Strategies for Effective Financial Management and Debt Avoidance

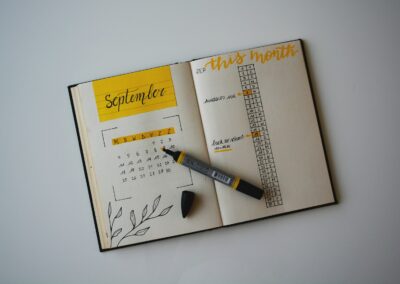

Introduction to Expense Tracking for Financial Health

Expense tracking for financial health is a fundamental practice that helps individuals and businesses maintain a healthy financial balance and avoid accumulating debt. In the economically vibrant regions of Saudi Arabia, UAE, Riyadh, and Dubai, effective expense tracking is crucial for ensuring long-term financial stability and growth. By diligently monitoring expenditures, both individuals and organizations can make informed financial decisions, optimize their budgets, and achieve their financial goals. This proactive approach to financial management not only supports economic stability but also fosters sustainable success.

The Importance of Expense Tracking in Personal Finance

Expense tracking is a cornerstone of personal finance management, offering a clear picture of where money is being spent and identifying opportunities for savings. In regions like Saudi Arabia and the UAE, where economic opportunities are abundant, understanding personal spending habits is essential. By using digital tools and apps designed for expense tracking, individuals can categorize their expenses, set budgets, and track their progress over time. This visibility into financial behavior helps individuals make adjustments as needed, ensuring they live within their means and avoid unnecessary debt. Additionally, expense tracking aids in planning for future expenses and setting aside funds for savings and investments, contributing to long-term financial health.

Implementing Effective Expense Tracking Systems

Implementing effective expense tracking systems involves adopting tools and practices that provide accurate and timely financial data. For businesses in Riyadh and Dubai, where financial management is key to competitive advantage, leveraging advanced expense tracking software can streamline this process. These tools offer features such as real-time tracking, automated expense categorization, and detailed reporting. By integrating these systems with existing financial management platforms, businesses can gain comprehensive insights into their spending patterns, identify cost-saving opportunities, and ensure compliance with financial regulations. Effective expense tracking systems support better decision-making, enhance financial transparency, and improve overall financial performance.

Reducing Debt Through Expense Tracking

One of the significant benefits of expense tracking is its role in debt reduction. By keeping a close eye on expenses, individuals and businesses can avoid overspending and accumulating debt. In economically dynamic regions like Saudi Arabia and the UAE, where access to credit is readily available, managing debt effectively is crucial. Expense tracking helps identify discretionary spending that can be curtailed, allowing for more funds to be allocated towards debt repayment. This disciplined approach not only reduces financial liabilities but also improves credit scores and financial resilience. By prioritizing expense tracking, individuals and businesses can achieve a debt-free financial status and enjoy greater financial freedom.

Leveraging Technology for Enhanced Financial Management

Technology plays a pivotal role in modern expense tracking, offering innovative solutions that enhance financial management. In cities like Riyadh and Dubai, where technological advancements are rapidly transforming various industries, leveraging digital tools for expense tracking is becoming increasingly common. Mobile apps, cloud-based software, and AI-driven platforms provide users with intuitive interfaces and advanced features for managing their finances. These technologies enable real-time expense tracking, predictive analytics, and personalized financial advice, making it easier for users to stay on top of their finances. By embracing these technological solutions, individuals and businesses can achieve greater efficiency, accuracy, and control in their financial management practices.

Enhancing Financial Literacy Through Expense Tracking

Financial literacy is closely linked to effective expense tracking. By understanding how to track and manage expenses, individuals and businesses can develop a deeper understanding of financial principles and practices. Educational resources and tutorials on expense tracking provide valuable guidance on budgeting, saving, and investing. In regions like Saudi Arabia and the UAE, where financial literacy initiatives are gaining momentum, promoting expense tracking as a key component of financial education can significantly enhance financial well-being. These resources empower users to make informed financial decisions, plan for the future, and achieve greater financial security.

Supporting Business Success with Robust Financial Management

For business executives and entrepreneurs, robust financial management is essential for sustaining growth and achieving long-term success. Expense tracking provides critical insights into business operations, helping leaders identify areas for cost reduction and efficiency improvement. In the competitive markets of Riyadh and Dubai, effective financial management practices, including expense tracking, are vital for maintaining profitability and driving innovation. By fostering a culture of financial discipline and transparency, businesses can enhance their financial performance, build stronger relationships with stakeholders, and secure a competitive edge in their industry.

Conclusion: The Strategic Value of Expense Tracking

Expense tracking for financial health is a strategic practice that offers significant benefits for individuals and businesses in Saudi Arabia, UAE, Riyadh, and Dubai. By diligently monitoring expenditures and implementing effective tracking systems, users can avoid debt, optimize their budgets, and achieve their financial goals. This proactive approach to financial management not only enhances economic stability but also supports sustainable growth and success. As technological innovations continue to reshape the financial landscape, the importance of expense tracking will remain a cornerstone of effective financial management, enabling users to navigate financial challenges with confidence and prudence.

—

#ExpenseTracking #FinancialHealth #PersonalFinance #DebtManagement #Budgeting #FinancialPlanning #BusinessTechnology #SaudiArabia #UAE #Riyadh #Dubai