Understanding the Legal Landscape and Future Needs

Current Regulatory Framework for Virtual Currencies

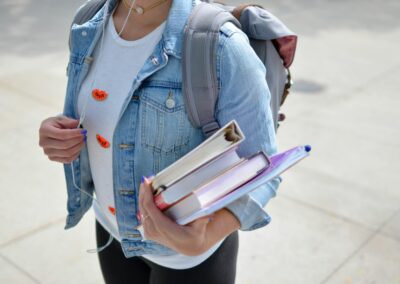

As the metaverse continues to expand, the use of virtual currencies and assets within these digital spaces is becoming increasingly prevalent. Existing regulations for virtual currencies often draw from traditional financial frameworks, aiming to ensure transparency, prevent fraud, and protect consumers. In regions like Saudi Arabia, UAE, Riyadh, and Dubai, regulatory bodies are closely monitoring these developments to foster innovation while maintaining financial stability.

In Saudi Arabia and the UAE, financial authorities have taken proactive steps to regulate virtual currencies. The Saudi Arabian Monetary Authority (SAMA) and the UAE Central Bank have issued guidelines to regulate Initial Coin Offerings (ICOs) and virtual asset service providers. These regulations aim to prevent money laundering, fraud, and other illicit activities, ensuring a secure environment for users and investors.

However, the unique nature of the metaverse presents new regulatory challenges. Unlike traditional digital currencies, virtual assets in the metaverse are often tied to digital goods and services, complicating their classification and regulation. This has led to a growing need for specialized regulations that address the nuances of virtual currencies within these immersive environments.

Emerging Challenges in Regulating Virtual Assets

The integration of virtual currencies in the metaverse brings forth several emerging challenges. One major issue is the lack of standardized regulations across different jurisdictions. In the rapidly evolving digital landscape of Riyadh and Dubai, inconsistencies in regulatory frameworks can hinder the growth and adoption of virtual currencies, creating barriers for businesses and users alike.

Another significant challenge is the potential for fraud and scams within the metaverse. The anonymity and decentralization that characterize virtual currencies can be exploited by malicious actors. Regulatory bodies in Saudi Arabia and the UAE are working to implement stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations to combat these threats. However, the dynamic and borderless nature of the metaverse requires continuous updates and international cooperation to remain effective.

Additionally, the ownership and transfer of virtual assets pose unique legal questions. Traditional laws governing property and intellectual rights may not adequately address the complexities of digital assets in the metaverse. For instance, virtual real estate, NFTs (Non-Fungible Tokens), and other digital goods require clear legal definitions and protections to ensure fair transactions and dispute resolution.

Future Regulatory Needs for the Metaverse

To address these challenges, future regulations must be adaptive and forward-thinking. Policymakers in Saudi Arabia, the UAE, Riyadh, and Dubai are exploring ways to create a cohesive regulatory framework that balances innovation with security. This includes developing specific laws for the ownership, transfer, and taxation of virtual assets, as well as establishing international standards for digital transactions.

One potential solution is the creation of regulatory sandboxes, which allow businesses to test new technologies and business models in a controlled environment. The UAE has already implemented such initiatives, providing a space for fintech startups to innovate while under regulatory supervision. This approach can help identify potential regulatory gaps and develop tailored solutions that support the growth of the metaverse.

Moreover, collaboration between public and private sectors is crucial. Engaging with stakeholders, including tech companies, financial institutions, and legal experts, can provide valuable insights into the practical implications of regulatory decisions. This collaborative approach can lead to more comprehensive and effective regulations that foster trust and security in the digital economy.

Global Implications and International Cooperation

The global nature of the metaverse necessitates international cooperation in regulatory efforts. As virtual currencies and assets can be exchanged across borders seamlessly, inconsistencies in regulations can create loopholes and vulnerabilities. Saudi Arabia, the UAE, Riyadh, and Dubai are increasingly participating in global forums to harmonize regulatory standards and share best practices.

International bodies such as the Financial Action Task Force (FATF) play a pivotal role in setting global standards for virtual currencies. By aligning local regulations with international guidelines, countries can enhance their ability to monitor and control digital transactions. This alignment also facilitates cross-border cooperation in tackling financial crimes and ensuring the integrity of the metaverse ecosystem.

In addition to regulatory alignment, there is a need for robust enforcement mechanisms. Regulatory bodies must have the authority and resources to monitor compliance and take action against violations. This includes investing in advanced technologies and training personnel to keep pace with the evolving digital landscape. In regions like Riyadh and Dubai, where the focus on technology and innovation is strong, such investments are essential to maintaining a secure and vibrant digital economy.

Conclusion: Navigating the Future of Virtual Currencies in the Metaverse

The rapid growth of the metaverse presents both opportunities and challenges for regulators. As virtual currencies and assets become integral to digital interactions, there is an urgent need for comprehensive and adaptive regulations. By addressing the unique characteristics of the metaverse and fostering international cooperation, regulators in Saudi Arabia, the UAE, Riyadh, and Dubai can create a secure and thriving digital environment.

Future regulations must balance innovation with security, providing clear guidelines for the ownership, transfer, and taxation of virtual assets. By leveraging regulatory sandboxes and engaging with stakeholders, policymakers can develop effective solutions that support the growth of the metaverse. With the right regulatory framework, the metaverse can unlock new possibilities for digital interactions, economic growth, and business success.

#VirtualCurrencies #Metaverse #DigitalAssets #EmergingChallenges #SaudiArabia #UAE #Riyadh #Dubai #ArtificialIntelligence #Blockchain #ExecutiveCoaching #GenerativeAI #ModernTechnology #BusinessSuccess #LeadershipSkills #ProjectManagement