Understanding the Impact of Angel Investor Networks

Enhancing Startup Growth and Success

The benefits of a vibrant angel investor network are manifold, particularly in fostering the growth and success of startups. Angel investors provide essential seed capital that enables entrepreneurs to transform innovative ideas into viable businesses. In regions like Saudi Arabia and the UAE, where the entrepreneurial ecosystem is rapidly evolving, the presence of a robust angel investor network can significantly accelerate startup development. These investors not only offer financial support but also bring valuable expertise, mentorship, and industry connections. This comprehensive support system is crucial for startups navigating the early stages of growth, helping them to overcome challenges and scale effectively.

Stimulating Economic Development

A well-established angel investor network can also drive broader economic development. In cities like Riyadh and Dubai, fostering a dynamic startup ecosystem can create jobs, stimulate innovation, and attract further investment. Angel investors play a pivotal role in this process by identifying and supporting high-potential startups that contribute to economic diversification and resilience. As these startups grow and succeed, they generate economic value, enhance competitiveness, and contribute to the overall prosperity of the region. The ripple effect of a thriving startup ecosystem supported by angel investors can lead to sustainable economic growth and development.

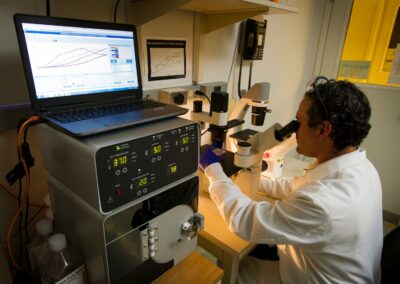

Promoting Innovation and Technological Advancement

Innovation is at the heart of economic progress, and angel investors are key enablers of technological advancement. By investing in startups that leverage cutting-edge technologies such as Artificial Intelligence (AI), Blockchain, and the Metaverse, angel investors can drive significant technological progress. In regions like Saudi Arabia and the UAE, where governments are prioritizing digital transformation, angel investors can support startups that are developing groundbreaking solutions. This symbiotic relationship between angel investors and innovative startups can accelerate the adoption of new technologies, positioning the region as a leader in technological advancement and innovation.

Strategies for Developing and Sustaining Angel Investor Networks

Developing a vibrant angel investor network requires creating a supportive investment environment. Governments in Saudi Arabia and the UAE can play a crucial role by implementing policies and regulations that encourage angel investment. This includes offering tax incentives, simplifying regulatory processes, and providing legal protections for investors. By reducing the barriers to investment, governments can attract more individuals to become angel investors, thereby expanding the network. Additionally, creating platforms for networking and collaboration can facilitate connections between potential investors and startups, fostering a more cohesive and supportive ecosystem.

Building Investor Education and Awareness

Education and awareness are fundamental to sustaining an angel investor network. Many potential investors may lack the knowledge or confidence to invest in startups. By offering educational programs, workshops, and seminars, regions can equip aspiring angel investors with the necessary skills and insights. These programs can cover various aspects of angel investing, including due diligence, portfolio management, and understanding startup dynamics. By building a well-informed investor community, regions like Riyadh and Dubai can ensure that angel investors are better prepared to make informed investment decisions, thereby increasing the overall effectiveness of the network.

Fostering Collaboration and Community Building

Collaboration and community building are essential for the long-term sustainability of angel investor networks. Establishing associations or groups dedicated to angel investing can provide a platform for investors to share experiences, insights, and opportunities. These networks can facilitate mentorship, peer learning, and collective investment strategies, thereby enhancing the overall impact of angel investing. In Saudi Arabia and the UAE, fostering a sense of community among angel investors can lead to more coordinated and strategic investments, ultimately benefiting the entire startup ecosystem. By promoting a culture of collaboration and mutual support, regions can sustain a vibrant and effective angel investor network.

#AngelInvestorNetwork #StartupEcosystem #Entrepreneurship #SaudiArabia #UAE #Riyadh #Dubai #Investment #BusinessSuccess #LeadershipSkills