The Role of Stablecoins in Modern Payment Systems

Minimizing Price Volatility

The integration of stablecoins in cross-border payments offers significant benefits by providing the advantages of cryptocurrencies while minimizing price volatility. Stablecoins are a type of cryptocurrency designed to maintain a stable value by being pegged to a reserve of assets, typically fiat currencies like the US dollar or commodities such as gold. This stability makes them an attractive option for cross-border transactions, where price predictability is crucial.

In Saudi Arabia and the UAE, the adoption of stablecoins is gaining traction among businesses looking to streamline their international payment processes. Traditional cryptocurrencies, despite their advantages, often suffer from significant price fluctuations, making them less reliable for predictable financial planning. Stablecoins address this issue by offering a stable value, ensuring that the amount sent and received remains consistent, regardless of market conditions.

This stability is particularly beneficial for businesses operating in Riyadh and Dubai, where maintaining stable cash flow is critical for operational efficiency. By using stablecoins, companies can avoid the risks associated with currency volatility, ensuring that their international transactions are both secure and predictable. This predictability enhances financial planning and risk management, making stablecoins a valuable tool for modern businesses.

Enhancing Efficiency and Reducing Costs

The use of stablecoins in cross-border payments also enhances efficiency and reduces costs. Traditional international payment systems often involve multiple intermediaries, leading to high transaction fees and long processing times. Stablecoins, operating on blockchain technology, eliminate the need for these intermediaries, allowing for faster and more cost-effective transactions.

For businesses in Saudi Arabia and the UAE, the efficiency of stablecoin transactions translates into significant time and cost savings. Payments that traditionally took days to process can now be completed in minutes, improving cash flow management and enabling quicker settlement of international trade deals. This speed is particularly advantageous for sectors such as e-commerce and import/export, where timely payments are essential for maintaining supply chain continuity.

Additionally, the lower transaction fees associated with stablecoin payments make them an attractive option for businesses looking to optimize their operational costs. By reducing the financial burden of cross-border transactions, companies can allocate more resources towards growth and innovation, driving overall business success in a competitive global market.

Ensuring Transparency and Security

Another significant benefit of using stablecoins in cross-border payments is the enhanced transparency and security they offer. Transactions conducted using stablecoins are recorded on a decentralized blockchain ledger, ensuring that all parties have access to a transparent and immutable record of each transaction. This transparency helps to prevent fraud and ensures that all transactions are conducted in a secure and verifiable manner.

For businesses in Riyadh and Dubai, this level of security is critical for maintaining trust with international partners and customers. The use of blockchain technology ensures that each transaction is traceable and tamper-proof, providing an additional layer of security that is often lacking in traditional payment systems. This security is particularly important in regions with high volumes of international trade, where ensuring the integrity of financial transactions is paramount.

Furthermore, the use of stablecoins can enhance compliance with regulatory requirements. As financial regulators in Saudi Arabia and the UAE continue to develop frameworks for digital currencies, stablecoins offer a compliant and transparent solution for businesses looking to leverage the benefits of cryptocurrency while adhering to legal standards. This compliance ensures that businesses can operate within the regulatory framework, avoiding potential legal risks and fostering a stable financial environment.

Case Studies: Successful Implementations in Saudi Arabia and UAE

Saudi Arabia: Vision 2030 and Digital Currency Adoption

Saudi Arabia’s Vision 2030 initiative aims to diversify the economy and promote technological innovation. As part of this vision, the adoption of digital currencies, including stablecoins, is seen as a key driver of economic growth and financial modernization. Several pilot projects have been launched to explore the potential of stablecoins in enhancing cross-border payment systems.

One notable example is the partnership between the Saudi Arabian Monetary Authority (SAMA) and the UAE Central Bank to develop a joint digital currency called “Aber.” This initiative aims to facilitate cross-border payments between the two countries using a stablecoin, demonstrating the commitment of both nations to leveraging modern technologies for financial innovation. The successful implementation of Aber could serve as a model for other countries looking to streamline cross-border transactions using stablecoins.

By adopting stablecoins, Saudi Arabia is not only enhancing its financial infrastructure but also attracting global businesses and investors. The ability to conduct fast, low-cost international transactions makes the kingdom an attractive destination for companies looking to expand their operations in the Middle East. As more businesses adopt stablecoins, Saudi Arabia is poised to become a leader in digital currency innovation and cross-border payment systems.

UAE: Dubai’s Smart City Vision and Blockchain Innovation

Dubai’s ambition to become a global leader in smart city innovation is driving the adoption of blockchain and stablecoins in various sectors. The Dubai Blockchain Strategy aims to make Dubai the first city fully powered by blockchain, and the integration of stablecoins in cross-border payments is a key focus area of this strategy. The government and private sector are collaborating to implement blockchain solutions that enhance efficiency and transparency in financial transactions.

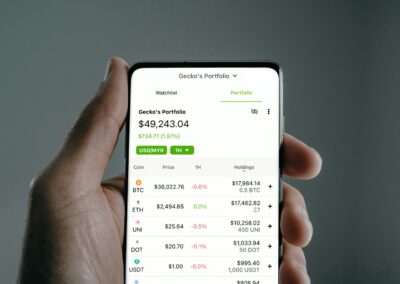

Several businesses in Dubai have already started using stablecoins for international payments, ranging from real estate companies to financial services firms. This adoption is facilitated by the presence of blockchain technology providers and cryptocurrency exchanges in the region, which offer secure and reliable platforms for conducting transactions. The use of stablecoins allows these businesses to tap into a global customer base, offering flexible payment options that cater to the needs of international clients.

The Dubai government has also launched several initiatives to promote the adoption of blockchain and stablecoins. For example, the Dubai Future Foundation is exploring the use of stablecoins in government services, highlighting the emirate’s commitment to technological advancement and economic diversification. As Dubai continues to innovate and embrace digital currencies, the adoption of stablecoins is set to play a crucial role in driving economic growth and positioning the city as a hub for innovative and reliable financial solutions.

Conclusion

The integration of stablecoins in cross-border payments is revolutionizing the way businesses in Saudi Arabia and the UAE operate. By providing the benefits of cryptocurrencies while minimizing price volatility, stablecoins offer significant advantages in terms of stability, efficiency, transparency, and security. As these regions continue to embrace digital innovation and blockchain technology, the adoption of stablecoins is set to play a crucial role in driving economic growth and business success. With initiatives like Vision 2030 and the Dubai Blockchain Strategy, Saudi Arabia and the UAE are leading the way in creating a more stable, efficient, and secure global payment ecosystem.

—

#Stablecoins #CrossBorderPayments #CryptocurrencyStability #PaymentEfficiency #SaudiArabia #UAE #Riyadh #Dubai #ArtificialIntelligence #Blockchain #Metaverse #GenerativeAI #ModernTechnology #BusinessSuccess #Leadership #ManagementSkills #ProjectManagement