Transforming Payroll Management with Automated Systems

Introduction to Payroll Automation for Regulatory Compliance

The implementation of payroll automation for regulatory compliance is revolutionizing payroll management by automatically applying relevant federal, state, and local tax laws and labor regulations. These advanced systems leverage modern technology to streamline payroll processes, ensuring accuracy and compliance while significantly reducing administrative burdens. In regions like Saudi Arabia and the UAE, where cities such as Riyadh and Dubai are rapidly expanding, the adoption of these systems is essential for meeting the increasing demands for effective payroll management and regulatory adherence. By integrating technologies such as Artificial Intelligence (AI), Blockchain, and modern data analytics, business executives, mid-level managers, and entrepreneurs can optimize their payroll strategies and ensure a competitive edge in the market.

Technological Innovations in Payroll Automation

Modern payroll automation systems leverage advanced technologies to maximize efficiency and compliance in payroll management. Artificial Intelligence (AI) plays a pivotal role in processing payroll data, identifying discrepancies, and ensuring accurate application of tax laws and labor regulations. Additionally, the integration of Blockchain technology ensures the transparency and security of payroll data, providing a tamper-proof record of transactions and compliance activities. These innovations are particularly valuable for business leaders in Riyadh and Dubai, who must navigate complex regulatory environments while ensuring their workforce is compensated accurately and timely. By utilizing advanced payroll automation systems, organizations can significantly enhance their compliance processes and build a robust, satisfied workforce.

Economic and Operational Benefits

The adoption of payroll automation for regulatory compliance offers substantial economic and operational benefits. Traditional methods of payroll management often involve significant time and resource investments in manually processing payroll, calculating taxes, and ensuring compliance. In contrast, modern payroll automation systems automate these processes, providing accurate and real-time data with minimal human intervention. This efficiency is particularly valuable for the fast-growing urban areas of Riyadh and Dubai, where maintaining high levels of payroll accuracy and compliance is essential for business growth and competitiveness. By enhancing compliance capabilities, these systems help organizations reduce errors, avoid penalties, and improve employee satisfaction. This approach aligns with the broader goals of Saudi Arabia and the UAE to promote innovation and economic development.

Strategic Implementation and Leadership in Payroll Automation

Strategic Integration of Payroll Automation Systems

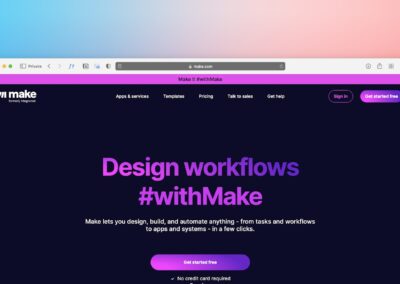

For businesses, the strategic integration of payroll automation systems into their management processes is a critical step toward achieving organizational goals. These technologies provide tools for real-time monitoring, data analysis, and automated compliance, enabling companies to manage payroll efficiently and accurately. In industries such as technology, finance, and healthcare, where compliance with labor regulations is crucial, advanced payroll systems ensure that payroll processes adhere to all relevant laws. By adopting these technologies, businesses in Riyadh and Dubai can enhance their management practices, build strong teams, and drive organizational success.

Leadership and Management Skills in Embracing Payroll Automation

The successful adoption of payroll automation systems requires visionary leadership and strong management skills. Business executives must foster a culture of continuous improvement, encouraging their teams to embrace new technologies and develop the necessary expertise. This involves investing in training programs to ensure that employees are proficient in using these systems and can interpret the data effectively. Additionally, leaders must collaborate with technology providers and regulatory bodies to ensure compliance with payroll standards. By championing the adoption of advanced payroll systems, leaders in Riyadh and Dubai can position their organizations at the forefront of technological advancement, driving growth and competitiveness in an ever-changing environment.

Final Thoughts on Integrating Payroll Automation into Management Strategy

In conclusion, the use of payroll automation systems for regulatory compliance represents a significant advancement in enhancing management practices and improving payroll accuracy and efficiency. For business executives and entrepreneurs in Riyadh and Dubai, these technologies offer powerful capabilities for improving operational efficiency and ensuring compliance with complex regulatory environments. By embracing payroll automation systems and the advanced systems that power them, organizations can navigate the challenges of payroll management with confidence, ensuring their continued success in a rapidly evolving world. As we look to the future, the strategic integration of these technologies into business operations will be a hallmark of forward-thinking leadership and innovative management.

Ensuring Sustainability Through Technological Innovation

The strategic use of payroll automation systems is not just about efficiency but also about building long-term sustainability in management practices. By continuously improving their payroll processes and compliance capabilities, businesses can adapt to the changing landscape of regulatory requirements and workforce expectations. This proactive approach, supported by cutting-edge technology, ensures that organizations in Riyadh and Dubai remain resilient and capable of thriving despite the challenges they may face. In an increasingly interconnected and technologically advanced world, the adoption of payroll automation systems is a critical component of sustainable business success.

Building a Sustainable Future with Payroll Automation

In addition to enhancing management practices, payroll automation systems play a vital role in building a sustainable future. By integrating technological advancements into their operational strategies, organizations can ensure that their efforts not only address immediate payroll compliance needs but also contribute to long-term sustainability goals. This approach aligns with the broader vision of cities like Riyadh and Dubai, which are committed to sustainable urban development. By leveraging payroll automation systems, businesses can achieve a balance between economic growth and employee well-being, ensuring that their operations leave a positive legacy for future generations.

Conclusion: Future Prospects and Strategic Planning

The future of payroll management lies in the continued evolution and deployment of advanced payroll automation systems. As AI and Blockchain technologies advance, these tools will become even more sophisticated, providing deeper insights and more effective solutions for managing payroll compliance. Business leaders in Saudi Arabia and the UAE must stay abreast of these developments and integrate them into their strategic planning to ensure sustained success. By leveraging payroll automation for regulatory compliance, organizations can enhance their management capabilities, improve employee satisfaction, and contribute to broader goals of innovation and economic growth.

—

#PayrollAutomation, #RegulatoryCompliance, #LaborRegulations, #TaxCompliance, #AI, #Blockchain, #ModernTechnology, #SaudiArabia, #UAE, #Riyadh, #Dubai, #BusinessSuccess, #Leadership, #ManagementSkills, #ProjectManagement