Leveraging Financial Technology for Enhanced Payments and Expense Management

The Role of Fintech in Supporting the Gig Economy in Saudi Arabia and UAE

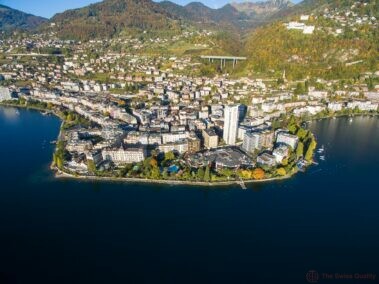

Fintech in the gig economy plays a crucial role in supporting the growth of freelancers and independent contractors by providing tools for managing payments and expenses. As the gig economy continues to expand in regions like Saudi Arabia and the UAE, fintech solutions are becoming indispensable for ensuring efficient financial operations. This transformation is particularly evident in the bustling cities of Riyadh and Dubai, where modern technology and innovative financial services intersect to create a dynamic environment for gig workers.

In Saudi Arabia, the gig economy is gaining momentum, driven by the Kingdom’s Vision 2030 initiative which promotes economic diversification and technological innovation. Fintech solutions are vital in this context, offering freelancers and independent contractors the ability to manage their payments seamlessly. Platforms like digital wallets and mobile banking apps allow gig workers in Riyadh to receive payments instantly, track their income, and manage their finances with ease. These tools not only enhance financial transparency but also ensure that gig workers have access to their earnings whenever needed, thereby fostering financial stability and growth.

Similarly, the UAE, particularly Dubai, is a hub for gig economy activities, attracting freelancers from around the globe. The integration of fintech in the gig economy is essential for providing efficient financial management tools that cater to the unique needs of freelancers. In Dubai, fintech companies offer advanced payment processing solutions that enable instant and secure transactions. These platforms also provide features such as automated invoicing, expense tracking, and financial reporting, which are crucial for freelancers who need to manage their business finances effectively. By leveraging fintech, freelancers in Dubai can focus more on their core work and less on administrative tasks, thereby increasing their productivity and success.

Advanced Fintech Solutions for Payments and Expense Management

Advanced fintech solutions are revolutionizing payments and expense management for freelancers and independent contractors in the gig economy. These technologies offer streamlined processes that reduce the administrative burden and enhance financial efficiency. In Saudi Arabia and the UAE, the adoption of these solutions is transforming the way gig workers handle their finances, providing them with tools that are tailored to their specific needs.

In Riyadh, fintech platforms are equipped with features that automate the entire payment process, from invoicing to receiving payments. These platforms use artificial intelligence (AI) to generate invoices automatically based on the work completed, track payment statuses, and send reminders to clients. This automation reduces the time freelancers spend on administrative tasks, allowing them to focus on their projects. Additionally, fintech solutions in Riyadh offer integration with local banking systems, ensuring that freelancers can easily transfer their earnings to their bank accounts without any delays.

Dubai’s fintech landscape is equally advanced, offering sophisticated tools for expense management that cater to the needs of gig workers. Freelancers in Dubai can use fintech apps to categorize their expenses, track their spending, and generate detailed financial reports. These tools often come with features like receipt scanning and automated expense categorization, which simplify the process of tracking business expenses. By providing a clear overview of their financial health, these fintech solutions help freelancers in Dubai make informed decisions about their spending and savings, ultimately contributing to their financial success.

Moreover, blockchain technology is emerging as a powerful tool in the fintech ecosystem, providing secure and transparent financial transactions. In both Riyadh and Dubai, blockchain-based fintech platforms are being adopted to ensure that payments are processed securely and efficiently. Blockchain’s decentralized nature eliminates the need for intermediaries, reducing transaction fees and processing times. This technology also provides an immutable record of all transactions, ensuring transparency and accountability. For freelancers, this means greater trust in the payment process and assurance that their earnings are secure.

The Future of Fintech in the Gig Economy: AI and the Metaverse

The future of fintech in the gig economy is set to be shaped by the integration of artificial intelligence (AI) and the metaverse, offering even more advanced tools for managing payments and expenses. In Saudi Arabia and the UAE, these emerging technologies are poised to further transform the financial landscape for freelancers and independent contractors, providing innovative solutions that enhance efficiency and security.

In Riyadh, AI-driven fintech solutions are expected to play a significant role in improving financial management for gig workers. AI can analyze vast amounts of financial data to provide personalized insights and recommendations, helping freelancers optimize their income and expenses. For instance, AI-powered budgeting tools can track spending patterns and suggest ways to save money, while predictive analytics can forecast future earnings and expenses based on historical data. These insights enable freelancers to make better financial decisions and plan for the future more effectively.

Dubai is at the forefront of exploring the potential of the metaverse in fintech, offering new opportunities for immersive financial experiences. The metaverse, a virtual shared space, can provide gig workers with a unique platform for managing their finances. In a virtual environment, freelancers can interact with financial advisors, attend virtual workshops on financial planning, and use virtual tools for budgeting and expense tracking. This immersive experience can make financial management more engaging and accessible, helping freelancers in Dubai stay on top of their finances in a fun and interactive way.

Additionally, generative AI is poised to revolutionize the creation of financial content and tools for gig workers. In both Riyadh and Dubai, generative AI can be used to develop customized financial templates, reports, and educational materials tailored to the needs of freelancers. This technology can generate personalized financial advice based on an individual’s specific circumstances, helping gig workers navigate the complexities of financial management with ease. By leveraging generative AI, fintech platforms can offer more personalized and relevant support to freelancers, enhancing their financial well-being and success.

Conclusion

In conclusion, fintech is playing a crucial role in supporting the growth of the gig economy by providing advanced tools for managing payments and expenses. In regions like Saudi Arabia and the UAE, fintech solutions are transforming the financial landscape for freelancers and independent contractors, offering streamlined processes and enhanced financial efficiency. As technologies such as AI, blockchain, and the metaverse continue to evolve, the future of fintech in the gig economy looks promising, with even more innovative solutions on the horizon. For business executives, mid-level managers, and entrepreneurs, embracing fintech is essential for staying competitive and driving success in the modern economy.

#fintech #gigeconomy #paymentsmanagement #expensetracking #freelancers #SaudiArabia #UAE #Riyadh #Dubai #AI #blockchain #metaverse #businesssuccess #leadership #managementskills #projectmanagement