Transforming Financial Transactions in Saudi Arabia and the UAE

The Role of Blockchain in Compliance

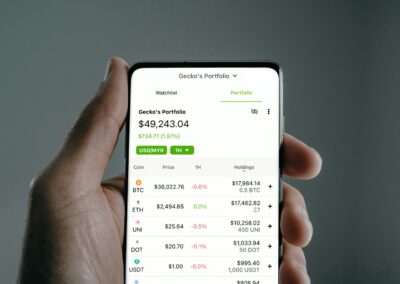

The role of blockchain in enhancing compliance and regulatory reporting of cross-border payments is becoming increasingly significant in the financial sector. In regions such as Saudi Arabia and the UAE, where economic growth and technological advancements are top priorities, blockchain technology is proving to be an essential tool for ensuring adherence to international standards. By providing a transparent and immutable ledger of all transactions, blockchain ensures that financial institutions can meet regulatory requirements more efficiently and effectively.

In Saudi Arabia, the adoption of blockchain technology aligns with the Kingdom’s Vision 2030, which aims to diversify the economy and promote innovation across various sectors, including finance. Banks and financial institutions in Riyadh are increasingly integrating blockchain to streamline compliance processes and improve the accuracy of regulatory reporting. This technology allows for real-time tracking and verification of transactions, thereby reducing the risk of errors and enhancing the overall efficiency of cross-border payments.

Similarly, in the UAE, particularly in Dubai, blockchain technology is being leveraged to enhance compliance and regulatory reporting in the financial sector. Dubai’s dynamic financial ecosystem and its commitment to becoming a global fintech hub make it an ideal environment for the adoption of blockchain solutions. By implementing blockchain, financial institutions in Dubai can ensure that cross-border payments are conducted in accordance with international standards, thereby enhancing transparency and trust among stakeholders. The use of blockchain not only improves compliance but also supports the growth of the financial sector by attracting international investors and promoting economic development.

Ensuring Adherence to International Standards

Blockchain technology plays a crucial role in ensuring adherence to international standards in cross-border payments. Each transaction recorded on the blockchain is immutable and verifiable, providing a clear and transparent record of all financial activities. This level of transparency is essential for meeting regulatory requirements and ensuring that all transactions comply with international standards.

In Riyadh, financial institutions are leveraging blockchain to enhance the transparency of their cross-border payment processes. By providing a verifiable record of all transactions, blockchain enables banks to demonstrate compliance with international regulations and standards. This is particularly important in the context of cross-border payments, where regulatory requirements can vary significantly between jurisdictions. Blockchain’s ability to provide a secure and transparent record of transactions helps banks in Riyadh to navigate these complexities and ensure that their operations remain compliant with international standards.

Dubai is also embracing blockchain to ensure compliance with international standards in cross-border payments. The city’s commitment to innovation and its status as a global financial hub make it an ideal environment for the implementation of blockchain solutions. By leveraging blockchain technology, financial institutions in Dubai can enhance the transparency and accountability of their cross-border payment processes, thereby improving compliance with international regulations. The use of blockchain ensures that all stakeholders have access to accurate and reliable information, thereby enhancing trust and confidence in the financial system.

Blockchain and the Future of Cross-Border Payments

The integration of blockchain technology in cross-border payments is set to revolutionize the financial sector by providing enhanced compliance, transparency, and efficiency. As the financial landscape continues to evolve, blockchain is becoming an essential tool for managing and verifying transactions. By providing an immutable and transparent record of all activities, blockchain ensures that cross-border payments are conducted in a secure and reliable manner, thereby reducing the risk of fraud and enhancing trust among stakeholders.

In Saudi Arabia, the adoption of blockchain for cross-border payments aligns with the Kingdom’s vision of becoming a leader in financial technology. By leveraging blockchain, financial institutions in Riyadh can offer more secure and transparent services, thereby attracting international investors and promoting economic growth. The use of blockchain not only ensures the integrity of cross-border payments but also supports compliance with regulatory standards, ensuring that all stakeholders are protected. As the financial sector continues to evolve, blockchain is set to play an increasingly important role in managing and verifying cross-border payments, thereby enhancing the efficiency and reliability of financial transactions.

Dubai is also at the forefront of adopting blockchain technology for cross-border payments. The city’s commitment to innovation and its status as a global financial hub make it an ideal environment for the implementation of blockchain solutions. By leveraging blockchain, financial institutions in Dubai can offer clients a higher level of transparency and security, thereby enhancing trust and confidence in the financial system. This is particularly important for attracting international investors and promoting economic growth. The future of cross-border payments in Dubai looks promising, with blockchain set to play a pivotal role in ensuring compliance and regulatory reporting.

Leadership and Management in Implementing Blockchain Solutions

The successful implementation of blockchain technology in ensuring compliance and regulatory reporting of cross-border payments requires strong leadership and effective management skills. Business executives and mid-level managers in Saudi Arabia and the UAE play a crucial role in driving these technological advancements and ensuring that their organizations are well-equipped to handle the complexities of digital asset management. This involves staying abreast of emerging technologies, fostering a culture of innovation, and investing in the necessary infrastructure and talent to support these initiatives.

In Riyadh and Dubai, leaders in the financial sector are increasingly recognizing the importance of digital transformation. By embracing blockchain technology, they can enhance the transparency, accountability, and efficiency of their cross-border payment processes, thereby improving operational performance and mitigating risks. Effective project management is also essential in this context, as it ensures that technological implementations are completed on time, within budget, and to the highest standards.

Leadership in the modern business environment also involves a commitment to continuous learning and development. Executives and managers in Saudi Arabia and the UAE must be proactive in acquiring new skills and knowledge to navigate the complexities of the digital age. This includes understanding the implications of blockchain technology for their organizations and being able to leverage these technologies to achieve strategic objectives. By fostering a culture of innovation and investing in the necessary infrastructure, leaders can ensure that their organizations remain at the forefront of financial technology and continue to drive business success.

Conclusion: Embracing Blockchain for Enhanced Compliance

In conclusion, the role of blockchain in enhancing compliance and regulatory reporting of cross-border payments is revolutionizing the financial sector by providing a transparent and immutable ledger of all transactions. By ensuring adherence to international standards, blockchain enhances the efficiency and reliability of cross-border payments, thereby reducing the risk of fraud and enhancing trust among stakeholders. In Saudi Arabia and the UAE, the adoption of blockchain technology aligns with the broader goals of economic diversification and technological leadership.

The commitment of Riyadh and Dubai to technological innovation and digital transformation is evident in their adoption of blockchain for cross-border payments. Business executives and mid-level managers in these regions play a pivotal role in driving these advancements, leveraging their leadership and management skills to ensure successful implementations. As the financial landscape continues to evolve, it is clear that blockchain technology will play an increasingly important role in ensuring compliance and regulatory reporting of cross-border payments. By embracing these technologies, Saudi Arabia and the UAE are well-positioned to lead the way in the future of financial services, offering cutting-edge solutions that meet the needs of a diverse and dynamic global audience.

—

#blockchain #compliance #regulatoryreporting #crossborderpayments #internationalstandards #financialtechnology #businesssuccess #saudiarabia #uae #riyadh #dubai #artificialintelligence #moderntechnology #leadershipskills #managementskills #projectmanagement