Building Trust and Ensuring Business Success in Saudi Arabia and the UAE

The Importance of Transparent Communication

Transparent communication is fundamental to a successful investor relations strategy for startups. Investors need to be kept well-informed about the company’s progress, challenges, and future plans. Regular updates through comprehensive reports, newsletters, and meetings help maintain transparency and build trust. In Saudi Arabia and the UAE, where business environments are rapidly evolving, consistent and clear communication is essential to keep investors aligned with the company’s vision and objectives.

Transparency extends beyond merely sharing successes; it involves being open about setbacks and challenges as well. For instance, in fields such as Artificial Intelligence and Blockchain, where technological advancements are rapid and sometimes unpredictable, keeping investors informed about developments, potential risks, and mitigation strategies is crucial. This approach not only manages expectations but also fosters a culture of trust and reliability, which is essential for long-term investor relationships.

Utilizing modern technology to facilitate communication can further enhance investor relations. Platforms that offer real-time updates and analytics enable investors to stay informed and engaged. This is particularly relevant in the UAE and Saudi Arabia, where tech-savvy investors expect timely and accurate information. By adopting such tools, businesses can provide a transparent view of their operations, strengthening investor confidence.

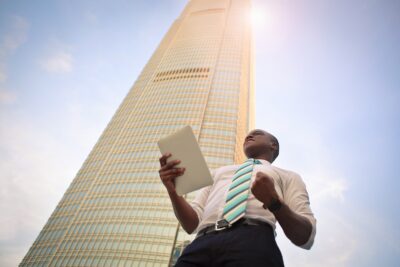

Building Strong Relationships through Strategic Alignment

Aligning the company’s goals with investor expectations is vital for maintaining positive relationships. This involves understanding investors’ objectives and ensuring that the company’s strategic direction supports these goals. Regular strategic reviews and alignment meetings can help achieve this. In regions like Riyadh and Dubai, where economic diversification and innovation are key priorities, aligning with investors who share a similar vision can drive mutual success.

Executive coaching services can play a significant role in this alignment process. By developing leadership skills and enhancing strategic thinking, executive coaching helps leaders effectively communicate and implement the company’s vision. This, in turn, reassures investors that their investments are in capable hands. For example, a company focused on the Metaverse or Generative AI can benefit from executive coaching by ensuring that its leaders are equipped to navigate these complex and rapidly evolving fields.

Involving investors in the decision-making process can also strengthen relationships. By engaging them in strategic discussions and seeking their input, companies can demonstrate respect for their insights and expertise. This collaborative approach not only aligns expectations but also leverages the investors’ knowledge and networks, providing additional value to the business. In the context of Saudi Arabia and the UAE, where business networks and relationships are highly valued, such an approach can be particularly beneficial.

Adapting to Change and Managing Risks

Change management is another critical aspect of a successful investor relations strategy for startups. Businesses in Saudi Arabia and the UAE must be agile and adaptable to thrive in their dynamic markets. Keeping investors informed about change management strategies, including how the company plans to adapt to market shifts or technological advancements, can help manage expectations and reduce uncertainties.

Risk management is also essential in maintaining positive investor relationships. Investors need to feel confident that the company is proactive in identifying and mitigating risks. This involves not only financial risks but also operational, technological, and market risks. For example, in industries like Blockchain and Artificial Intelligence, where regulatory landscapes can change rapidly, having a robust risk management strategy and keeping investors informed about it can build confidence and trust.

Offering tailored management consulting services to address specific investor concerns can further strengthen relationships. These services can provide investors with in-depth insights into the company’s operations, financial health, and strategic direction. By addressing their concerns directly and providing detailed solutions, businesses can demonstrate their commitment to investor satisfaction and long-term success.

#InvestorRelations #Startups #SaudiArabia #UAE #Innovation #EconomicGrowth #Entrepreneurship #TechEcosystem #BusinessSuccess #AI #Blockchain #LeadershipSkills #ProjectManagement