Exploring the Role of Machine Learning in the Evolution of Automated Trading Systems

Machine Learning: The Future of Automated Trading Systems

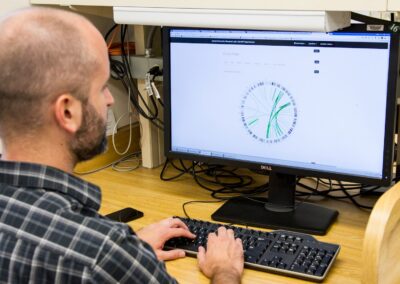

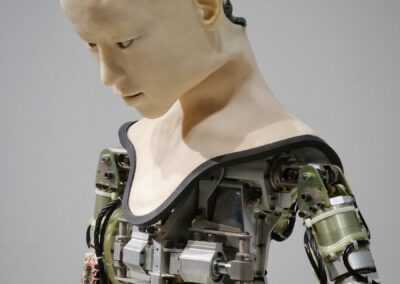

The integration of machine learning in automated trading systems is poised to revolutionize the financial markets, particularly in rapidly growing economies such as Saudi Arabia and the UAE. With Riyadh and Dubai emerging as global financial hubs, the adoption of advanced technologies like machine learning (ML) is becoming increasingly vital for maintaining a competitive edge. ML algorithms can process vast amounts of data with unprecedented speed and accuracy, allowing for the development of trading strategies that are not only efficient but also adaptable to the ever-changing market conditions.

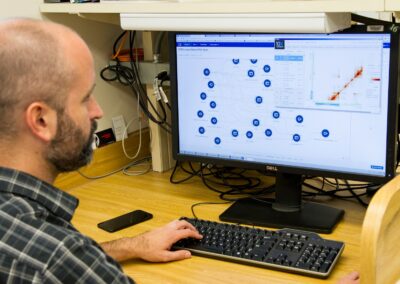

As business executives and mid-level managers in these regions look to enhance their trading systems, the focus is shifting toward harnessing the power of machine learning to predict market trends and automate decision-making processes. This shift is driven by the need for real-time analysis and the ability to respond swiftly to market fluctuations, which are crucial in a fast-paced environment. Furthermore, the integration of AI and ML in trading systems aligns with the broader goals of national visions like Saudi Arabia’s Vision 2030, which emphasizes technological advancement and economic diversification.

In addition to enhancing trading performance, Machine Learning in automated trading systems offers significant benefits in risk management. By analyzing historical data and identifying patterns, ML algorithms can predict potential risks and provide recommendations for mitigating them. This capability is particularly valuable in volatile markets, where quick and informed decisions can make the difference between profit and loss. As a result, the future prospects for ML in trading systems are not only promising but also essential for the continued success of businesses in the region.

Leadership and Change Management in the Era of AI-Powered Trading

The successful implementation of machine learning in automated trading systems requires strong leadership and effective change management strategies. As AI technologies continue to evolve, business leaders in Saudi Arabia and the UAE must be prepared to guide their organizations through the complexities of digital transformation. This involves not only adopting new technologies but also fostering a culture of innovation and continuous learning among employees.

Executive coaching services are playing an increasingly important role in this process, helping leaders develop the skills needed to navigate the challenges of integrating AI and ML into their operations. Effective communication is key to ensuring that all stakeholders understand the benefits of these technologies and are aligned with the organization’s strategic goals. In regions like Riyadh and Dubai, where the pace of technological advancement is rapid, the ability to lead through change is critical for maintaining a competitive advantage.

Moreover, the integration of Machine Learning in automated trading systems brings new ethical considerations that leaders must address. As these systems become more autonomous, questions around transparency, accountability, and fairness will need to be carefully managed. This is where leadership and management skills become crucial, as they enable executives to balance the benefits of automation with the need for responsible AI practices. By prioritizing ethical considerations, businesses can build trust with their stakeholders and ensure long-term success.

The Role of AI, Blockchain, and the Metaverse in Shaping the Future of Trading

In addition to machine learning in automated trading systems, other emerging technologies like blockchain and the metaverse are set to play a significant role in the future of trading. Blockchain technology, with its decentralized and secure nature, is already transforming how financial transactions are conducted. In trading, blockchain can enhance transparency, reduce fraud, and streamline processes, making it an ideal complement to AI-driven trading systems.

The metaverse, a virtual world where users can interact in a digital environment, also holds potential for revolutionizing trading. In this space, businesses can conduct transactions, host virtual trading floors, and engage with clients in new and innovative ways. For instance, financial institutions in Dubai and Riyadh could leverage the metaverse to create immersive experiences for their clients, offering real-time insights and data visualization that enhance decision-making.

As these technologies continue to develop, the intersection of AI, blockchain, and the metaverse will create new opportunities for businesses to innovate and grow. For leaders in Saudi Arabia and the UAE, staying ahead of these trends will be key to achieving long-term success. By embracing these technologies and integrating them into their trading systems, businesses can position themselves at the forefront of the global financial market.

#MachineLearning #AutomatedTrading #AIinBusiness #Blockchain #Leadership #Dubai #Riyadh #SaudiVision2030 #UAEtech #DigitalTransformation