Transforming Financial Services in Saudi Arabia and the UAE

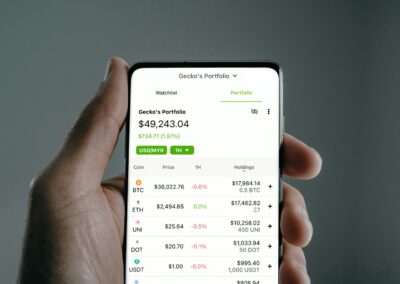

The Role of Fintech in Enhancing Cross-Border Payments

Fintech in cross-border payments is revolutionizing the financial landscape by enabling seamless international transactions and reducing associated costs and complexities. As global trade and international business expand, the need for efficient and cost-effective cross-border payment solutions becomes increasingly critical. In Saudi Arabia and the UAE, fintech innovations are playing a pivotal role in transforming how businesses and individuals conduct international transactions, fostering economic growth and enhancing financial inclusion.

In Riyadh, financial institutions are leveraging fintech to streamline cross-border payments. Traditional methods of international transactions often involve multiple intermediaries, resulting in high fees and lengthy processing times. Fintech solutions, utilizing technologies such as blockchain and artificial intelligence (AI), provide a more direct and efficient route for transferring funds across borders. By reducing the reliance on intermediaries, fintech significantly lowers transaction costs and speeds up the process, making cross-border payments more accessible to businesses and individuals alike. This aligns with Saudi Arabia’s Vision 2030, which aims to diversify the economy and promote financial innovation.

Dubai, as a global financial hub, is also at the forefront of adopting fintech solutions to enhance cross-border payments. The UAE Central Bank has been proactive in implementing regulatory frameworks that support fintech innovation. This has led to the development of advanced payment platforms that enable real-time international transactions. By leveraging fintech, businesses in Dubai can manage their international operations more efficiently, reducing the complexities associated with currency exchange and compliance. This fosters a more competitive business environment, attracting international investors and promoting economic growth.

Leveraging Blockchain Technology for Secure and Transparent Transactions

Blockchain technology is a cornerstone of fintech solutions in cross-border payments, offering unparalleled security and transparency. Blockchain’s decentralized ledger system ensures that all transactions are recorded immutably and are verifiable by all parties involved. This not only enhances security but also builds trust among users, as the risk of fraud and errors is significantly reduced.

In Riyadh, financial institutions are integrating blockchain technology into their payment systems to enhance the security of cross-border transactions. By utilizing blockchain, banks can create a tamper-proof record of all transactions, ensuring that every transfer is transparent and verifiable. This level of transparency is crucial for regulatory compliance and helps build trust with international partners. Additionally, blockchain enables smart contracts, which can automate the execution of payment agreements based on predefined conditions. This reduces the need for manual intervention, further streamlining the payment process and reducing operational costs.

Dubai’s financial sector is also capitalizing on the benefits of blockchain technology for cross-border payments. The UAE has established itself as a leader in blockchain adoption, with several initiatives aimed at integrating blockchain across various sectors. In the realm of international payments, blockchain provides a robust solution for ensuring the integrity and efficiency of transactions. By reducing the need for intermediaries and automating verification processes, blockchain technology significantly lowers transaction costs and accelerates processing times. This makes Dubai an attractive destination for businesses seeking reliable and efficient cross-border payment solutions.

Enhancing Efficiency with Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are revolutionizing cross-border payments by enhancing efficiency and accuracy. These technologies can analyze vast amounts of data in real-time, identify patterns, and predict potential issues before they arise. This proactive approach helps financial institutions manage risks more effectively and optimize their payment processes.

In Riyadh, AI and ML are being integrated into fintech solutions to improve the efficiency of cross-border payments. AI-powered algorithms can monitor transactions in real-time, detecting anomalies and potential fraud. This enables banks to respond swiftly to any suspicious activities, ensuring the security of international payments. Additionally, machine learning models can analyze historical transaction data to identify trends and optimize routing for faster and more cost-effective transfers. By leveraging AI and ML, financial institutions in Riyadh can provide more reliable and efficient cross-border payment services.

Dubai’s financial institutions are also harnessing the power of AI and ML to enhance their cross-border payment systems. AI-driven platforms can automate many aspects of the payment process, from identity verification to compliance checks, reducing the need for manual intervention and minimizing errors. Machine learning models can continuously improve based on new data, ensuring that payment systems remain adaptive and efficient. By integrating AI and ML into their fintech solutions, Dubai’s financial sector can offer cutting-edge payment services that meet the evolving needs of businesses and individuals in a globalized economy.

Driving Business Success through Fintech Innovations

Supporting Small and Medium-Sized Enterprises (SMEs)

Fintech innovations in cross-border payments are particularly beneficial for small and medium-sized enterprises (SMEs). These businesses often face significant challenges when dealing with international transactions, including high fees, lengthy processing times, and complex regulatory requirements. Fintech solutions provide SMEs with more accessible and affordable options for managing their cross-border payments, enabling them to compete more effectively in the global market.

In Riyadh, fintech platforms are offering tailored solutions to meet the needs of SMEs. These platforms provide user-friendly interfaces that simplify the process of sending and receiving international payments. By reducing transaction costs and improving processing times, fintech enables SMEs to manage their cash flow more effectively and focus on their core business activities. Additionally, fintech solutions often include features such as multi-currency accounts and automated compliance checks, making it easier for SMEs to navigate the complexities of international trade.

Dubai’s vibrant SME sector is also benefiting from the advancements in fintech for cross-border payments. Financial institutions in Dubai are partnering with fintech companies to offer innovative payment solutions that cater specifically to the needs of SMEs. These solutions provide SMEs with access to competitive exchange rates, real-time transaction tracking, and flexible payment options. By leveraging fintech, SMEs in Dubai can expand their international operations and tap into new markets, driving business growth and contributing to the overall economic development of the UAE.

Fostering Innovation and Competitiveness in the Financial Sector

Fintech innovations are driving significant changes in the financial sector, fostering a culture of innovation and competitiveness. By adopting advanced technologies, financial institutions can enhance their service offerings, improve operational efficiency, and deliver better value to their customers. This, in turn, promotes a more dynamic and competitive financial environment.

In Riyadh, the adoption of fintech is fostering innovation within the financial sector. Financial institutions are leveraging advanced technologies to develop new products and services that meet the evolving needs of their customers. This includes mobile banking apps, digital wallets, and real-time payment platforms that provide customers with greater convenience and control over their finances. By embracing fintech, Riyadh’s financial institutions are positioning themselves as leaders in innovation, attracting more customers and driving business growth.

Dubai’s financial sector is also experiencing a wave of innovation driven by fintech. The city’s strategic initiatives to promote fintech adoption have created a fertile ground for startups and established financial institutions to collaborate and innovate. This has led to the development of cutting-edge payment solutions that cater to the diverse needs of businesses and individuals. By fostering a culture of innovation, Dubai is enhancing its competitiveness as a global financial hub and attracting international investments.

Conclusion

Fintech in cross-border payments is revolutionizing the financial landscape by enabling seamless international transactions and reducing the costs and complexities associated with traditional methods. By leveraging advanced technologies such as blockchain, artificial intelligence, and machine learning, financial institutions in Saudi Arabia and the UAE are enhancing the efficiency, security, and transparency of cross-border payments. These innovations not only support SMEs and foster business growth but also drive innovation and competitiveness within the financial sector. As fintech continues to evolve, it will play a crucial role in shaping the future of international payments, promoting economic development, and enhancing financial inclusion.

#Fintech #CrossBorderPayments #InternationalTransactions #SaudiArabia #UAE #Riyadh #Dubai #ArtificialIntelligence #Blockchain #TheMetaverse #GenerativeArtificialIntelligence #ModernTechnology #BusinessSuccess #LeadershipSkills #ManagementSkills #ProjectManagement