How Fintech Innovations Enhance Access to Banking Services

The Role of Fintech in Financial Inclusion

In today’s rapidly evolving financial landscape, fintech solutions for financial inclusion are proving to be transformative for underserved populations. Fintech companies leverage advanced technologies such as artificial intelligence, blockchain, and generative AI to develop innovative solutions that make banking services more accessible and affordable. In regions like Saudi Arabia and the UAE, where digital transformation is a priority, fintech is playing a pivotal role in enhancing financial inclusion and driving economic growth.

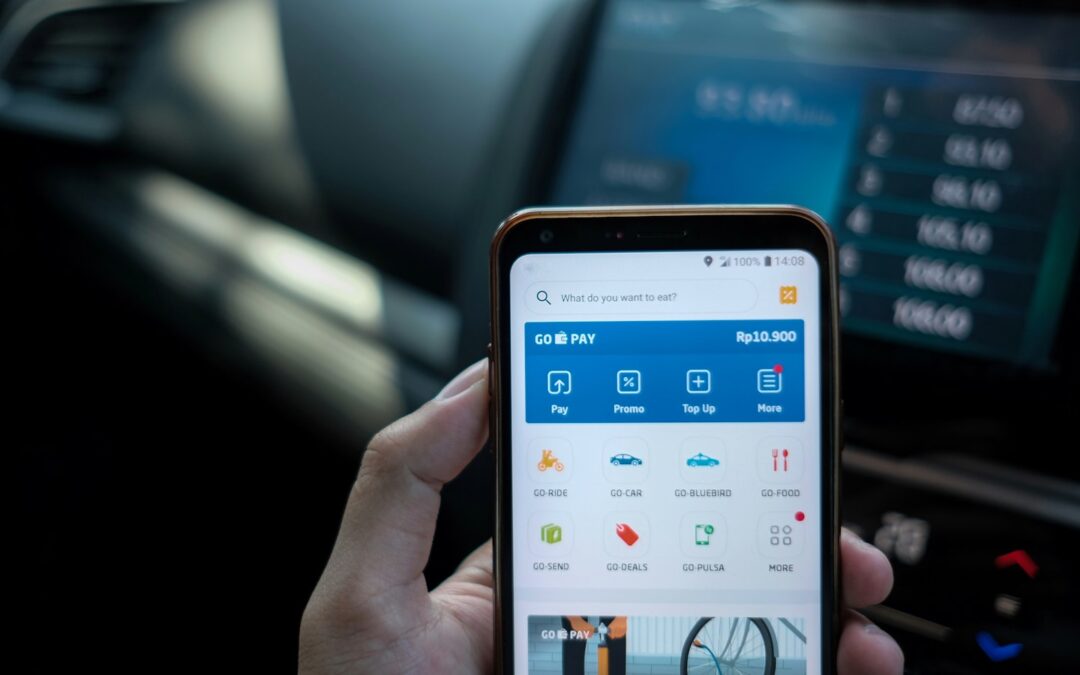

Fintech solutions are designed to bridge the gap between traditional banking services and the needs of underserved communities. Many individuals and small businesses in these populations are excluded from conventional banking systems due to high costs, lack of documentation, and geographical constraints. Fintech addresses these barriers by offering mobile banking, peer-to-peer lending, and digital payment systems that are both user-friendly and cost-effective. In cities such as Riyadh and Dubai, where mobile penetration is high, these solutions enable broader access to essential financial services.

Moreover, fintech innovations empower underserved populations by providing tools for financial management and literacy. Mobile apps and digital platforms offer features such as budgeting tools, savings plans, and financial education resources. These tools help users manage their finances more effectively and make informed decisions, contributing to their overall financial well-being. In the fast-paced and diverse markets of Saudi Arabia and the UAE, fintech solutions are crucial for fostering financial literacy and inclusion.

Blockchain and AI: Revolutionizing Financial Services

Blockchain technology and artificial intelligence (AI) are at the forefront of fintech innovations, offering significant benefits for financial inclusion. Blockchain’s decentralized and secure nature ensures transparent and tamper-proof transactions, which is especially important for populations with limited trust in traditional financial institutions. By providing a secure platform for financial activities, blockchain helps build trust and encourages participation in the financial system.

AI enhances fintech solutions by enabling personalized financial services. Through advanced data analytics, AI can assess individual financial behaviors and provide tailored advice and products. For instance, AI-driven credit scoring models can evaluate creditworthiness based on alternative data sources, allowing individuals without traditional credit histories to access loans. This capability is particularly beneficial in Riyadh and Dubai, where diverse populations require customized financial solutions to meet their unique needs.

Additionally, the integration of AI and blockchain can streamline financial processes and reduce costs. AI can automate routine tasks such as identity verification and fraud detection, while blockchain ensures the security and integrity of these processes. This combination not only enhances efficiency but also makes financial services more accessible to underserved populations. In the technologically advanced markets of Saudi Arabia and the UAE, such integrated fintech solutions are essential for expanding financial inclusion and supporting economic development.

Leadership and Project Management in Fintech Implementation

Driving Innovation with Effective Leadership

Effective leadership is crucial for the successful implementation of fintech solutions aimed at enhancing financial inclusion. Business executives and mid-level managers must champion these initiatives, fostering a culture of innovation and inclusivity within their organizations. By demonstrating a commitment to addressing the financial needs of underserved populations, leaders can drive the adoption and impact of fintech solutions.

Executive coaching services play a vital role in developing the leadership skills required for managing fintech projects. Coaches provide personalized guidance, helping leaders navigate the complexities of fintech adoption and build effective strategies. In regions like Riyadh and Dubai, where regulatory environments and market dynamics are constantly evolving, executive coaching can equip leaders with the insights and skills needed to leverage fintech for social and economic impact.

Moreover, effective leadership involves fostering partnerships with various stakeholders, including governments, non-profits, and technology providers. Collaborative efforts are essential for scaling fintech solutions and ensuring they meet the diverse needs of underserved populations. By building strong networks and alliances, leaders in Saudi Arabia and the UAE can enhance the reach and effectiveness of their fintech initiatives, ultimately driving greater financial inclusion and business success.

Strategic Project Management for Fintech Success

Strategic project management is critical for the successful deployment of fintech solutions. Project managers must oversee the entire implementation process, from initial planning and development to deployment and evaluation. This involves coordinating resources, managing timelines, and ensuring that all project activities align with the organization’s goals and regulatory requirements.

Project managers in fintech must possess a deep understanding of both technology and financial services. They are responsible for managing the integration of advanced technologies such as AI and blockchain into existing systems, ensuring seamless and efficient operations. In the fast-paced business environments of Riyadh and Dubai, where agility and precision are essential, skilled project management is vital for the successful implementation of fintech solutions.

Additionally, project management in fintech requires a focus on customer-centricity. Understanding the needs and preferences of underserved populations is crucial for developing solutions that are both effective and user-friendly. Project managers must engage with these communities to gather insights and feedback, ensuring that the solutions developed truly address their financial needs. By adopting a customer-centric approach, fintech companies can create impactful solutions that enhance financial inclusion and drive economic growth in regions like Saudi Arabia and the UAE.

Conclusion

Fintech solutions for financial inclusion offer significant benefits for underserved populations by providing accessible, affordable, and secure financial services. By leveraging advanced technologies such as artificial intelligence, blockchain, and generative AI, fintech companies can address the unique financial needs of these communities. Effective leadership and strategic project management are crucial for the successful development and implementation of these solutions. In regions like Saudi Arabia and the UAE, where digital transformation is a priority, fintech innovations can significantly enhance financial inclusion and drive economic growth. By fostering a culture of innovation and inclusivity, fintech companies can bridge the financial gap and empower communities to achieve greater financial stability and success.

#Fintech, #FinancialInclusion, #BankingServices, #UnderservedPopulations, #SaudiArabia, #UAE, #Riyadh, #Dubai, #ArtificialIntelligence, #Blockchain, #Metaverse, #GenerativeAI, #BusinessSuccess, #LeadershipSkills, #ProjectManagement