Empowering Investors Through Technology

The Rise of Fintech in Investment Management

The application of fintech in investment management can democratize access to investment opportunities, providing tools and platforms for all types of investors. In recent years, the convergence of technology and finance has led to significant advancements in how investments are managed and accessed. Fintech solutions have revolutionized traditional investment management by offering innovative platforms that cater to a broader audience, including retail investors who were previously underserved.

In Saudi Arabia, fintech adoption is accelerating as part of the Vision 2030 initiative, which aims to diversify the economy and enhance financial inclusion. Fintech platforms are making investment opportunities more accessible to the general population, allowing individuals to invest in a variety of assets, including stocks, bonds, and real estate, with minimal barriers to entry. These platforms often provide educational resources and tools that empower investors to make informed decisions, fostering a culture of financial literacy and empowerment.

Similarly, in the UAE, fintech companies are leveraging advanced technologies such as artificial intelligence (AI) and blockchain to offer personalized investment advice and automated portfolio management. By utilizing AI algorithms, these platforms can analyze vast amounts of data to provide tailored investment strategies that align with individual risk profiles and financial goals. Blockchain technology, on the other hand, ensures transparency and security in transactions, building trust among investors and promoting wider adoption of fintech solutions in investment management.

Tools and Platforms Democratizing Investments

Robo-Advisors: Automated and Personalized Investment Strategies

Robo-advisors have emerged as a key component of fintech in investment management, offering automated and personalized investment strategies to a wide range of investors. These digital platforms use sophisticated algorithms to create and manage investment portfolios based on the investor’s financial goals, risk tolerance, and time horizon. In Riyadh, the adoption of robo-advisors is growing as investors seek cost-effective and efficient ways to manage their investments without the need for traditional financial advisors.

In Dubai, fintech startups are developing robo-advisors that incorporate local market insights and regulatory requirements, ensuring that the investment strategies are relevant and compliant. These platforms provide investors with continuous portfolio monitoring and rebalancing, optimizing returns while minimizing risks. The user-friendly interfaces and low fees associated with robo-advisors make them an attractive option for both novice and experienced investors looking to streamline their investment processes.

Additionally, the integration of AI in robo-advisors enhances their capabilities by providing real-time market analysis and predictive analytics. This allows investors to stay ahead of market trends and make proactive adjustments to their portfolios. The use of AI also enables robo-advisors to offer personalized financial advice, taking into account an investor’s unique financial situation and preferences. By democratizing access to sophisticated investment management tools, robo-advisors are playing a crucial role in transforming the investment landscape in Saudi Arabia, the UAE, and beyond.

Investment Platforms: Bridging the Gap

Accessible and Inclusive Financial Markets

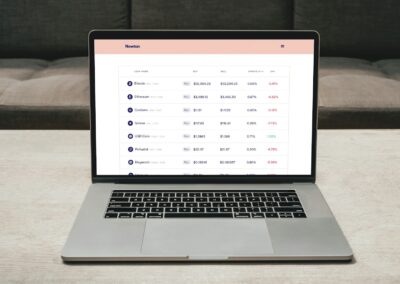

Investment platforms powered by fintech are bridging the gap between traditional financial markets and everyday investors. These platforms offer a range of investment products, from stocks and bonds to alternative assets such as peer-to-peer lending and real estate crowdfunding. By lowering the barriers to entry, fintech platforms enable more people to participate in financial markets, promoting inclusivity and financial empowerment.

In Saudi Arabia, investment platforms are tailored to meet the needs of local investors, providing Sharia-compliant investment options and educational resources to guide their investment decisions. These platforms leverage technology to offer real-time access to market data, investment research, and performance tracking, allowing investors to make informed decisions and manage their portfolios effectively. The convenience and accessibility of fintech investment platforms are driving their popularity among Saudi investors, contributing to the growth of the fintech sector in the region.

Dubai’s vibrant fintech ecosystem is also fostering the development of innovative investment platforms that cater to a diverse investor base. These platforms use blockchain technology to enhance the transparency and security of transactions, reducing the risk of fraud and ensuring the integrity of the investment process. By providing a seamless and user-friendly experience, fintech investment platforms are attracting a growing number of investors who seek to diversify their portfolios and achieve their financial goals.

Conclusion

The application of fintech in investment management is democratizing access to investment opportunities, empowering investors with innovative tools and platforms. In regions like Saudi Arabia and the UAE, where fintech adoption is rapidly growing, these technologies are transforming the investment landscape by making financial markets more accessible and inclusive. Robo-advisors and investment platforms are at the forefront of this transformation, offering automated, personalized, and secure investment solutions that cater to a wide range of investors.

As fintech continues to evolve, it will play an increasingly important role in shaping the future of investment management. By leveraging advanced technologies such as AI and blockchain, fintech companies are enhancing the efficiency, transparency, and inclusivity of financial markets. This not only benefits individual investors but also contributes to the overall growth and stability of the financial ecosystem. The ongoing collaboration between fintech innovators and regulatory bodies will be crucial in ensuring that these advancements are implemented responsibly and sustainably, paving the way for a more inclusive and democratized investment landscape.

—

#Fintech #InvestmentManagement #DemocratizeInvestment #FinancialTechnology #SaudiArabia #UAE #Riyadh #Dubai #ArtificialIntelligence #Blockchain #BusinessSuccess #Leadership #ManagementSkills #ProjectManagement