Switzerland Slow Dance with Technology?

Switzerland, a country synonymous with precision, neutrality, and excellence in fields like banking and pharmaceuticals, takes a decidedly cautious approach when it comes to adopting new technologies. While this careful, methodical stance has its benefits, it also means that Switzerland often finds itself trailing behind more agile nations like the United Kingdom in integrating technological advancements into everyday life. The recent rollout of instant bank payments within Switzerland is a prime example of this lag, revealing much about the nation’s approach to innovation and change.

Why the Slow Pace?

Switzerland’s hesitancy to embrace new technologies isn’t accidental; it’s rooted in a cultural and political mindset that prioritizes stability and thoroughness over speed. The country’s decentralized political structure plays a significant role here. With 26 cantons, each wielding considerable autonomy, pushing through any nationwide technological change requires consensus across these diverse regions. This can turn what might be a straightforward process in other countries into a lengthy and complex negotiation.

Moreover, Switzerland’s direct democracy system—where major changes often go to a public vote—further slows down the adoption of new technologies. This system ensures that citizens have a direct say in significant decisions, which is a strength of Swiss democracy, but it also means that changes happen at a deliberate, often sluggish pace.

The Case of Instant Payments

Let’s take the example of instant payments. In the UK, the Faster Payments Service (FPS) was introduced back in 2008, fundamentally transforming how people and businesses move money. With FPS, payments that used to take days became nearly instantaneous, available 24/7. This system has been a cornerstone of the UK’s financial infrastructure for over a decade.

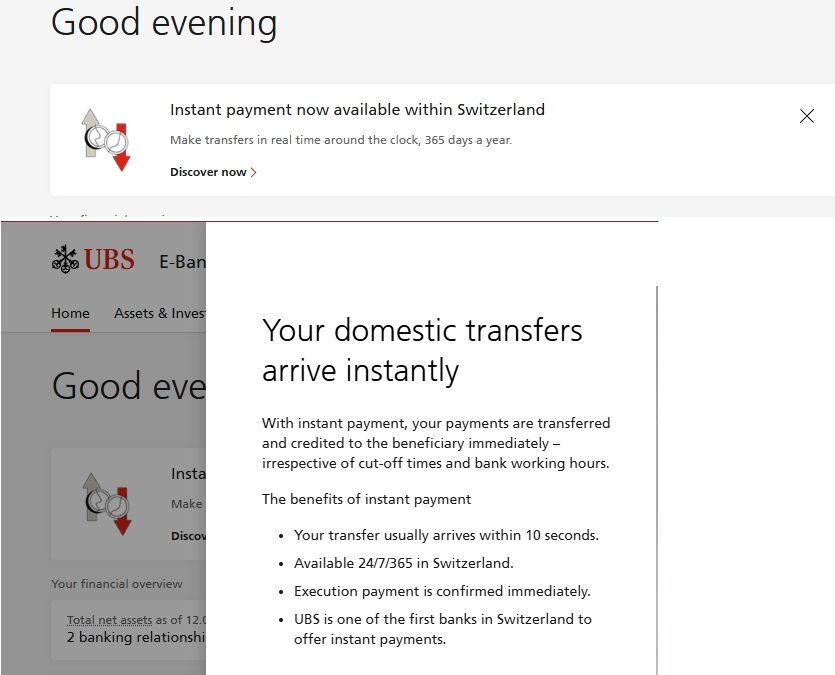

Switzerland, on the other hand, has only recently begun to roll out similar functionality. As of 2024, Swiss banks like UBS are just starting to offer instant payments within the country. For a nation known as a global financial hub, this is a notably late arrival to a technology that has long been considered standard in other leading financial centers.

The delay is even more striking given Switzerland’s reputation in finance. In a sector where speed and efficiency are critical, the fact that it took so long to implement instant payments is telling. It reflects a broader tendency in Swiss institutions to prioritize tried-and-true methods over the adoption of new, potentially disruptive technologies.

Switzerland vs. the UK: A Tale of Two Approaches

When we compare Switzerland’s approach to technological adoption with that of the UK, the differences are stark. The UK has consistently taken a more proactive stance in embracing new technologies, often leading the way in areas like digital government services and mobile payments.

Digital Government Services

In the UK, the Government Digital Service (GDS), launched in 2011, has been a game-changer in how public services are delivered online. The UK government’s digital strategy has been centered on user experience and accessibility, resulting in a streamlined, centralized portal where citizens can easily access a wide range of services. Whether it’s filing taxes or renewing a passport, the process is typically quick and efficient.

Switzerland, however, has been slower to digitize its government services. The country’s federal structure means that digital initiatives often roll out unevenly, with different cantons adopting different solutions at varying speeds. While efforts like the “Digital Switzerland” initiative are underway to create a more unified approach, progress has been slower and less consistent than in the UK.

Mobile Payments

Another area where the UK has surged ahead is in the adoption of mobile payment technologies. Services like Apple Pay, Google Pay, and Samsung Pay were quickly embraced by UK consumers and banks alike. The UK’s financial sector has been responsive to the demand for more convenient payment methods, leading to rapid and widespread adoption of mobile payments.

In contrast, Switzerland’s adoption of mobile payments has been more gradual. While TWINT, a Swiss mobile payment solution, has gained traction, it hasn’t reached the same level of ubiquity as mobile payment options in the UK. Part of this slower uptake can be attributed to Switzerland’s conservative banking culture, where traditional payment methods like cash and debit cards remain deeply ingrained. The Swiss banking sector’s preference for stability and familiarity over innovation has undoubtedly slowed the transition to more modern payment technologies.

The Roots of Swiss Caution

So, why does Switzerland move so slowly when it comes to adopting new technologies? Several factors contribute to this cautious approach, all of which are deeply embedded in the country’s socio-political fabric.

A Conservative Banking Sector

Switzerland’s banking sector is globally renowned for its conservatism. While this cautious approach has helped the country maintain its reputation as a safe and stable financial center, it has also meant that Swiss banks are often slow to adopt new technologies. The stringent regulatory environment in Switzerland prioritizes security and reliability, sometimes at the expense of innovation. This conservatism is a double-edged sword: it protects the sector from volatility but also slows down the adoption of advancements like instant payments.

Strong Legal and Regulatory Frameworks

Switzerland’s robust legal and regulatory frameworks ensure high standards but can also act as a brake on the rapid adoption of new technologies. Compliance with these regulations requires exhaustive testing and validation, which takes time. While this thoroughness is one of the reasons for Switzerland’s high standards, it also means that technological innovation often progresses at a measured pace.

Direct Democracy and Public Opinion

As mentioned earlier, Switzerland’s direct democracy system ensures that major decisions reflect the will of the people. However, this also means that adopting new technologies can be delayed by the need for public consultation and referenda. While this approach has its merits, it contrasts sharply with the UK’s more centralized decision-making process, which allows for quicker implementation of technological changes.

Moving Forward: The Challenge for Switzerland

Switzerland’s cautious approach to technology has served it well in many respects, particularly in maintaining high standards and avoiding unnecessary risks. However, as the pace of global technological change continues to accelerate, Switzerland may need to reconsider its approach. Balancing the need for caution with the demands of a rapidly evolving digital landscape will be critical for the country’s continued success.

The challenge for Switzerland lies in finding ways to embrace new technologies more swiftly without compromising the qualities that have made it a global leader in so many fields. As the world becomes increasingly technology-driven, Switzerland will need to adapt, ensuring that it remains competitive while staying true to its values of precision, reliability, and stability.

In conclusion, while Switzerland’s slow adoption of new technologies can be frustrating, especially in comparison to more agile nations like the UK, it’s also a reflection of the country’s deep-rooted commitment to doing things right. The task ahead is not just to speed up but to ensure that in the process, Switzerland continues to uphold the standards that have made it one of the most respected countries in the world.