The Impact of Fintech on Small and Medium-Sized Enterprises

Facilitating Easier Access to Funding

Fintech impact on SMEs has been profound, especially in the context of funding access. Traditionally, small and medium-sized enterprises (SMEs) faced significant challenges in securing funding due to stringent requirements and lengthy approval processes associated with traditional banking institutions. Fintech companies have revolutionized this landscape by offering more streamlined and accessible funding options.

In Saudi Arabia and the UAE, fintech solutions have significantly improved funding opportunities for SMEs. Platforms such as peer-to-peer lending, crowdfunding, and online lending marketplaces have emerged as viable alternatives to traditional bank loans. These platforms leverage advanced algorithms and data analytics to assess creditworthiness more efficiently, allowing SMEs to receive funding quickly and with less bureaucratic hassle.

Dubai, a hub for innovation and entrepreneurship, has seen a surge in fintech adoption among SMEs. The ease of access to diverse funding sources has empowered local businesses to scale rapidly and compete on a global stage. Similarly, in Riyadh, fintech companies are bridging the funding gap for SMEs, contributing to the city’s economic diversification goals.

Enhancing Financial Management Capabilities

Advanced Financial Management Tools

Another critical area where fintech has made a significant impact is in the realm of financial management. SMEs often struggle with efficient financial management due to limited resources and expertise. Fintech solutions provide these enterprises with advanced financial management tools that simplify and automate various financial processes.

For instance, cloud-based accounting software, expense management platforms, and automated invoicing systems have become essential tools for SMEs. These solutions offer real-time financial data, enabling business owners to make informed decisions and maintain better control over their finances. In the UAE, fintech innovations are being integrated into the broader business ecosystem, helping SMEs optimize their operations and enhance profitability.

Mobile Banking and Payment Solutions

Mobile banking and payment solutions have further streamlined financial management for SMEs. Fintech companies offer mobile apps that facilitate seamless transactions, from accepting customer payments to paying suppliers. These solutions are particularly beneficial in regions like Saudi Arabia, where mobile penetration is high, and digital payments are becoming increasingly popular.

In Dubai, for example, fintech-driven mobile payment solutions have enhanced the retail sector by providing SMEs with secure and efficient payment processing capabilities. This shift towards digital payments reduces reliance on cash, mitigates risks associated with cash handling, and improves transaction speed and convenience.

Promoting Financial Inclusion and Growth

Expanding Financial Access

One of the most transformative effects of fintech on the SME sector is its role in promoting financial inclusion. By leveraging technology, fintech companies can reach underserved and unbanked populations, providing them with essential financial services. This expanded access to financial resources fosters entrepreneurship and economic growth, particularly in emerging markets.

In Riyadh and other parts of Saudi Arabia, fintech initiatives are driving financial inclusion by offering digital banking solutions that cater to the needs of SMEs. These solutions eliminate the barriers posed by traditional banking and create opportunities for businesses to thrive, contributing to the nation’s economic development goals.

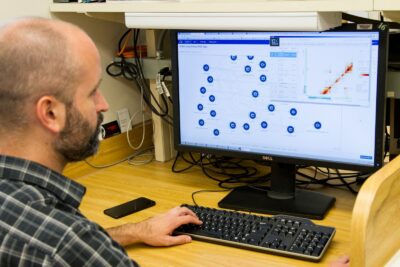

Data-Driven Insights and Business Intelligence

Fintech solutions also equip SMEs with data-driven insights and business intelligence that were previously accessible only to larger corporations. Advanced analytics and machine learning algorithms analyze transaction data, customer behavior, and market trends, providing SMEs with actionable insights to enhance their business strategies.

In the UAE, fintech-driven business intelligence tools are empowering SMEs to understand their market dynamics better and make data-informed decisions. This capability not only improves operational efficiency but also drives innovation and competitiveness in the business landscape.

The Future of Fintech in the SME Sector

Integrating Blockchain for Transparency and Security

Blockchain-Based Financial Solutions

Looking ahead, the integration of blockchain technology into fintech solutions is poised to further revolutionize the SME sector. Blockchain offers unparalleled transparency, security, and efficiency in financial transactions. By leveraging blockchain, fintech companies can provide SMEs with secure and immutable records of transactions, reducing the risk of fraud and enhancing trust in financial dealings.

In Dubai, where the government is actively promoting blockchain adoption, SMEs are set to benefit from this technological advancement. Blockchain-based financial solutions can streamline supply chain financing, automate contract execution through smart contracts, and facilitate cross-border transactions with greater efficiency and lower costs.

Decentralized Finance (DeFi) Opportunities

Decentralized finance (DeFi) is another emerging trend within the fintech space that holds significant potential for SMEs. DeFi platforms leverage blockchain technology to create open and permissionless financial systems. SMEs can access a range of financial services, such as lending, borrowing, and asset management, without relying on traditional intermediaries.

In Saudi Arabia, the growing interest in DeFi solutions presents new opportunities for SMEs to explore innovative financial products and services. By participating in DeFi ecosystems, SMEs can tap into global liquidity pools, access diverse funding sources, and optimize their financial operations in a decentralized and efficient manner.

Driving Innovation and Competitive Advantage

Collaborative Fintech Ecosystems

The future of fintech in the SME sector will also be shaped by collaborative ecosystems that foster innovation and growth. Fintech hubs in Riyadh and Dubai are becoming hotspots for collaboration between startups, financial institutions, and regulatory bodies. These ecosystems provide SMEs with access to cutting-edge technologies, mentorship, and funding, enabling them to innovate and scale their businesses.

In the UAE, initiatives such as regulatory sandboxes and innovation labs are supporting fintech startups in developing and testing new solutions tailored to the needs of SMEs. This collaborative approach ensures that fintech innovations are aligned with market demands and regulatory frameworks, driving sustainable growth in the SME sector.

Continuous Technological Advancements

Continuous advancements in technology will further propel the fintech sector and its impact on SMEs. Emerging technologies such as artificial intelligence, machine learning, and the Internet of Things (IoT) will enhance fintech solutions, offering SMEs even more sophisticated tools for financial management, customer engagement, and operational efficiency.

In Saudi Arabia, the integration of AI-driven analytics into fintech platforms is providing SMEs with deeper insights into market trends and consumer behavior. This intelligence enables businesses to stay ahead of the competition, adapt to changing market conditions, and deliver personalized experiences to their customers.

Conclusion: Embracing the Fintech Revolution

The fintech revolution is transforming the SME sector by providing easier access to funding, enhancing financial management capabilities, and promoting financial inclusion. In regions like Saudi Arabia, the UAE, Riyadh, and Dubai, the adoption of fintech solutions is driving economic growth and fostering innovation. For business executives, mid-level managers, and entrepreneurs, understanding and leveraging fintech is crucial for achieving business success in the digital age.

As fintech continues to evolve, SMEs that embrace these technologies will be better positioned to navigate the complexities of the modern business landscape, enhance their competitive advantage, and contribute to sustainable economic development.

—

#Fintech #SMEs #FundingAccess #FinancialManagement #BusinessTechnology #UAEFintech #SaudiArabiaFintech #DubaiBusiness #RiyadhBusiness