Enhancing Financial Planning and Tax Management

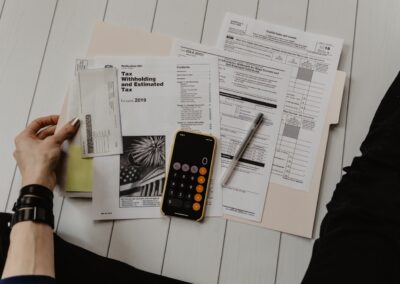

The Importance of Accessing Past Tax Returns

Accessing past tax returns is crucial for efficient financial planning and tax management. In dynamic financial environments such as Saudi Arabia and the UAE, having the ability to reference previous tax information can greatly enhance one’s ability to plan and manage current and future finances. Business executives, mid-level managers, and entrepreneurs in Riyadh and Dubai can leverage historical tax data to make informed decisions, optimize deductions, and ensure compliance with tax regulations.

Past tax returns serve as a comprehensive record of an individual’s or business’s financial history. They include detailed information about income, expenses, deductions, and credits claimed in previous years. For example, a professional in Riyadh might need to reference their past tax returns to verify income when applying for a loan or mortgage. By accessing these records, they can provide accurate financial information and improve their chances of approval.

Moreover, having access to past tax returns simplifies the process of filing current taxes. Taxpayers can easily carry forward unused deductions or credits, ensuring they maximize their tax savings. For instance, an entrepreneur in Dubai might use last year’s tax return to claim a carryforward business loss, reducing their taxable income for the current year. This strategic approach to tax planning can result in significant financial savings and enhanced financial stability.

Implementing Effective Tax Management Strategies

Implementing effective tax management strategies requires a structured approach that leverages past tax returns while incorporating best practices in financial planning. For individuals and businesses in Saudi Arabia and the UAE, adopting a comprehensive strategy can significantly enhance their ability to manage taxes and improve financial health.

A successful tax management strategy begins with organizing and maintaining accurate financial records. Taxpayers should keep detailed records of all financial transactions, including income, expenses, and investments. For instance, a mid-level manager in Riyadh might use financial management software to track their expenses and generate detailed reports. By keeping accurate records, they can ensure that all eligible deductions and credits are claimed, reducing their overall tax liability.

In addition to maintaining accurate records, individuals and businesses should regularly review their past tax returns to identify opportunities for tax savings. Taxpayers can work with financial advisors or tax professionals to analyze their previous returns and develop strategies to optimize their tax position. For example, a Dubai-based business owner might work with a tax advisor to identify opportunities for claiming additional deductions or credits, such as those related to research and development or employee benefits.

Furthermore, individuals and businesses should stay informed about changes in tax laws and regulations that could impact their tax planning strategies. Tax laws in Saudi Arabia and the UAE are continually evolving, and staying up-to-date with these changes is essential for effective tax management. For instance, a financial executive in Riyadh might attend tax planning seminars or subscribe to financial news services to stay informed about new tax regulations. By staying current with tax laws, they can ensure that their tax planning strategies remain compliant and effective.

Supporting Long-Term Financial Success with Advanced Technology

The Role of Artificial Intelligence and Blockchain in Tax Management

Artificial intelligence (AI) and blockchain technology are revolutionizing tax management, providing enhanced security, transparency, and efficiency in managing financial records and filing taxes. These technologies offer sophisticated tools and insights that empower users to make informed decisions and optimize their tax strategies.

AI-driven algorithms analyze vast amounts of financial data to identify trends, optimize tax strategies, and provide personalized advice. For instance, an AI-powered tax management tool can assess a taxpayer’s financial behavior, predict future tax liabilities, and recommend proactive measures to minimize taxes. In Riyadh, an individual might rely on AI to navigate complex tax decisions, ensuring that their tax planning strategy is tailored to their specific needs and goals.

Blockchain technology, on the other hand, enhances the security and transparency of financial transactions. By leveraging blockchain, tax management tools can ensure that all financial activities are securely recorded and verifiable. This level of transparency is particularly valuable for taxpayers in Dubai, where trust and integrity are paramount in financial dealings. For example, a blockchain-based tax management platform can provide an immutable record of all financial transactions, giving users confidence in the accuracy and security of their tax filings.

Maximizing Financial Efficiency through Continuous Learning

Accessing past tax returns not only helps individuals manage taxes but also supports continuous learning and financial literacy. By reviewing past financial records and understanding the implications of previous tax decisions, taxpayers can make more informed decisions and improve their financial management skills.

For instance, a young professional in Riyadh might review their past tax returns to understand how different deductions and credits impacted their tax liability. By analyzing this information, they can learn how to optimize their tax strategy in the future and avoid common mistakes. This continuous learning process is essential for developing a deeper understanding of tax planning and improving financial literacy.

Businesses in Dubai can also benefit from accessing past tax returns by incorporating financial education into their corporate wellness programs. By offering employees access to tax management tools and financial literacy resources, companies can support their workforce’s financial well-being and reduce stress related to tax issues. This approach not only improves employee satisfaction and productivity but also fosters a culture of financial responsibility within the organization.

Maximizing Business Potential with Access to Past Tax Returns

In conclusion, accessing past tax returns offers significant advantages for individuals and businesses in Saudi Arabia, the UAE, Riyadh, and Dubai. By providing a comprehensive record of financial history, these records enable users to make informed financial decisions, optimize tax savings, and ensure compliance with tax regulations. Implementing effective tax management strategies, leveraging AI and blockchain technology, and supporting continuous financial learning are key components of maximizing the potential of past tax returns. As the financial landscape continues to evolve, accessing past tax returns will play a crucial role in helping individuals and businesses navigate financial challenges and secure a prosperous future.

#TaxReturns #FinancialPlanning #TaxDeductions #TaxCredits #FinancialRecords #SaudiArabiaFinance #UAEFinancialStrategies #RiyadhTaxPlanning #DubaiFinancialManagement #AIinFinance #BlockchainTechnology #MetaverseFinance #GenerativeAI #ModernFinancialTools #BusinessSuccess #LeadershipSkills #ProjectManagementTechniques