Harnessing the Power of Edge Computing for Success in Financial Markets

In the realm of real-time financial trading, where milliseconds can make the difference between profit and loss, edge computing is emerging as a game-changer, providing a plethora of advantages that were previously unattainable. In this article, we delve into the transformative power of edge computing in real-time financial trading and explore the benefits it offers to traders and financial institutions alike. Edge computing, a distributed computing paradigm that brings computation and data storage closer to the location where it is needed, is revolutionizing various industries, and the financial sector is no exception.

Reduced Latency: The Key to Real-Time Trading

Latency, the delay in data transmission and processing, is the arch-nemesis of real-time financial trading. Traditional centralized cloud architectures, while powerful, often introduce significant latency due to the distance data needs to travel. Edge computing addresses this issue head-on by processing data closer to the source, at the “edge” of the network. This proximity drastically reduces latency, enabling traders to receive market data and execute trades with lightning-fast speed. For high-frequency trading (HFT) firms, where microseconds matter, this reduction in latency can translate to a substantial competitive advantage.

Enhanced Reliability and Resilience

The financial markets are dynamic and unpredictable, and any downtime or disruption can lead to substantial financial losses. Edge computing enhances the reliability and resilience of real-time trading systems by distributing computing resources across multiple edge nodes. If one node fails, others can seamlessly take over, ensuring uninterrupted trading operations. This decentralized architecture reduces the risk of a single point of failure, providing a robust foundation for real-time trading systems.

Improved Data Processing and Analytics

The sheer volume of data generated in real-time financial trading can overwhelm traditional centralized systems. Edge computing empowers traders with the ability to process and analyze vast amounts of data closer to the source. This not only reduces the burden on centralized infrastructure but also enables real-time analytics and decision-making. By leveraging machine learning and artificial intelligence algorithms at the edge, traders can identify patterns, detect anomalies, and make informed trading decisions in a fraction of the time it would take with traditional systems.

Cost Efficiency and Scalability

Edge computing offers a cost-effective solution for real-time financial trading by minimizing the need for expensive data transfer and storage in centralized cloud environments. By processing data locally at the edge, organizations can reduce bandwidth costs and optimize resource utilization. Additionally, edge computing provides scalability, allowing firms to easily add or remove edge nodes as their trading volumes and data processing needs evolve. This flexibility ensures that real-time trading systems can adapt to changing market conditions and business requirements.

Real-World Applications: Edge Computing in Action

The adoption of edge computing in real-time financial trading is already transforming the industry. In the realm of algorithmic trading, edge computing enables the execution of complex trading strategies with minimal latency, leading to improved trade execution and profitability. Additionally, edge computing is playing a vital role in risk management by facilitating real-time monitoring and analysis of market data, enabling firms to identify and mitigate risks swiftly.

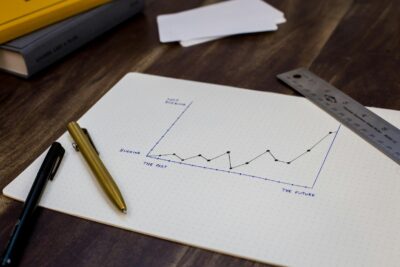

The Future of Real-Time Financial Trading

As edge computing technology continues to mature and evolve, its impact on real-time financial trading is expected to grow exponentially. With the advent of 5G networks and the increasing proliferation of Internet of Things (IoT) devices, the edge computing landscape is poised for rapid expansion. This growth will unlock new possibilities for real-time trading, enabling even faster and more sophisticated trading strategies. Moreover, edge computing is expected to democratize access to real-time trading, making it more accessible to smaller firms and individual traders.

Embracing the Edge: A Strategic Imperative

For financial institutions and traders operating in the fast-paced world of real-time financial markets, embracing edge computing is no longer a luxury but a strategic imperative. The ability to process and analyze vast amounts of data with minimal latency, coupled with enhanced reliability and cost efficiency, gives firms a decisive edge over their competitors. By adopting edge computing solutions, organizations can unlock new levels of agility, responsiveness, and innovation, positioning themselves for success in the ever-evolving financial landscape.

Edge Computing and Regulatory Compliance

In the heavily regulated financial industry, ensuring compliance with stringent rules and regulations is paramount. Edge computing can aid in regulatory compliance by providing a transparent and auditable trail of trading activities. By processing and storing data locally at the edge, firms can maintain better control over their data and ensure adherence to data privacy and security standards. Additionally, edge computing can facilitate real-time monitoring of trading activities, enabling firms to detect and address any potential compliance issues promptly.

Challenges and Considerations

While the benefits of edge computing in real-time financial trading are undeniable, there are challenges and considerations that organizations need to address. Security remains a top concern, as edge devices and networks are vulnerable to cyberattacks. Implementing robust security measures, such as encryption, authentication, and intrusion detection, is crucial to safeguard sensitive financial data. Additionally, managing and orchestrating a distributed edge computing infrastructure can be complex, requiring specialized skills and tools. Organizations need to carefully plan their edge computing deployments to ensure seamless integration with existing systems and processes.

#edgecomputing #financialtrading #real-timetrading #lowlatency #highfrequencytrading #dataprecessing #riskmanagement #algorithmictrading #competitiveadvantage #5G #IoT #machinelearning #AI