How Digital Assets Diversify Investment Portfolios in Saudi Arabia and the UAE

The Rising Importance of Digital Assets

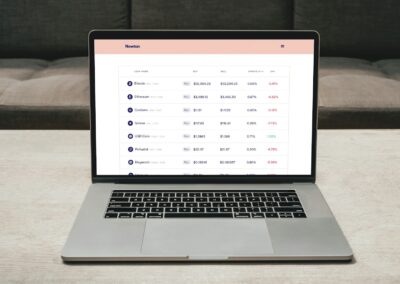

Digital assets, including cryptocurrencies, tokenized assets, and blockchain-based financial instruments, are becoming essential components of diversified investment portfolios in Saudi Arabia and the UAE. These modern financial instruments provide investors with opportunities to achieve higher returns and reduce overall portfolio risk through diversification. The integration of digital assets into investment strategies is increasingly viewed as a necessary evolution in the ever-changing landscape of global finance.

The appeal of digital assets lies in their potential for significant appreciation and their low correlation with traditional asset classes like stocks and bonds. By including digital assets in a portfolio, investors can hedge against market volatility and economic downturns. For instance, during periods of economic uncertainty, digital assets such as Bitcoin or Ethereum have often shown resilience, providing a safe haven for investors. This characteristic is particularly valuable in regions like Saudi Arabia and the UAE, where economic diversification is a strategic priority.

Moreover, the adoption of digital assets is supported by the robust technological infrastructure and regulatory frameworks being developed in these regions. Saudi Arabia and the UAE are at the forefront of embracing blockchain technology, recognizing its potential to revolutionize various sectors, including finance. The proactive stance of these countries in regulating and promoting digital assets ensures that investors can confidently explore these new opportunities within a secure and transparent environment.

Blockchain Technology: The Backbone of Digital Assets

Blockchain technology is the foundation of digital assets, providing the necessary infrastructure for their creation, transfer, and security. In Saudi Arabia and the UAE, the implementation of blockchain is transforming the financial landscape, offering unprecedented transparency and efficiency. By leveraging blockchain, digital assets can be securely recorded and transferred without the need for intermediaries, reducing costs and increasing transaction speed.

The benefits of blockchain extend beyond just financial transactions. For example, tokenized assets, which represent ownership of real-world assets like real estate or commodities on a blockchain, allow for fractional ownership and easier transferability. This democratization of investment opportunities enables a broader range of investors to participate in markets that were previously inaccessible. In Saudi Arabia, the Vision 2030 initiative is heavily investing in blockchain technology to enhance financial inclusion and stimulate economic growth. Similarly, the UAE’s Blockchain Strategy 2021 aims to leverage blockchain to improve government efficiency and foster innovation in the financial sector.

Blockchain’s immutable ledger ensures the integrity and security of digital asset transactions. This transparency is crucial for building investor trust and protecting against fraud. The decentralized nature of blockchain also means that there is no single point of failure, making digital asset systems more resilient to cyber-attacks. For business executives and entrepreneurs in Saudi Arabia and the UAE, understanding and leveraging blockchain technology is essential for capitalizing on the growing digital asset market.

Digital Assets and Generative Artificial Intelligence

The integration of Generative Artificial Intelligence (AI) with digital assets is opening new avenues for innovation and investment. Generative AI can analyze vast amounts of data to generate investment strategies, predict market trends, and identify profitable opportunities in the digital asset space. This advanced technology is particularly beneficial for managing the complexities and volatility associated with digital assets.

In Saudi Arabia and the UAE, the combination of generative AI and digital assets is enhancing decision-making processes for investors. AI-powered tools can provide real-time insights and automated trading strategies, allowing investors to respond swiftly to market changes. These tools are invaluable for navigating the fast-paced and often unpredictable digital asset markets. Additionally, AI can help in risk management by identifying potential threats and anomalies that could impact digital asset portfolios.

Generative AI also supports the creation of new types of digital assets and investment products. For instance, AI can be used to design and issue smart contracts that automate various aspects of financial transactions, ensuring compliance and efficiency. This innovation is fostering a new wave of financial products that cater to the evolving needs of investors in Saudi Arabia and the UAE. By embracing generative AI, investors and financial institutions can stay ahead of the curve and capitalize on the opportunities presented by the digital asset revolution.

Business Success and Leadership in the Digital Asset Era

Driving Business Success with Digital Assets

The incorporation of digital assets into business strategies is driving success for companies in Saudi Arabia and the UAE. For business executives and entrepreneurs, digital assets offer new avenues for raising capital, diversifying revenue streams, and enhancing financial resilience. Companies can issue their own tokens or participate in initial coin offerings (ICOs) to attract investment and fund innovative projects. This approach not only provides access to a broader investor base but also enables companies to leverage blockchain technology for greater transparency and efficiency.

In addition to capital raising, digital assets can be used for various operational purposes. For example, companies can utilize stablecoins for international transactions, reducing the time and cost associated with cross-border payments. This efficiency is particularly valuable for businesses operating in the globalized economies of Saudi Arabia and the UAE. Furthermore, digital assets can be integrated into supply chain management to enhance traceability and reduce fraud. By using blockchain to track the provenance of goods, companies can ensure the authenticity and quality of their products, building consumer trust and loyalty.

Moreover, the strategic use of digital assets can provide a competitive edge in the rapidly evolving digital economy. Companies that adopt digital assets early can position themselves as innovators and leaders in their industry. This forward-thinking approach is essential for staying ahead in the competitive markets of Saudi Arabia and the UAE. By leveraging digital assets, businesses can achieve greater operational efficiency, attract new investment, and drive long-term growth.

Leadership and Management Skills for the Digital Asset Era

Effective leadership and management are crucial for navigating the complexities of the digital asset era. Business leaders in Saudi Arabia and the UAE must develop a deep understanding of digital assets and blockchain technology to guide their organizations successfully. This involves staying informed about regulatory developments, technological advancements, and market trends. Leaders must also foster a culture of innovation and continuous learning within their organizations, encouraging their teams to embrace new technologies and explore new business models.

Strong change management skills are essential for implementing digital asset strategies. The adoption of digital assets often requires significant changes to existing processes and workflows. Leaders must effectively communicate the benefits of digital assets to their teams, address any resistance or concerns, and provide the necessary training and support. By managing these changes effectively, leaders can ensure a smooth transition and maximize the benefits of digital asset integration.

Additionally, leaders must focus on building partnerships and collaborations to leverage the full potential of digital assets. This includes working with technology providers, regulatory bodies, and other stakeholders to create a supportive ecosystem for digital asset innovation. By fostering collaboration, leaders can drive the adoption of digital assets and unlock new opportunities for their organizations.

In conclusion, digital assets play a crucial role in diversifying investment portfolios and providing new opportunities for investors in Saudi Arabia and the UAE. By leveraging blockchain technology and generative AI, investors and businesses can enhance their financial strategies and drive success in the digital economy. Effective leadership and management are essential for navigating the digital asset era and capitalizing on the opportunities it presents.

#DigitalAssets #InvestmentPortfolios #SaudiArabia #UAE #Blockchain #ModernTechnology #BusinessSuccess #Leadership #ManagementSkills #ProjectManagement