The Role of Blockchain in Revolutionizing Cross-Border Payments in the Middle East

Introduction to Blockchain in Cross-Border Payments

Blockchain technology in cross-border payments is transforming the financial landscape in Saudi Arabia and UAE. The implementation of blockchain by JPMorgan Chase for their Interbank Information Network (IIN) has significantly enhanced the security and efficiency of cross-border transactions. As global financial hubs, Riyadh and Dubai are at the forefront of adopting this innovative technology to streamline international payments and reduce transaction costs.

In Saudi Arabia, the integration of blockchain in the banking sector aligns with Vision 2030, which aims to modernize the economy and promote technological advancement. Blockchain provides a decentralized ledger that records all transactions transparently and immutably, ensuring that cross-border payments are secure and traceable. This technology addresses the inefficiencies and high costs associated with traditional banking systems, offering a faster and more reliable alternative for international transactions.

Similarly, the UAE, particularly Dubai, is embracing blockchain to solidify its position as a global financial leader. The Dubai Blockchain Strategy aims to make Dubai the first city fully powered by blockchain by 2020, promoting the widespread adoption of blockchain across various sectors, including finance. By leveraging blockchain technology, financial institutions in Dubai can enhance the speed and security of cross-border payments, benefiting businesses and consumers alike.

The Security Benefits of Blockchain in Financial Transactions

One of the most significant advantages of blockchain technology in cross-border payments is its enhanced security features. Blockchain’s decentralized nature means that no single entity controls the transaction ledger, reducing the risk of fraud and tampering. Each transaction is verified and recorded across multiple nodes, creating a secure and transparent system that is difficult to alter.

In Saudi Arabia, financial institutions are adopting blockchain to mitigate the risks associated with cross-border payments. The immutable nature of blockchain records ensures that all transactions are accurately documented and cannot be modified, providing an additional layer of security. This is particularly important in preventing fraudulent activities and ensuring the integrity of financial data. By utilizing blockchain, Saudi banks can offer their clients a more secure and trustworthy platform for international transactions.

Dubai is also leveraging blockchain to enhance the security of its financial systems. The use of blockchain in cross-border payments allows for real-time verification and settlement, reducing the potential for errors and discrepancies. Additionally, blockchain’s cryptographic protocols ensure that transaction data is encrypted and secure, protecting sensitive financial information from cyber threats. As Dubai continues to innovate in the fintech space, the adoption of blockchain technology will play a crucial role in maintaining the security and reliability of its financial services.

Efficiency Gains Through Blockchain-Enabled Cross-Border Payments

Blockchain technology offers significant efficiency gains for cross-border payments by streamlining the transaction process and reducing the need for intermediaries. Traditional banking systems often involve multiple steps and intermediaries, resulting in delays and higher costs. Blockchain, however, enables direct and instantaneous transactions between parties, cutting down processing times and costs.

In Saudi Arabia, the implementation of blockchain in cross-border payments is helping to reduce transaction times from several days to just a few minutes. This increased efficiency is particularly beneficial for businesses engaged in international trade, allowing them to manage cash flows more effectively and respond to market changes swiftly. The reduction in transaction costs also makes cross-border payments more affordable, encouraging greater participation in the global economy.

Dubai is similarly experiencing the efficiency benefits of blockchain technology. Financial institutions in Dubai are using blockchain to automate and streamline payment processes, eliminating the need for manual intervention and reducing the risk of human error. This not only speeds up transaction times but also improves the overall accuracy and reliability of financial operations. As Dubai continues to position itself as a leading fintech hub, the efficiency gains offered by blockchain technology will be instrumental in driving economic growth and competitiveness.

JPMorgan Chase’s Interbank Information Network: A Case Study

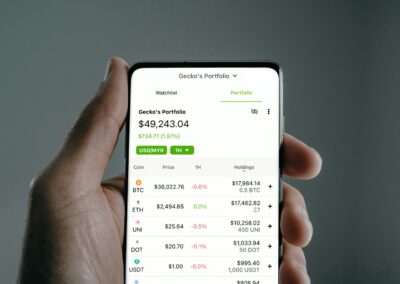

JPMorgan Chase’s implementation of blockchain technology for their Interbank Information Network (IIN) serves as a compelling case study of how blockchain can enhance cross-border payments. The IIN leverages blockchain to facilitate real-time information sharing between participating banks, improving the speed and accuracy of cross-border transactions.

In Saudi Arabia, financial institutions are drawing inspiration from JPMorgan Chase’s successful implementation of blockchain technology. By adopting similar blockchain-based networks, Saudi banks can enhance their cross-border payment capabilities, providing faster and more reliable services to their clients. The IIN’s success demonstrates the potential of blockchain to transform traditional banking systems, offering a blueprint for financial institutions in Saudi Arabia to follow.

Dubai is also taking note of JPMorgan Chase’s innovative approach to cross-border payments. The city’s commitment to becoming a global leader in blockchain technology aligns with the principles demonstrated by the IIN. By adopting blockchain-based solutions, financial institutions in Dubai can improve their cross-border payment processes, ensuring that transactions are secure, efficient, and transparent. The success of the IIN highlights the transformative potential of blockchain technology, encouraging further adoption and innovation in Dubai’s financial sector.

The Future of Blockchain in Cross-Border Payments

The future of blockchain in cross-border payments in Saudi Arabia and UAE looks promising, with continuous advancements and widespread adoption on the horizon. As blockchain technology evolves, it will become even more integral to the financial systems of these regions, offering enhanced security, efficiency, and transparency.

In Saudi Arabia, the ongoing efforts to integrate blockchain into various sectors, including finance, will ensure that the country remains at the forefront of technological innovation. The government’s support for blockchain research and development, combined with the strategic Vision 2030 framework, will drive the adoption of blockchain-based financial solutions, making cross-border payments more efficient and secure.

Similarly, in the UAE, the commitment to becoming a global blockchain leader will spur the continued integration of blockchain technology in financial services. Dubai’s thriving fintech ecosystem, supported by progressive regulations and a robust infrastructure, will foster the development and deployment of advanced blockchain technologies. This will not only improve cross-border payments but also pave the way for new and innovative financial products and services.

Conclusion: Embracing Blockchain for Enhanced Financial Services

The implementation of blockchain technology in cross-border payments is transforming the financial landscape in Saudi Arabia and UAE, enhancing the security and efficiency of transactions. By leveraging blockchain, financial institutions can offer faster, more reliable, and more secure payment solutions, benefiting businesses and consumers alike. The success of initiatives like JPMorgan Chase’s Interbank Information Network highlights the potential of blockchain to revolutionize traditional banking systems.

As Saudi Arabia and UAE continue to embrace technological innovation, the adoption of blockchain in financial services will play a crucial role in driving economic growth and business success. By staying at the forefront of blockchain research and development, these regions are setting new standards in financial innovation, positioning themselves as leaders in the global fintech landscape. The future of blockchain in cross-border payments is bright, promising a more efficient, secure, and transparent financial system for all.

—

#blockchaintechnology #crossborderpayments #SaudiArabia #UAE #JPMorganChase #InterbankInformationNetwork #Riyadh #Dubai #financialtechnology