Ensuring Traveler Protection through Strategic Collaborations

The Importance of Travel Insurance in the Modern Travel Industry

Travel insurance policies protect travelers against trip cancellations, medical emergencies, and other unexpected occurrences, enhancing the overall travel experience. This is particularly relevant in regions like Saudi Arabia and the UAE, where travel is a significant part of both business and leisure activities.

In cities such as Riyadh and Dubai, where the travel industry is booming, the integration of travel insurance into the services offered by OTAs is vital. For instance, an OTA in Riyadh might partner with a leading travel insurance provider to offer customizable insurance packages that cater to the specific needs of travelers. This ensures that clients are protected from potential financial losses and receive timely assistance in case of emergencies.

Moreover, leveraging advanced technologies such as artificial intelligence (AI) and blockchain can further enhance the effectiveness of these partnerships. AI can assist in personalizing insurance offerings based on individual travel preferences and behaviors, while blockchain ensures the transparency and security of insurance transactions. By incorporating these technologies, OTAs can provide a more reliable and user-friendly insurance experience.

Key Benefits of Travel Insurance Partnerships

Travel insurance partnerships offer numerous benefits to both OTAs and travelers. These benefits include comprehensive coverage options, streamlined claim processes, and enhanced customer trust. By integrating these capabilities, OTAs can provide a holistic travel solution that addresses the diverse needs of modern travelers.

Comprehensive coverage options are a significant advantage of travel insurance partnerships. These policies cover a wide range of scenarios, including trip cancellations, medical emergencies, lost luggage, and travel delays. For example, an OTA in Dubai can offer travel insurance packages that include coverage for adventure activities, ensuring that travelers engaging in activities such as desert safaris or scuba diving are adequately protected.

Streamlined claim processes are another critical benefit. Travel insurance providers often have established systems for processing claims quickly and efficiently, reducing the stress and hassle for travelers. For instance, a traveler from the UAE who experiences a medical emergency abroad can easily file a claim and receive assistance through the OTA’s partner insurance provider, ensuring that they get the necessary support without delay.

Enhanced customer trust is also a crucial outcome of these partnerships. When travelers know that their OTA has partnered with reputable insurance providers, they are more likely to book their trips with confidence. This trust is particularly important in regions like Saudi Arabia, where ensuring safety and reliability is paramount for both business and leisure travelers. By offering reliable travel insurance options, OTAs can build stronger relationships with their customers and encourage repeat business.

Implementing Effective Travel Insurance Partnerships

Implementing effective travel insurance partnerships requires a strategic approach that includes careful selection of partners, integration with existing systems, and continuous improvement. OTAs must start by identifying reputable insurance providers that offer comprehensive and customizable coverage options. This selection process should include evaluating the provider’s financial stability, customer service reputation, and range of coverage options.

In Saudi Arabia and the UAE, where regulatory compliance is critical, choosing insurance providers that adhere to local regulations is essential. OTAs must ensure that their partners are licensed and compliant with local insurance laws, providing peace of mind to their clients. Additionally, training OTA staff on the details of the insurance offerings ensures that they can effectively communicate the benefits to travelers.

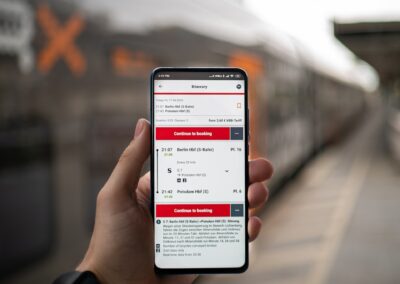

The next step is to integrate the insurance offerings with the OTA’s booking systems. This integration allows travelers to easily add insurance coverage to their bookings and access policy details through the OTA’s platform. For example, an OTA in Riyadh might develop an integrated system that allows travelers to select their desired coverage options during the booking process, ensuring a seamless and user-friendly experience.

Continuous improvement is also vital for maintaining the effectiveness of these partnerships. OTAs should regularly review the performance of their insurance offerings, gather feedback from travelers, and make necessary adjustments to enhance the overall experience. By staying responsive to customer needs and industry trends, OTAs can ensure that their travel insurance partnerships remain relevant and valuable.

Future Trends in Travel Insurance Partnerships

The future of travel insurance partnerships with OTAs promises further advancements and innovations, driven by emerging technologies such as AI, machine learning, and blockchain. These technologies will enable more personalized and efficient insurance offerings, enhancing the overall travel experience.

AI and machine learning can analyze vast amounts of data to identify patterns and predict potential risks. This capability allows OTAs to offer personalized insurance packages that cater to the specific needs and preferences of travelers. For example, an OTA in Dubai might use AI to analyze a traveler’s booking history and suggest insurance coverage that aligns with their travel habits and destinations.

Blockchain technology offers a secure and transparent way to manage insurance transactions, ensuring that all parties have access to accurate and tamper-proof records. This transparency is particularly valuable in building trust between travelers and insurance providers. For instance, an OTA in Saudi Arabia can use blockchain to manage insurance policies, ensuring that travelers have access to their coverage details at all times and can verify the authenticity of their policies.

In addition to AI and blockchain, the integration of the metaverse and generative AI into travel insurance partnerships offers exciting possibilities. The metaverse can provide immersive virtual environments where travelers can explore their insurance options and interact with representatives in real-time. Generative AI can assist in creating customized insurance policies based on real-time data and traveler feedback, ensuring that coverage options are continually optimized.

Conclusion

In conclusion, travel insurance partnerships with OTAs are essential for ensuring traveler protection and enhancing the overall travel experience. By integrating advanced technologies such as AI, blockchain, and the metaverse, these partnerships can offer more personalized and efficient insurance solutions. In regions like Saudi Arabia, UAE, Riyadh, and Dubai, where travel is a significant part of business and leisure activities, these partnerships play a crucial role in building trust and ensuring safety. Embracing these advancements will enable OTAs to provide comprehensive travel solutions, support operational efficiency, and drive business growth.

#travelinsurance #OTAs #onlinetravelagencies #travelprotection #tripcancellations #medicalemergencies #SaudiArabia #UAE #Riyadh #Dubai #AI #blockchain #metaverse #generativeAI #businesssuccess #leadership #managementskills #projectmanagement