Unlocking Financial Insights: The Role of Generative AI in Saudi Arabia and the UAE

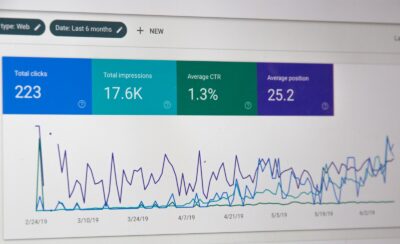

Enabling Data-Driven Decisions

Generative AI is revolutionizing the field of finance in Saudi Arabia and the UAE, offering financial analysts and investors powerful tools to unlock valuable insights from vast amounts of data. By harnessing the power of AI algorithms, analysts can analyze market trends, company performance, and economic indicators to make data-driven decisions with confidence. In Riyadh and Dubai, this technology is being leveraged to its fullest potential, enabling analysts to identify investment opportunities, assess risks, and anticipate market fluctuations more accurately. From predictive analytics to sentiment analysis, generative AI is transforming the way financial professionals approach decision-making, enabling them to stay ahead of the curve in today’s dynamic and complex financial landscape.

Optimizing Portfolios with AI

Portfolio optimization is a key objective for investors seeking to maximize returns while minimizing risk. Generative AI offers investors in Saudi Arabia and the UAE innovative solutions for optimizing their investment portfolios based on their unique financial goals and risk tolerance. By utilizing AI-driven algorithms, investors can analyze historical data, forecast future market trends, and identify the most promising investment opportunities across asset classes. In Riyadh and Dubai, this technology is empowering investors to build diversified portfolios that deliver superior risk-adjusted returns, even in volatile market conditions. From asset allocation to rebalancing strategies, generative AI is reshaping the way investors approach portfolio management, helping them achieve their financial objectives with greater precision and efficiency.

Project Management: Implementing AI-driven Financial Initiatives

Project management is another critical aspect of implementing AI-driven financial initiatives in Saudi Arabia and the UAE. Financial institutions must carefully plan and execute AI projects to ensure their success and sustainability. This involves identifying key stakeholders, setting clear objectives, and allocating resources effectively. By employing project management best practices, such as agile methodologies and risk management strategies, financial institutions can mitigate potential challenges and ensure that AI-driven financial initiatives are delivered on time and within budget. In Riyadh and Dubai, project management professionals with expertise in AI technologies are in high demand, as financial institutions seek to leverage generative AI to enhance decision-making processes and drive competitive advantage. By prioritizing project management excellence, Saudi Arabia and the UAE can position themselves as leaders in the global adoption of AI-driven financial technologies.

Enhancing Risk Management Strategies

Effective risk management is essential for safeguarding investment portfolios and preserving capital in the face of market uncertainty. Generative AI plays a crucial role in enhancing risk management strategies for financial analysts and investors in Saudi Arabia and the UAE. By leveraging AI-driven models, analysts can identify potential risks, such as market volatility, credit defaults, and geopolitical events, and develop proactive risk mitigation strategies to protect investments. In Riyadh and Dubai, this technology is enabling analysts to conduct stress tests, scenario analysis, and Monte Carlo simulations to assess the impact of various risk factors on portfolio performance. From liquidity risk to operational risk, generative AI is empowering financial professionals to navigate turbulent market conditions with confidence and resilience, ensuring the long-term success of their investment strategies.

Leadership and Management Skills in Financial Innovation

As generative AI continues to reshape the landscape of finance in Saudi Arabia and the UAE, strong leadership and management skills are essential for driving innovation and implementing AI-driven solutions effectively. Financial leaders must possess the vision and strategic acumen to harness the power of AI technologies and ensure that they are integrated into decision-making processes seamlessly. This requires effective communication, stakeholder engagement, and a deep understanding of the opportunities and challenges presented by AI-driven financial innovations. Executive coaching services tailored to the needs of financial leaders can play a vital role in developing these skills, empowering leaders to lead with confidence and foresight in a rapidly evolving industry. By investing in leadership development and management consulting services, financial institutions in Saudi Arabia and the UAE can maximize the benefits of generative AI and drive positive change in the finance sector.

#GenerativeAI #Finance #SaudiArabia #UAE #Riyadh #Dubai #ChangeManagement #ExecutiveCoaching #EffectiveCommunication #ManagementConsulting #ArtificialIntelligence #Blockchain #TheMetaverse #LeadershipSkills #ProjectManagement #DataDrivenDecisions #PortfolioOptimization #RiskManagement