Empowering Financial Decisions through Modern Technology

The Role of Fintech in Financial Literacy

Fintech solutions are revolutionizing the landscape of financial literacy by providing innovative tools and platforms that empower individuals to make informed financial decisions. In regions like Saudi Arabia and the UAE, the adoption of fintech is driving significant advancements in financial education. Through the integration of Artificial Intelligence and Blockchain technologies, fintech solutions offer personalized financial advice, real-time spending tracking, and secure transactions, making financial literacy more accessible and engaging.

In Saudi Arabia, fintech initiatives are aligned with Vision 2030, aiming to diversify the economy and enhance the financial sector. Fintech platforms are being leveraged to deliver financial education programs that cater to the needs of diverse populations, including youth and small business owners. These programs utilize interactive tools and gamified learning experiences to enhance understanding and retention of financial concepts.

Similarly, in the UAE, fintech is at the forefront of financial literacy efforts, with Dubai emerging as a global hub for fintech innovation. The city’s strategic investments in fintech are designed to boost financial inclusion and literacy. Through partnerships with educational institutions and financial organizations, Dubai is fostering a culture of financial awareness and competence among its residents. These efforts are crucial for the sustained economic growth and development of the region.

Modern Technology Enhancing Financial Education

The integration of modern technology in fintech solutions is a key driver of financial literacy programs. Artificial Intelligence (AI) and Machine Learning (ML) algorithms enable fintech platforms to provide tailored financial advice based on individual spending patterns and financial goals. For instance, AI-driven chatbots and virtual assistants offer instant support and guidance on budgeting, saving, and investing, making financial advice more accessible to a broader audience.

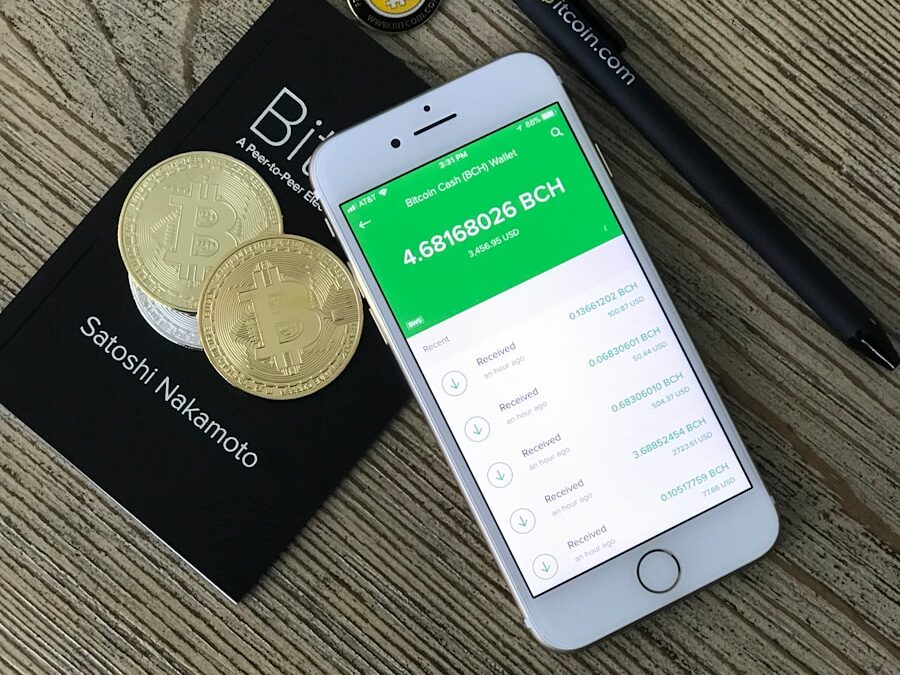

Blockchain technology also plays a pivotal role in enhancing financial literacy. By ensuring the transparency and security of financial transactions, blockchain builds trust among users, encouraging them to engage more actively with financial education tools. In Riyadh, fintech companies are utilizing blockchain to develop secure digital wallets and payment systems that simplify financial management and education.

Generative Artificial Intelligence (GAI) is another innovative technology being harnessed to support financial literacy. GAI applications can create personalized financial education content, such as interactive tutorials and simulations, that cater to different learning styles and levels of financial knowledge. These customized learning experiences are instrumental in helping individuals develop a solid understanding of financial principles and practices.

Leadership and Management Skills in Promoting Financial Literacy

Effective leadership and management skills are essential in promoting and sustaining financial literacy programs. Business executives and mid-level managers play a crucial role in integrating fintech solutions within their organizations and communities. By championing financial literacy initiatives, leaders can drive cultural change and foster an environment where financial education is prioritized.

In Dubai and Riyadh, leadership in both the public and private sectors is pivotal in advancing financial literacy. Government agencies and financial institutions are collaborating to develop comprehensive financial education programs that are accessible to all citizens. These programs include workshops, seminars, and online courses that cover a wide range of financial topics, from basic budgeting to advanced investment strategies.

Moreover, project management skills are vital in the successful implementation of fintech-driven financial literacy programs. Effective project management ensures that these initiatives are well-planned, executed, and monitored for impact. This includes setting clear objectives, allocating resources efficiently, and measuring outcomes to continuously improve the programs. By leveraging strong project management practices, organizations can maximize the benefits of fintech solutions in promoting financial literacy.

Blockchain and AI: Game Changers in Financial Literacy

Blockchain and Artificial Intelligence are game changers in the realm of financial literacy. Blockchain’s decentralized nature provides unparalleled security and transparency, which are crucial for building trust in financial transactions and education. In Saudi Arabia, fintech companies are harnessing blockchain to create robust financial education platforms that offer secure and verifiable learning experiences. These platforms enable users to earn digital certificates and badges, incentivizing continuous learning and engagement.

Artificial Intelligence, on the other hand, offers personalized learning experiences that cater to individual needs and preferences. AI-powered financial literacy tools can analyze user data to identify gaps in knowledge and provide targeted educational content. This personalized approach enhances the effectiveness of financial education programs, making them more relevant and impactful for users.

In the UAE, the combination of blockchain and AI is transforming financial literacy initiatives. Dubai’s fintech ecosystem is leveraging these technologies to develop comprehensive financial education platforms that integrate real-time data, interactive tutorials, and secure transaction systems. These platforms are designed to empower individuals with the knowledge and skills needed to make informed financial decisions, ultimately contributing to the economic growth and stability of the region.

Project Management in Financial Literacy Initiatives

Project management plays a critical role in the success of financial literacy initiatives. Effective project management ensures that these programs are well-structured, efficiently executed, and continuously evaluated for improvement. In both Saudi Arabia and the UAE, project managers are at the helm of fintech-driven financial literacy projects, coordinating efforts between various stakeholders to achieve common goals.

Key project management practices include defining clear objectives, setting realistic timelines, and allocating resources effectively. By adhering to these practices, project managers can ensure that financial literacy initiatives are delivered on time and within budget. Additionally, continuous monitoring and evaluation are essential to measure the impact of these programs and identify areas for improvement.

In Riyadh, project management in financial literacy initiatives involves close collaboration between government agencies, educational institutions, and fintech companies. This collaborative approach ensures that financial education programs are comprehensive, inclusive, and aligned with national economic goals. Similarly, in Dubai, project managers are leveraging fintech solutions to create dynamic and scalable financial literacy initiatives that address the diverse needs of the population.

Conclusion: The Future of Financial Literacy

The future of financial literacy is bright, thanks to the transformative potential of fintech solutions. In regions like Saudi Arabia and the UAE, the integration of modern technology, such as Artificial Intelligence and Blockchain, is driving significant advancements in financial education. By leveraging these technologies, fintech platforms are making financial literacy more accessible, engaging, and effective.

Leadership and management skills are crucial in promoting and sustaining these initiatives, ensuring that financial literacy programs are well-structured, efficiently executed, and continuously improved. As fintech continues to evolve, it will play an increasingly important role in empowering individuals to make informed financial decisions, contributing to the overall economic growth and development of the region.

In conclusion, fintech solutions are not just tools for financial transactions; they are powerful enablers of financial literacy and empowerment. By embracing fintech and leveraging its potential, Saudi Arabia, the UAE, and other regions can foster a financially literate and empowered population, driving sustainable economic success and prosperity.

#FintechSolutions, #FinancialLiteracy, #SaudiArabia, #UAE, #Dubai, #Riyadh, #ArtificialIntelligence, #Blockchain, #ModernTechnology, #Leadership, #ManagementSkills, #ProjectManagement