Enhancing Security and Efficiency in Financial Transactions

The Role of Fintech in Digital Identity Verification

Fintech innovations in digital identity verification are revolutionizing the way financial transactions are conducted, enhancing both security and efficiency. In regions like Saudi Arabia and the UAE, where digital transformation is a key strategic objective, fintech solutions are critical in developing secure and efficient identity verification processes. Digital identity verification leverages advanced technologies such as artificial intelligence, blockchain, and biometrics to authenticate individuals accurately and swiftly.

In Saudi Arabia, the Vision 2030 initiative emphasizes the modernization of financial services, including the adoption of fintech solutions to improve security and user experience. Fintech companies are collaborating with financial institutions to implement AI-driven identity verification systems. These systems can analyze vast amounts of data to verify identities in real-time, reducing the risk of fraud and ensuring that financial transactions are secure and compliant with regulatory standards.

Similarly, in the UAE, fintech innovations are transforming the financial sector by providing more secure and efficient methods for identity verification. The Dubai International Financial Centre (DIFC) is actively promoting the use of digital identity solutions to streamline financial transactions and enhance security. Blockchain technology, for instance, offers a decentralized and immutable record of identity verification, ensuring that all parties involved in a transaction can trust the authenticity of the information. This level of transparency and security is essential for maintaining trust in the financial system.

Benefits of Digital Identity Verification

Implementing digital identity verification provides numerous benefits that significantly enhance the security and efficiency of financial transactions. One of the primary advantages is the reduction of fraud. Traditional identity verification methods, such as manual document checks, are prone to errors and manipulation. Digital identity verification leverages AI and machine learning to detect fraudulent activities and ensure that only legitimate transactions are processed. This reduces the risk of identity theft and financial fraud, protecting both consumers and financial institutions.

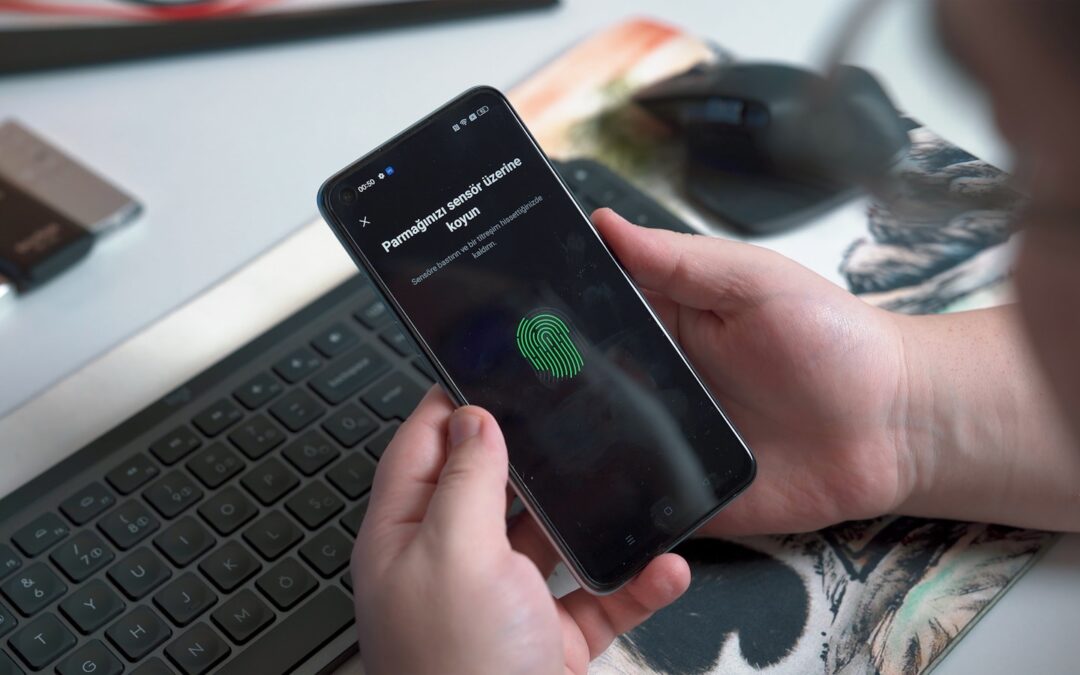

Another significant benefit is the improvement in user experience. Digital identity verification processes are faster and more convenient than traditional methods. Users can verify their identities using biometric data such as fingerprints or facial recognition, which can be done quickly and easily from their mobile devices. This not only enhances security but also improves the overall user experience, making financial services more accessible and user-friendly.

Moreover, digital identity verification enhances regulatory compliance. Financial institutions are required to comply with stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Digital identity solutions provide a comprehensive and accurate way to verify customer identities, ensuring that institutions meet regulatory requirements. This reduces the risk of non-compliance and associated penalties, while also enhancing the reputation of financial institutions as trusted and reliable entities.

The Impact of Blockchain on Digital Identity Verification

Blockchain technology is playing a crucial role in advancing digital identity verification. Blockchain provides a secure and decentralized platform for recording and verifying identities, ensuring that the information is tamper-proof and easily accessible. In Saudi Arabia, blockchain is being explored as a tool for creating robust digital identity verification systems. By recording identity verification data on a blockchain, financial institutions can ensure that the data is accurate, secure, and transparent.

In the UAE, blockchain is already being used to enhance digital identity verification processes. For example, the Dubai Blockchain Strategy aims to implement blockchain technology across government services, including identity verification for financial transactions. This strategy not only improves the efficiency of verification processes but also ensures that all identity data is secure and immutable. By leveraging blockchain, fintech companies in the UAE can provide financial institutions with reliable and efficient identity verification solutions that enhance trust and security in the financial system.

Furthermore, blockchain technology facilitates cross-border financial transactions. As businesses in Riyadh and Dubai increasingly engage in international trade and finance, the ability to verify identities securely and efficiently across borders is essential. Blockchain provides a global platform for identity verification, ensuring that financial transactions can be conducted seamlessly and securely anywhere in the world. This cross-border capability is particularly valuable for businesses looking to expand their operations and build trust with international partners.

Driving Business Success with Digital Identity Verification

Enhancing Leadership and Management Skills through Fintech

The adoption of fintech innovations in digital identity verification is not only about improving security and efficiency but also about enhancing leadership and management skills within organizations. Business leaders in Saudi Arabia and the UAE can leverage these technologies to develop more effective compliance strategies and foster a culture of innovation and security. By using fintech tools to monitor and manage identity verification processes, leaders can gain valuable insights into their organization’s regulatory performance and identify areas for improvement.

In Saudi Arabia, executive coaching programs are incorporating fintech training to help leaders understand the strategic importance of digital identity verification. By learning how to use fintech tools effectively, leaders can make data-driven decisions that enhance their organization’s compliance posture. This proactive approach to identity management not only reduces the risk of fraud and regulatory penalties but also builds a strong foundation for sustainable business growth.

In the UAE, where the business environment is highly competitive, effective leadership in digital identity verification can be a key differentiator. Business executives and managers can use fintech solutions to streamline identity verification processes, reduce operational costs, and enhance overall efficiency. By focusing on leadership development and management skills, organizations can ensure that their teams are well-equipped to navigate the complexities of digital identity verification and drive business success.

Project Management in Implementing Digital Identity Solutions

Effective project management is critical for the successful implementation of digital identity verification solutions. This involves planning, executing, and monitoring projects to ensure that fintech tools are integrated seamlessly into existing compliance frameworks. In Saudi Arabia, where businesses are undertaking ambitious digital transformation projects, strong project management skills are essential for managing the complexities of fintech implementation.

By adopting best practices in project management, organizations can ensure that their fintech initiatives are completed on time, within budget, and to the required quality standards. This includes defining clear project objectives, allocating resources effectively, and managing risks proactively. In the UAE, where the fintech sector is rapidly evolving, effective project management is crucial for maintaining a competitive edge and ensuring that digital identity solutions deliver the expected benefits.

Project management training and development programs can equip business leaders and managers with the skills needed to implement fintech solutions successfully. This includes developing competencies in areas such as data analytics, AI, blockchain, and regulatory compliance. By fostering a culture of continuous improvement and innovation, organizations can maximize the impact of their fintech investments and achieve their strategic objectives.

Conclusion: The Future of Fintech in Digital Identity Verification

Fintech innovations in digital identity verification are transforming the financial sector by enhancing the security and efficiency of transactions. In regions like Saudi Arabia and the UAE, where digital transformation is a key strategic objective, these innovations are driving significant changes in the financial landscape. By leveraging technologies such as AI, blockchain, and biometrics, fintech companies can provide secure and efficient identity verification solutions that protect consumers and financial institutions alike.

Effective leadership and project management are crucial for the successful implementation of fintech solutions in digital identity verification. By investing in leadership development and management training, organizations can ensure that their teams are well-equipped to navigate the complexities of regulatory compliance and drive business success. As we move towards a future where digital identity verification is the norm, embracing fintech innovations will be key to achieving regulatory compliance, enhancing security, and fostering sustainable growth in Saudi Arabia and the UAE.

—

#FintechInnovations, #DigitalIdentityVerification, #FinancialTransactions, #SaudiArabia, #UAE, #ArtificialIntelligence, #Blockchain, #TheMetaverse, #GenerativeAI, #BusinessSuccess, #LeadershipSkills, #ProjectManagement