Understanding the Impact of Blockchain in Supply Chain Finance

The Evolution of Supply Chain Finance

Supply chain finance has always been a critical component for businesses, ensuring that suppliers and buyers maintain liquidity and smooth operations. Traditionally, this process has involved numerous intermediaries, complex paperwork, and significant delays. However, the advent of blockchain-based platforms in supply chain finance is revolutionizing this landscape, particularly in regions like Saudi Arabia and the UAE. By leveraging the decentralized and transparent nature of blockchain, companies can now facilitate faster, more secure transactions, reducing the need for intermediaries and minimizing delays. This transformation is not only improving operational efficiency but also enhancing trust and collaboration among all parties involved in the supply chain.

Blockchain’s Role in Enhancing Transparency and Security

One of the most significant advantages of blockchain technology in supply chain finance is its ability to provide unparalleled transparency and security. In cities like Riyadh and Dubai, where business integrity and efficiency are paramount, blockchain ensures that every transaction is recorded in an immutable ledger. This level of transparency reduces the risk of fraud and errors, as all stakeholders have access to a single, unalterable source of truth. Furthermore, the security features inherent in blockchain technology, such as cryptographic hashing and decentralized consensus mechanisms, protect sensitive financial data from cyber threats, making it a robust solution for modern trade finance needs.

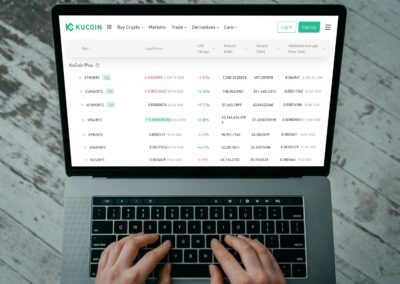

Driving Efficiency and Reducing Costs

Implementing blockchain-based platforms in supply chain finance can significantly reduce costs associated with traditional financial processes. By automating transactions through smart contracts, businesses in Saudi Arabia and the UAE can eliminate the need for manual intervention, thereby decreasing administrative expenses and human error. This efficiency is particularly beneficial for small and medium-sized enterprises (SMEs), which often struggle with cash flow issues and lengthy payment cycles. Moreover, the ability to track goods and payments in real-time ensures that all parties are informed of the transaction status, further streamlining operations and reducing the potential for disputes.

Integrating Artificial Intelligence and Blockchain

The integration of artificial intelligence (AI) with blockchain technology is poised to drive further innovation in trade finance. In dynamic business hubs like Riyadh and Dubai, AI can analyze vast amounts of data generated by blockchain transactions, providing valuable insights for decision-making and risk management. For example, AI algorithms can predict potential supply chain disruptions, allowing companies to take proactive measures. Additionally, AI-powered chatbots and virtual assistants can enhance customer service by providing instant support and resolving queries, thereby improving the overall efficiency and responsiveness of supply chain finance operations.

The Metaverse and Its Implications for Trade Finance

The metaverse, an immersive virtual environment, is emerging as a potential game-changer in various industries, including trade finance. In the context of supply chain finance, the metaverse can facilitate virtual collaboration and real-time interaction among stakeholders. Imagine a scenario where executives in Riyadh and Dubai can conduct meetings, inspect goods, and finalize contracts in a virtual space, all without the need for physical travel. This not only saves time and costs but also enables seamless global collaboration. As the metaverse continues to evolve, its integration with blockchain technology could lead to even more innovative solutions for managing complex supply chains.

Generative AI and Personalized Financial Solutions

Generative AI, which involves creating new content and solutions based on existing data, has the potential to revolutionize personalized financial services in supply chain finance. By analyzing historical transaction data and market trends, generative AI can develop customized financial products tailored to the specific needs of businesses in Saudi Arabia and the UAE. For instance, AI-generated credit scoring models can provide more accurate assessments of a company’s creditworthiness, enabling better financing terms. Additionally, generative AI can assist in developing predictive models for inventory management and demand forecasting, further enhancing the efficiency and effectiveness of supply chain finance.

In conclusion, the integration of blockchain-based platforms in supply chain finance is driving significant innovation and transforming trade finance. By enhancing transparency, security, and efficiency, blockchain technology is helping businesses in Saudi Arabia and the UAE overcome traditional financial challenges. Furthermore, the convergence of blockchain with emerging technologies such as AI, the metaverse, and generative AI promises to unlock new opportunities and elevate the capabilities of supply chain finance to unprecedented levels.

#BlockchainBasedPlatforms #SupplyChainFinance #TradeFinance #Innovation #SaudiArabia #UAE #Riyadh #Dubai #BusinessManagement #ExecutiveCoaching #AI #Metaverse #ProjectManagement