Harnessing the Power of Cryptocurrencies for Micropayments

The Emergence of Cryptocurrencies in Saudi Arabia and the UAE

The potential of cryptocurrencies to enable micropayments is revolutionizing the digital economy, particularly in forward-thinking regions like Saudi Arabia and the UAE. With the rise of blockchain technology, cryptocurrencies offer a secure and efficient method for conducting transactions, including those of very small value, known as micropayments. These transactions, often less than a dollar, are transforming business models by allowing for new revenue streams and enhanced customer engagement.

In Saudi Arabia, the Vision 2030 initiative emphasizes technological innovation as a key driver of economic diversification and growth. Cryptocurrencies, facilitated by blockchain, are a significant part of this vision, offering transparent and secure transaction methods that are particularly well-suited for the digital economy. Similarly, in the UAE, cities like Dubai and Abu Dhabi are at the forefront of integrating cryptocurrencies into their financial systems, promoting a modern and efficient economy.

Micropayments enabled by cryptocurrencies can significantly benefit various sectors, including content creation, online gaming, and digital services. For instance, content creators can monetize their work through small, frequent payments from a large audience base, providing an alternative to traditional subscription models. This flexibility is particularly attractive to tech-savvy consumers and millennials who prefer paying for content as they consume it. By adopting cryptocurrencies for micropayments, businesses in the Gulf region can tap into new revenue streams and enhance their competitive edge.

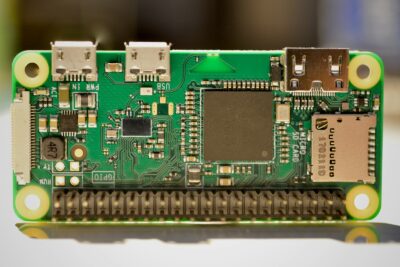

Blockchain Technology: The Backbone of Secure Micropayments

The integration of Blockchain technology is crucial for the success of cryptocurrencies in enabling micropayments. Blockchain provides a decentralized ledger that records transactions transparently and securely, ensuring the integrity and trustworthiness of each micropayment. This level of security is particularly important for fostering consumer confidence in digital transactions.

In Riyadh and Dubai, financial institutions and fintech companies are increasingly exploring blockchain solutions to facilitate secure and efficient micropayments. Blockchain’s ability to create immutable transaction records ensures that each micropayment is accurately tracked and verifiable, reducing the risk of fraud and errors. This transparency is essential for building trust among users and promoting the widespread adoption of cryptocurrencies for everyday transactions.

Moreover, blockchain technology supports the creation of smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. Smart contracts can automate micropayments, making the process more efficient and reducing administrative overhead. For example, a digital content platform can use smart contracts to automatically distribute payments to content creators based on user interactions and engagement metrics. This automation enhances efficiency and ensures timely payments, further promoting the use of cryptocurrencies for micropayments in the digital economy.

Innovative Business Models Enabled by Micropayments

The ability of cryptocurrencies to facilitate micropayments opens up numerous opportunities for innovative business models in the digital economy. One of the most significant impacts is the potential for pay-per-use services, where consumers pay small amounts for each use or interaction with a digital product or service. This model is particularly appealing in sectors like streaming services, online publishing, and digital art.

In the Gulf region, businesses are increasingly adopting pay-per-use models to cater to the preferences of modern consumers. For instance, a streaming service in Dubai might allow users to pay a small fee to watch a single episode of a TV show, rather than requiring a monthly subscription. This flexibility can attract a broader audience and increase overall revenue. Similarly, online publishers in Riyadh can use micropayments to charge readers for individual articles, providing an alternative to traditional subscription models and enabling more personalized content consumption.

Another innovative business model enabled by micropayments is the concept of micro-investments. This model allows users to invest small amounts of money in various assets, such as stocks, cryptocurrencies, or real estate, making investment opportunities more accessible to a wider audience. By lowering the barrier to entry, micro-investments can democratize access to financial markets and promote financial inclusion. Businesses in Saudi Arabia and the UAE can leverage this model to attract new investors and expand their customer base.

Business Success Through Cryptocurrencies and Micropayments

Enhancing Customer Engagement and Loyalty

The adoption of cryptocurrencies and micropayments can significantly enhance customer engagement and loyalty. By offering flexible payment options, businesses can cater to the diverse preferences of their customers, providing a more personalized and satisfying experience. For instance, a gaming company in Dubai can use micropayments to allow players to purchase in-game items or features, enhancing their gaming experience and increasing engagement.

In Saudi Arabia, businesses can use micropayments to implement loyalty programs that reward customers for their frequent interactions and purchases. These programs can offer small, frequent rewards that accumulate over time, encouraging repeat business and fostering long-term customer loyalty. By leveraging the transparency and security of blockchain technology, businesses can ensure that their loyalty programs are fair and trustworthy, further enhancing customer satisfaction.

Moreover, the use of cryptocurrencies for micropayments can attract tech-savvy consumers who are already familiar with digital currencies. By adopting innovative payment solutions, businesses can position themselves as forward-thinking and customer-centric, strengthening their brand image and competitive advantage. In the fast-paced digital economy, the ability to adapt to new technologies and meet the evolving needs of customers is crucial for business success.

Leadership and Management Skills for the Digital Economy

Effective leadership and management skills are essential for navigating the complexities of the digital economy and maximizing the potential of cryptocurrencies and micropayments. Business leaders in Saudi Arabia and the UAE must be equipped with the knowledge and skills to implement and manage digital technologies effectively. This includes understanding the potential of blockchain and cryptocurrencies, managing the integration of these technologies into existing systems, and ensuring that their teams are trained to leverage these innovations.

In Riyadh and Dubai, there is a growing emphasis on developing leadership and management skills that are aligned with the demands of the digital economy. Business executives and mid-level managers are increasingly attending training programs and workshops focused on digital transformation and innovation. These initiatives are designed to equip leaders with the skills needed to drive digital transformation and manage the transition to digital-first operations effectively.

Moreover, effective leadership in the digital economy requires a strategic vision that aligns digital initiatives with the overall business goals. This includes identifying the areas where digital technologies can have the most significant impact, setting clear objectives for digital transformation, and measuring the outcomes. By developing the right leadership and management skills, businesses in Saudi Arabia and the UAE can successfully navigate the challenges of the digital economy and achieve sustained business success.

Conclusion

The potential of cryptocurrencies to enable micropayments is transforming the digital economy, particularly in innovative regions like Saudi Arabia and the UAE. By leveraging blockchain technology, cryptocurrencies offer secure and efficient methods for conducting micropayments, opening up new opportunities for business models and customer engagement. For business leaders and entrepreneurs, the adoption of cryptocurrencies and micropayments offers valuable insights into the importance of digital transformation and the potential of technology to drive business success. As digital payments continue to evolve, their impact on the digital economy is expected to grow, offering new opportunities for innovation and growth in the Gulf region.

#Cryptocurrencies #Micropayments #DigitalEconomy #SaudiArabia #UAE #Riyadh #Dubai #Blockchain #BusinessSuccess #Leadership #Management #ProjectManagement #ArtificialIntelligence #GenerativeAI #Metaverse