The Role of Real-time AI Risk Evaluation in Financial Decision-Making

Understanding the Impact of Real-time AI Risk Evaluation on Financial Strategies

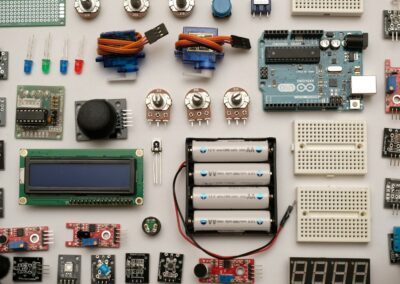

Real-time AI risk evaluation is revolutionizing financial decision-making processes in Saudi Arabia and the UAE, especially in key financial hubs like Riyadh and Dubai. As businesses navigate complex markets, the ability to assess risks instantaneously with the help of AI has become a vital component for success. Real-time AI risk evaluation integrates advanced algorithms and data analysis techniques to provide financial leaders with immediate insights into potential risks and opportunities. This capability allows organizations to make more informed decisions, adapt strategies on the fly, and respond to market fluctuations with greater agility.

In rapidly evolving markets like those in Riyadh and Dubai, the traditional methods of risk assessment are often too slow to keep up with the pace of change. Real-time AI risk evaluation offers a significant advantage by processing vast amounts of data from various sources in seconds, delivering actionable insights to decision-makers. This not only enhances the accuracy of financial strategies but also reduces the likelihood of costly errors. Businesses can now anticipate risks before they materialize, allowing for proactive measures that safeguard assets and investments.

Moreover, the adoption of real-time AI risk evaluation aligns with the broader goals of digital transformation and innovation in the financial sector across Saudi Arabia and the UAE. By leveraging AI to enhance risk management, financial institutions can improve their operational efficiency and competitiveness. The integration of AI-driven risk evaluation tools is particularly relevant in regions where financial markets are growing and diversifying. As more companies in Riyadh and Dubai recognize the value of real-time AI risk evaluation, it is expected to become a standard practice in financial decision-making, further driving the region’s economic growth.

AI-driven Risk Evaluation and its Influence on Business Success

The influence of AI-driven risk evaluation on business success cannot be overstated, especially in the context of Saudi Arabia and the UAE, where financial markets are pivotal to economic stability and growth. By incorporating real-time AI risk evaluation into their decision-making processes, businesses can achieve a higher level of precision in their financial strategies. This precision translates into better resource allocation, optimized investment portfolios, and a stronger ability to weather economic uncertainties. For business executives and entrepreneurs in Riyadh and Dubai, the adoption of AI-driven risk evaluation is a strategic move that enhances long-term profitability and sustainability.

In the competitive financial landscapes of Saudi Arabia and the UAE, where cities like Riyadh and Dubai serve as financial powerhouses, the ability to make swift and informed decisions is crucial. Real-time AI risk evaluation provides the tools needed to stay ahead of the competition by enabling businesses to respond to risks and opportunities in real time. This level of responsiveness not only protects companies from potential losses but also positions them to capitalize on emerging trends and market shifts. As a result, businesses that embrace AI-driven risk evaluation are better equipped to achieve consistent growth and success.

Real-time AI Risk Evaluation as a Catalyst for Change Management

Real-time AI risk evaluation is also emerging as a critical tool for effective change management in the financial sectors of Saudi Arabia and the UAE. As organizations in Riyadh and Dubai undergo digital transformation, the ability to assess and manage risks in real-time becomes essential for guiding these changes. AI-driven risk evaluation offers a dynamic approach to change management by providing real-time feedback on the potential impact of new initiatives, investments, and strategic shifts. This allows businesses to navigate the complexities of change with greater confidence and precision.

In the context of change management, real-time AI risk evaluation helps businesses identify potential obstacles and opportunities early in the process. This foresight enables organizations to adapt their strategies and operations to mitigate risks and maximize benefits. For financial institutions in Riyadh and Dubai, where change is often driven by regulatory developments, market volatility, or technological advancements, the ability to manage risks in real-time is invaluable. By integrating AI-driven risk evaluation into their change management frameworks, companies can ensure smoother transitions and more successful outcomes.

#RealTimeAI #RiskEvaluation #FinancialDecisionMaking #AIinFinance #BusinessSuccess #AIinBusiness #SaudiArabia #UAE #Riyadh #Dubai