Leveraging Technology for Financial Efficiency

Introduction to Tax Optimization Tools in Stock Trading Apps

The integration of tax optimization tools in stock trading apps is revolutionizing the way investors manage their portfolios and tax liabilities. In the fast-paced financial environments of Saudi Arabia, the UAE, Riyadh, and Dubai, these tools provide critical support for maximizing returns while ensuring compliance with tax regulations. This article explores the importance of tax optimization in stock trading apps and how it contributes to efficient financial management for business executives, mid-level managers, and entrepreneurs.

Benefits of Tax Optimization in Stock Trading

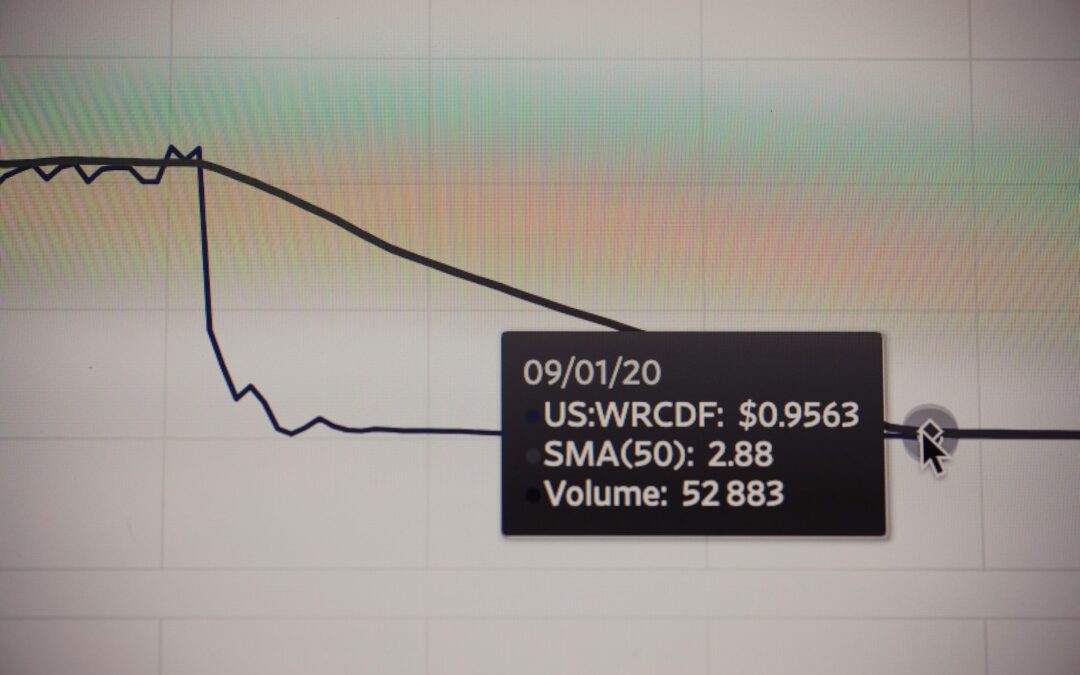

Tax optimization tools in stock trading apps offer numerous benefits, particularly in managing tax liabilities and maximizing investment returns. By automatically calculating the tax implications of trades, these tools help investors in Riyadh make informed decisions that minimize tax burdens. For example, features like tax-loss harvesting allow investors to offset gains with losses, reducing overall tax liability. This strategic approach to trading not only enhances returns but also ensures compliance with local tax laws, crucial for maintaining financial health and success.

Implementing Advanced Technologies for Tax Management

Advanced technologies such as Artificial Intelligence (AI) and blockchain further enhance the effectiveness of tax optimization tools in stock trading apps. AI algorithms can analyze trading patterns and provide personalized tax-saving strategies, making financial planning more efficient. In the UAE, where technological innovation is a priority, AI-driven tools empower investors to optimize their portfolios with minimal effort. Blockchain technology ensures the security and transparency of financial transactions, providing a reliable framework for tax management and compliance.

Enhancing Financial Success through Smart Tax Management

Personal Finance Management in a Digital Age

In today’s digital age, effective personal finance management involves leveraging smart tools for tax optimization. Customizable tax strategies enable users in Dubai to tailor their investment plans according to their unique financial situations and goals. By tracking and optimizing tax liabilities in real-time, investors can enhance their returns and achieve long-term financial stability. This proactive approach to tax management not only simplifies the investment process but also promotes disciplined financial planning and success.

Leadership and Management in Financial Planning

Leadership in financial planning involves promoting the adoption of advanced tax optimization tools and educating users on their benefits. Business executives and mid-level managers in Saudi Arabia play a pivotal role in encouraging the use of these tools for better financial outcomes. By fostering a culture of meticulous financial management, leaders can ensure that their organizations and employees are well-prepared to navigate complex tax regulations and maximize investment returns. This strategic approach is essential for maintaining competitiveness in a dynamic market.

Future Trends and Opportunities

As technology continues to evolve, the future of tax optimization in stock trading apps will see significant advancements. Trends such as the integration of generative AI for predictive financial modeling and enhanced blockchain solutions for secure transactions will redefine the landscape of investment and tax management. Organizations in Riyadh and the UAE that embrace these innovations will gain a competitive edge in financial management. Additionally, the adoption of mobile trading apps with real-time tax optimization features will provide users with unprecedented control over their investments, further enhancing their ability to manage tax liabilities effectively.

Conclusion

Tax optimization tools in stock trading apps are essential for efficient financial management and maximizing investment returns. By leveraging advanced technologies such as AI and blockchain, investors in Saudi Arabia, the UAE, Riyadh, and Dubai can optimize their tax strategies and ensure compliance with local regulations. Effective leadership and continuous improvement in financial planning are crucial for fostering a culture of disciplined investment and tax management. As technology continues to advance, the potential for innovation in tax optimization and financial planning is vast, offering significant opportunities for achieving long-term financial success.

#TaxOptimization #StockTradingApps #FinancialManagement #TaxLiability #InvestmentReturns #SaudiArabia #UAE #Riyadh #Dubai #AI #Blockchain #Leadership #ProjectManagement