How Machine Learning Algorithms Transform Financial Data into Predictive Risk Insights

The Role of Machine Learning Algorithms in Modern Financial Risk Analysis

In the dynamic financial landscapes of Saudi Arabia and the UAE, businesses are increasingly turning to machine learning algorithms in financial risk analysis to navigate the complexities of today’s markets. As companies in Riyadh, Dubai, and other key financial centers seek to optimize their risk management strategies, machine learning offers a powerful tool for analyzing vast amounts of financial data. This technology enables businesses to predict and assess risks with a level of accuracy and speed that was previously unattainable through traditional methods.

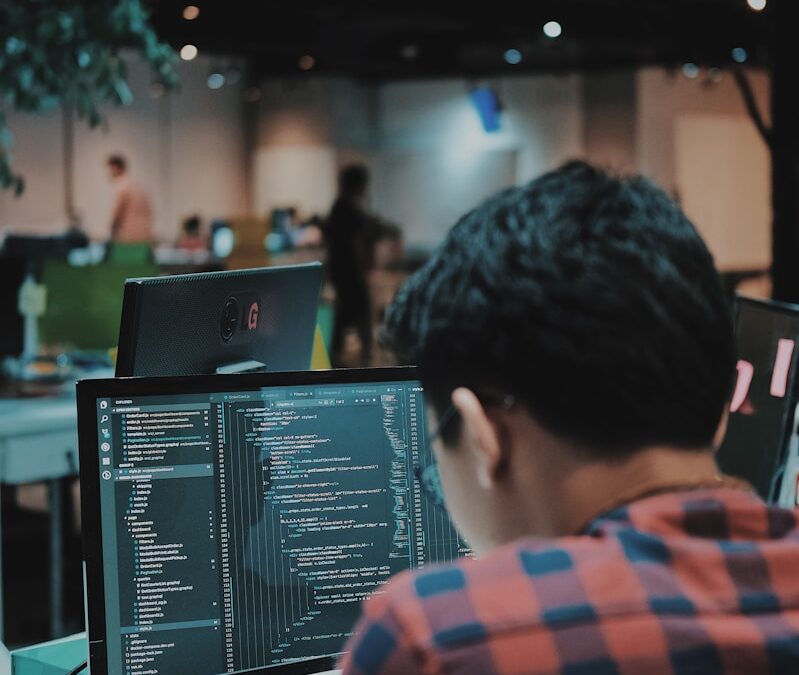

The strength of machine learning algorithms in financial risk analysis lies in their ability to process and analyze large volumes of data in real time. Financial markets generate enormous amounts of data daily, from stock prices and interest rates to economic indicators and global events. Machine learning algorithms can sift through this data, identifying patterns and correlations that might be invisible to human analysts. By doing so, these algorithms can predict potential risks, such as market downturns or credit defaults, allowing businesses to take proactive measures to mitigate these risks.

Moreover, the application of machine learning algorithms in financial risk analysis goes beyond merely identifying risks. These algorithms can continuously learn and adapt as new data becomes available, improving their predictive accuracy over time. This adaptability is crucial in the fast-paced markets of Saudi Arabia and the UAE, where financial conditions can change rapidly. By integrating machine learning into their risk management frameworks, businesses can stay ahead of market trends, protect their investments, and ensure long-term financial stability.

Implementing Machine Learning for Predictive Financial Risk Management

The implementation of machine learning algorithms in financial risk analysis requires a strategic approach that aligns with the specific needs and goals of a business. For companies in Saudi Arabia and the UAE, where market conditions are influenced by a range of economic, political, and social factors, it is essential to customize these algorithms to focus on the most relevant data points. This customization allows businesses to extract the most meaningful insights from their data, leading to more informed decision-making and more effective risk management.

One of the key advantages of using machine learning algorithms in financial risk analysis is their ability to process data from multiple sources simultaneously. For instance, a company might integrate data from stock markets, economic forecasts, and news reports into its risk analysis framework. Machine learning algorithms can analyze these diverse data streams in parallel, providing a comprehensive view of potential risks. This holistic approach to risk assessment is particularly valuable in the financial sectors of Riyadh and Dubai, where businesses must consider a wide range of factors when making investment decisions.

The Future of Financial Risk Management with Machine Learning

As financial markets in Saudi Arabia and the UAE continue to evolve, the role of machine learning algorithms in financial risk analysis will only become more central. The integration of these algorithms into financial workflows is expected to expand, offering businesses even more sophisticated tools for risk prediction and management. In the near future, advancements in artificial intelligence and machine learning are likely to lead to the development of even more powerful predictive models, capable of analyzing larger datasets and identifying more complex risk patterns.

One of the most exciting prospects for the future of machine learning algorithms in financial risk analysis is the potential for these tools to work in conjunction with other emerging technologies, such as Blockchain and Generative Artificial Intelligence. By combining the predictive power of machine learning with the transparency and security of Blockchain, businesses can create more reliable and tamper-proof risk assessment frameworks. Meanwhile, Generative AI could be used to simulate various market scenarios, helping businesses to test their risk management strategies under different conditions and refine their approaches accordingly.

#MachineLearning #RiskManagement #FinancialData #AIinFinance #PredictiveAnalytics #SaudiArabia #UAE #Riyadh #Dubai #BusinessStrategy #FinancialTechnology #ProjectManagement