key to the success of these initiatives, ensuring that projects are executed efficiently and deliver tangible benefits. By leveraging advanced project management tools and technologies, Dubai is setting a benchmark for blockchain implementation.

Conclusion

In conclusion, blockchain technology is revolutionizing cross-border payments by providing a faster, more secure, and cost-effective alternative to traditional methods. The strategic leadership and robust project management practices in Riyadh and Dubai are driving the successful adoption of blockchain, setting new standards for efficiency and innovation in the financial sector. As blockchain continues to evolve, its impact on cross-border payments will only grow, offering new opportunities for business success and economic growth. For business executives, mid-level managers, and entrepreneurs, embracing blockchain technology is essential for staying competitive and achieving long-term success in the digital age.

#blockchain #crossborderpayments #financialtechnology #SaudiArabia #UAE #Riyadh #Dubai #moderntechnology #businesssuccess #leadership #managementskills #projectmanagement