Enabling Efficient Financial Systems in Saudi Arabia and the UAE

Blockchain Technology in Real-Time Cross-Border Transactions

Blockchain for real-time cross-border transactions is transforming the financial landscape by reducing the need for intermediaries and lowering costs. This innovative technology is particularly impactful in regions like Saudi Arabia and the UAE, where efficient financial systems are critical for economic growth. By leveraging blockchain, financial institutions can achieve faster, more secure transactions, enhancing the overall efficiency of cross-border payments.

In Riyadh, the adoption of blockchain technology is gaining momentum. Financial institutions are increasingly recognizing the benefits of blockchain for real-time settlement of cross-border transactions. This technology eliminates the need for traditional intermediaries such as correspondent banks, reducing the time and cost associated with international payments. The Saudi Central Bank (SAMA) is actively exploring blockchain to streamline financial processes, aligning with the Kingdom’s Vision 2030 initiative to foster digital transformation and economic diversification.

Similarly, in Dubai, blockchain technology is at the forefront of financial innovation. The UAE Central Bank is leading efforts to integrate blockchain into the financial system, aiming to enhance the speed and security of cross-border transactions. Dubai’s proactive approach to embracing modern technology positions it as a global hub for fintech innovation. By adopting blockchain, Dubai aims to reduce transaction costs, increase transparency, and improve the overall efficiency of its financial infrastructure, supporting its vision of becoming a leading financial center.

Reducing Costs and Enhancing Security with Blockchain

The integration of blockchain technology in cross-border transactions offers significant cost reductions and enhanced security. Traditional cross-border payments often involve multiple intermediaries, each adding their own fees and processing times. Blockchain technology streamlines this process by providing a decentralized ledger that records transactions transparently and securely, eliminating the need for intermediaries.

In Saudi Arabia, financial institutions are leveraging blockchain to enhance the security of cross-border transactions. The immutable nature of blockchain ensures that transaction records cannot be altered or tampered with, providing a high level of security. This transparency is crucial for building trust among participants in the financial ecosystem. By reducing the reliance on intermediaries, blockchain also lowers the overall cost of transactions, making cross-border payments more affordable for businesses and consumers alike. This aligns with Saudi Arabia’s broader goals of economic diversification and digital transformation.

Dubai’s financial sector is also benefiting from the cost reductions and security enhancements offered by blockchain technology. The UAE Central Bank is implementing blockchain solutions to facilitate real-time settlement of cross-border transactions, reducing the time and costs associated with traditional payment methods. This approach not only improves operational efficiency but also enhances the competitiveness of Dubai’s financial services industry. By embracing blockchain, Dubai is positioning itself as a leader in financial technology, attracting businesses and investors from around the world.

Promoting Financial Inclusion through Blockchain

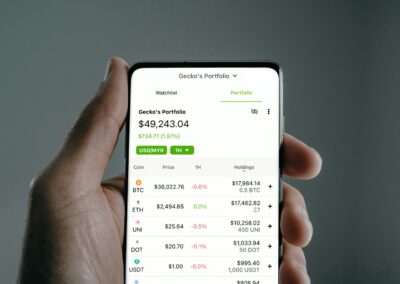

Blockchain technology has the potential to promote financial inclusion by providing accessible and affordable financial services to underserved populations. In regions like Saudi Arabia and the UAE, where financial inclusion is a key priority, blockchain can play a pivotal role in bringing more people into the formal financial system.

In Riyadh, the implementation of blockchain for cross-border transactions can significantly enhance financial inclusion. By reducing the cost and complexity of international payments, blockchain makes it easier for individuals and small businesses to access global markets. This increased access to financial services supports economic growth and development, aligning with Saudi Arabia’s Vision 2030 initiative to create a more inclusive and diversified economy.

Similarly, in Dubai, blockchain technology is being used to promote financial inclusion by providing affordable cross-border payment solutions. The UAE Central Bank’s efforts to integrate blockchain into the financial system aim to lower the barriers to financial access for underserved populations. By making cross-border payments more accessible, blockchain technology supports Dubai’s vision of being a global financial hub that caters to a diverse range of businesses and individuals.

The Future of Blockchain in Financial Services

Challenges and Opportunities in Implementing Blockchain

While the potential benefits of blockchain for real-time cross-border transactions are significant, there are also challenges that need to be addressed. Ensuring the scalability and interoperability of blockchain networks is crucial for their widespread adoption. Additionally, regulatory frameworks must be developed to govern the use of blockchain in financial transactions.

In Saudi Arabia, financial institutions are investing in research and development to address the scalability challenges of blockchain technology. By collaborating with technology providers and industry experts, these institutions aim to develop scalable blockchain solutions that can handle a high volume of transactions. This proactive approach is essential for ensuring the successful implementation of blockchain in cross-border payments, aligning with Saudi Arabia’s Vision 2030 goals.

Dubai’s financial sector is also addressing the challenges associated with blockchain implementation. The UAE Central Bank is working closely with regulatory bodies and industry stakeholders to develop comprehensive regulatory frameworks for blockchain technology. These frameworks ensure that blockchain is used responsibly and complies with existing financial laws. By fostering a collaborative approach, Dubai is creating an environment conducive to innovation and growth, supporting its vision of being a leader in financial technology.

Leadership and Project Management in Blockchain Implementation

The successful implementation of blockchain technology for cross-border transactions requires strong leadership and effective project management. Business executives and mid-level managers play a crucial role in driving these initiatives and ensuring their successful execution. In Saudi Arabia and the UAE, where the financial sector is rapidly evolving, strong leadership is essential to navigate the complexities of digital transformation.

Project management methodologies such as Agile and Scrum can facilitate the efficient development and deployment of blockchain solutions. These frameworks enable teams to work collaboratively, adapt to changes, and deliver high-quality solutions. In Riyadh, financial institutions are adopting Agile practices to accelerate the implementation of blockchain technology. By fostering a culture of innovation and continuous improvement, leaders can ensure that their organizations remain competitive in the fast-paced fintech landscape.

Effective leadership also involves fostering a culture of collaboration and learning. In Dubai, financial institutions are investing in training programs to equip their employees with the necessary skills to leverage blockchain technology. By promoting continuous learning and development, leaders can empower their teams to harness the full potential of blockchain. This holistic approach not only drives business success but also contributes to the overall growth and sustainability of the financial sector.

Conclusion

Blockchain for real-time cross-border transactions is revolutionizing the financial landscape in Saudi Arabia, the UAE, and beyond. By reducing the need for intermediaries and lowering costs, blockchain enhances the efficiency and security of cross-border payments. As the digital economy continues to evolve, strong leadership and effective project management will be crucial in navigating this transformation. Embracing these innovations not only ensures compliance with regulatory standards but also positions financial institutions at the forefront of the global fintech revolution.

#Blockchain #RealTimeSettlement #CrossBorderTransactions #SaudiArabia #UAE #Riyadh #Dubai #FinancialTechnology #ModernTechnology #BusinessSuccess #LeadershipSkills #ManagementSkills #ProjectManagement